OC Endorses Renewable Dispatch Effort

The Operating Committee endorsed a revised package of changes addressing renewable dispatch after the proposal had been sent back to the subcommittee level for additional fine tuning last month. The joint Independent Market Monitor/PJM proposal would require intermittent resources with capacity commitments to offer economic maximum megawatts equal to or greater than their hourly forecast.

Stakeholders speaking at the Sept. 8 OC meeting worried that the original language could result in renewable output being held back by use of an under-forecasted value and opted to send the proposal back to the DER and Inverter-Based Resources Subcommittee rather than vote on it. (See “Renewable Dispatch Proposal Vote Delayed,” PJM Operating Committee Briefs: Sept. 8, 2022.)

Some stakeholders were concerned about the proposal’s elimination of the curtailment flag, which PJM uses to notify generation operators that their units have been curtailed and that they should adjust their output accordingly. Friday’s presentation said the intent is to have generators following economic base points, rather than curtailments, which can be inadvertently prompted because of bid-in parameters or offers.

“I think we were able to work through those concerns,” PJM’s Michael Zhang said.

Cold Weather Preparations Begin

PJM is beginning to implement annual cold weather preparations, with data reporting for generating unit reactive capability verification underway from Oct. 1-31 and reporting for the seasonal fuel inventory and emissions data request beginning Oct. 17 and remaining open through Nov. 21. The cold weather preparation guideline and checklist will also be open Nov. 1 through Dec. 15.

The RTO is no longer facilitating a formal cold weather exercise and is asking generators to self-schedule their own testing in December on a day when temperatures are forecast to be below 35 degrees F.

Fuel Inventories Remain Low, Expected to Increase Going into Winter

Fuel production rates are up across most resource types, but inventory stocks remain low as volatility and prices remain high, according to the fuel supply overview presented to the OC. (See NERC Warns of Fuel Shortages Going into Winter.)

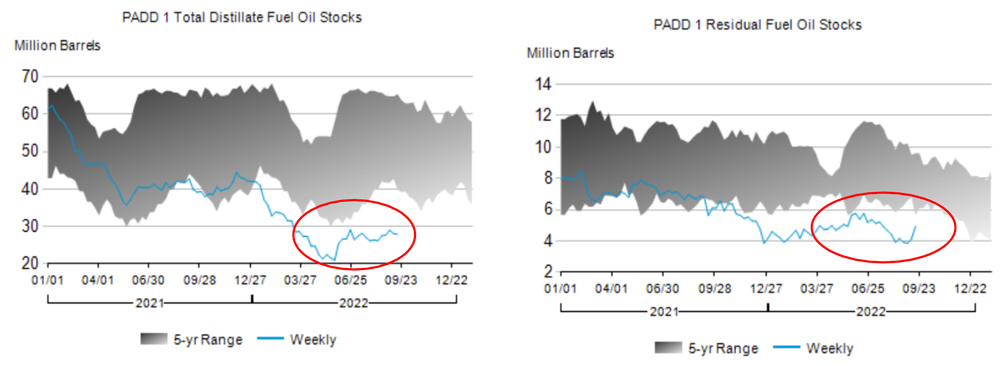

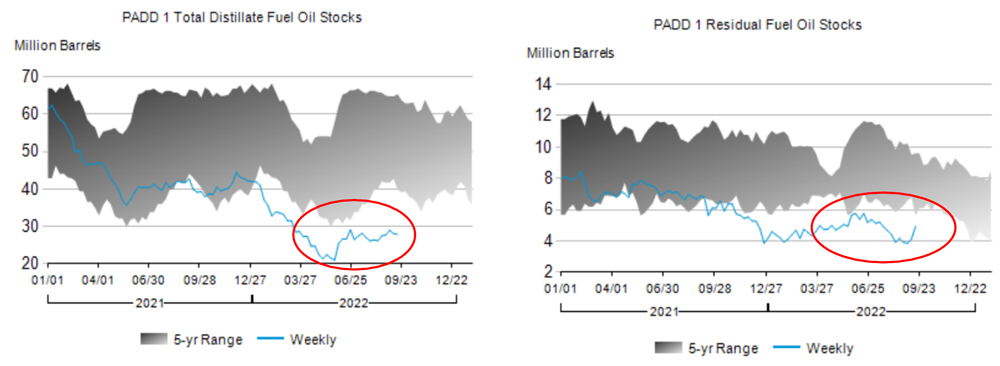

Oil inventories remain below their 5-year average as economic concerns continue to outweigh high production. | PJM

Oil inventories remain below their 5-year average as economic concerns continue to outweigh high production. | PJM

Distillate and residual fuel inventories remain about 9% below their five-year averages on the East Coast, PJM Principal Fuel Supply Strategist Brian Fitzpatrick said, while recession fears and a strong dollar continue to keep prices high.

Progress on contract negotiations for rail workers has alleviated concerns about a strike; however, not all unions have signed onto the agreement, and it’s believed that the process could continue through the Nov. 20 ratification deadline.

Production of both oil and coal fuels remain above average, and Fitzpatrick said inventories are expected to rise over the coming months as generators stock up for the winter season.

“So far, based on the response we’ve seen, no significant concerns have arisen,” Fitzpatrick said. “There have been signs of improvement recently with inventory build.”

Revisions to Fuel Requirements for Black Start Resources Presented

PJM’s Thomas Hauske went over the clarifications and revisions made to the proposed solution addressing fuel requirements for black start resources, which was endorsed by the Operating and Market Implementation committees last month. The Markets and Reliability Committee is scheduled to vote on the revised proposal during its Oct. 24 meeting. (See PJM, Monitor Debate Black Start Fuel Requirements Proposals.)

A provision allowing intermittent generators to contribute black start capacity as long as they are capable of providing 16 hours of full load operation with 90% confidence was clarified to ensure that it is only applicable for renewables. PJM also clarified that if a unit has its installed capacity increased because of a capital recovery upgrade, its black start revenues will be reduced commensurate with the increased capacity revenues received from the upgrade — preventing the generator from being paid twice for that added capacity.

Generators that store fuel onsite and are connected to two or more interstate pipelines will not be penalized if their fuel inventory falls below the 16-hour supply requirement if they can instead operate on fuel from the pipelines in the event of a black start.

Other OC Discussions

- The OC reviewed the recommended winter weekly reserve target from the 2022 reserve requirement, with a vote expected at the next meeting. This year’s recommendations are largely lower than last year’s study results, with 21% for December, 27% for January and 23% for February.

- The implementation of PPL’s dynamic line rating initiative is now live, after being delayed from the anticipated go-live date on Sept. 28. The program is now active following an Oct. 6 launch. PPL had already delayed an expected July launch until September because of additional work needed for changes to its energy management system by its vendor. (See “PPL Delays DLR Implementation to September,” PJM Operating Committee Briefs: July 14, 2022.)