NYISO’s Operating Committee on Feb. 15 voted to approve the results from the Expedited Deliverability Study (EDS) 2023-01 report that included 16 projects, two of which were found to be undeliverable.

The 14 projects found to be deliverable have until Feb. 22 to accept or reject their deliverable megawatts as determined by the EDS report. Developers that fail to notify NYISO about their decision will be deemed nonacceptances.

“Should every developer accept their deliverable megawatts, then EDS 2023-01 will be deemed complete,” said NYISO Manager of Facility Studies Wenjin Yan.

The EDS process fast-tracks projects seeking capacity resource interconnection service (CRIS) rights by assessing whether the project is deliverable as proposed, without the need for system deliverability upgrades. (See “Class Year & Expedited Deliverability Study Update,” NYISO to Ask FERC for Order 2023 Compliance Extension.)

The two projects deemed not fully deliverable, Q1039 Morris Solar (20 MW) and Q1212 Roosevelt Solar (19.9 MW), now must decide whether to await the next EDS cycle or join the upcoming transitional cluster study as a CRIS-only request to identify what upgrades are required to become deliverable. Projects looking to participate in the cluster study, however, must complete a small generator facility study.

NYISO will report to the developers about each other’s decisions, sharing whether projects chose to not proceed. Should one or more developers provide a nonacceptance notice after the initial decision period, then the ISO will issue updated study results for the EDS projects remaining that reflect the impact of any projects withdrawn.

The study is expected to be completed Feb. 22, but if a non-acceptance is issued, a revised EDS report will be issued March 7.

NYC PPTN

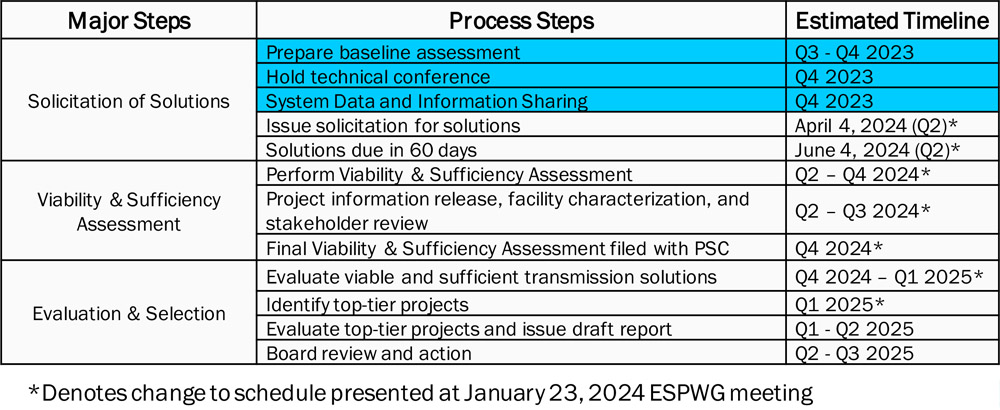

NYISO told the committee the New York City Public Policy Transmission Needs (PPTN) solicitation window will open April 4.

Developers’ proposed solutions are due by June 4, with NYISO committing to provide technical documents to developers prior to issuing the solicitation.

The New York Public Service Commission initiated the PPTN in June 2023, with the aim to both facilitate the delivery of 6,000 MW of offshore wind power generated off the Long Island coast to New York City and help meet the state’s Climate Leadership and Community Protection Act mandate to develop at least 9,000 MW of OSW by 2035 (22-E-0633).

Doreen Saia, an attorney with Greenberg Traurig, asked if NYISO was aware of the two Feb. 14 filings from the state’s Department of Public Service, which requested the ISO clarify how recent contract terminations from two OSW projects, Beacon Wind and Empire Wind 2, would be reflected in the PPTN and shared questions the department has received from stakeholders concerned about the terminations. (See Empire Wind 2 Cancels OSW Agreement with New York.)

Saia also wanted to know if the cancellations would result in NYISO adjusting the PPTN’s base case, power flow cases, modeling results, timeline or technical guidance documents.

Supriya Tawde, manager of transmission integration at NYISO, responded that the ISO will be “sharing updates to the power flow cases” next week and then reviewing “our procedures to make a determination if any other changes need to be made” based on these developments.

January Operations

Aaron Markham, NYISO vice president of operations, shared the January operations report with the OC, saying, “the above-average temperatures we’ve been experiencing came to an end” and resulted in a winter season peak load of 22,754 MW, which was roughly 94% of the baseline forecast for winter.

The cold snap led to increased natural gas prices, which in turn drove up wholesale energy market prices and contributed to slightly higher local reliability costs.

External ICAP Rights

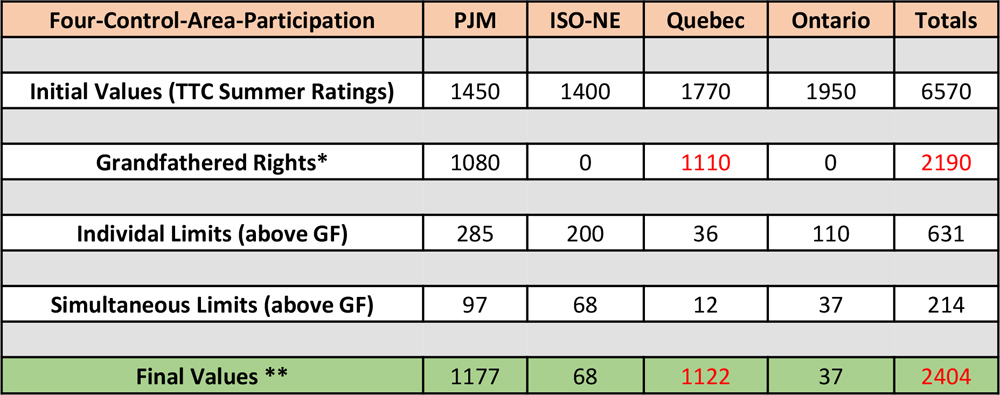

NYISO’s Business Issues Committee on Feb. 14 voted to approve revisions to the Installed Capacity Manual that update the maximum amount of import capacity allowed from neighboring control areas for the 2024/25 capability year.

The ISO can import 214 MW above grandfathered rights from its neighboring control areas this coming capability year, with 97 MW available from PJM, 68 MW from ISO-NE, 37 MW from Ontario and 12 MW from Quebec.

The revised figures represent a 10-MW decrease from the 2023/24 capability year, with PJM’s and Quebec’s limits increasing by 39 MW and 1 MW, respectively, and Ontario’s and ISO-NE’s decreasing by 43 MW and 7 MW, respectively.

Including existing transmission capacity for native load, and other grandfathered rights, the ISO’s biggest import sources are PJM (1,177 MW) and Quebec (1,122 MW).

The summer capability period auction will be held no later than 30 days prior to the start of the period on May 1.