CAISO staff and stakeholders are looking to address an inconsistency in how the ISO tests for structural market competitiveness inside and outside of its balancing authority area in the Western Energy Imbalance Market.

The issue was a topic of discussion at a Feb. 21 meeting of the ISO’s Price Formation Enhancements Working Group.

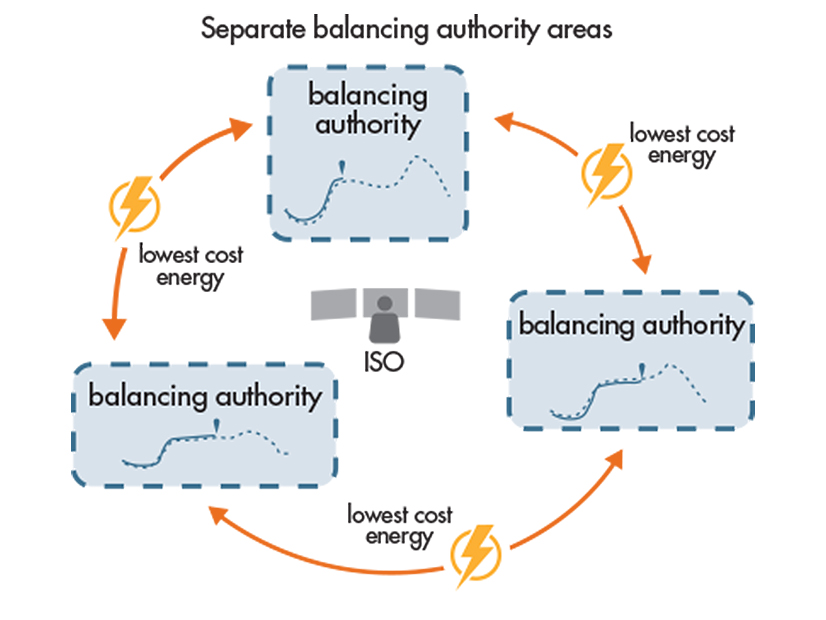

CAISO’s BAA-level Dynamic Competitive Path Assessment (DCPA), which is used to test for structural competitiveness and determine the need for market power mitigation, tests BAAs in isolation and does not consider external supply, ISO staff noted at the meeting.

But within its own BAA, CAISO does consider external supply, creating conditions that could make it easier for the ISO to pass the DCPA and avoid price mitigation.

To address the problem, the ISO has suggested grouping BAAs that are otherwise separated by price differences and testing them together, instead of testing them in isolation and looking only at internal supply relative to internal demand.

“The impact of this problem in the market is that balancing areas in the Western EIM may fail the DCPA, which is the market power mitigation test, more frequently than their actual competitiveness justified, subjecting them to mitigation too often,” said James Friedrich, lead policy developer at CAISO.

However, some stakeholders were concerned that the grouping method would apply the DCPA to two different types of market power — local and BAA-wide.

“It’s almost in our minds like you’re taking aspects of a local market power mitigation test and especially that triggering mechanism and trying to apply it to a BAA-level or system market power condition,” said Kallie Wells, senior consultant at Gridwell Consulting.

Responding to stakeholder concerns about the grouping methodology, Friedrich said he didn’t see a difference between local and BAA-level market power.

“You could define a balancing area as a local area that’s congested from the larger market and the larger system and all of the suppliers within that local area can potentially exert market power. … That’s what the test is for,” he said. “I don’t see why we would have a differentiation between local market power identifying price separated local areas and BAA-level market power. It’s just that the area with which you’re defining is a balancing area and not a single node on the system or a collection of nodes.”

Wells elaborated on stakeholder concerns regarding the differentiation of markets, saying it comes down to demand.

“The demand number that you’re using and that test to figure out if you should actually mitigate resources is different. So, in local market power, that demand is the counterflow,” she said. “But that’s not what you’re using in the BAA-level calculation. … You’re saying we’re going to take this binding transfer constraint as the trigger, and then instead of using the demand for counterflow on that transfer constraint, we’re actually just going to use the demand in the BAA-level area.”

Friedrich said Wells’ explanation helped him think about the issue differently, but that he’d need time to consider how to respond.

DMM Data Demonstrate DCPA Problems

In November, CAISO’s Department of Market Monitoring presented data breaking down how often WEIM BAAs are subject to mitigation and, within that subset, how many times their resources had bids altered.

The data revealed another issue: that because the existing BAA-level market power mitigation uses a transfer constraint-based trigger to test for structural uncompetitiveness, mitigation occurred most frequently in hours inconsistent with when one would expect to need to test, such as in times of high renewable and low load conditions.

“I think because of the mixing and matching of the trigger and the test or the type of market power you’re trying to address, you’re actually seeing that issue pop up in your results,” Wells said.

Dan Williams, principal adviser at The Energy Authority, suggested the ISO examine how transfer constraints materialized for WEIM entities that were using transmission rights to export from the CAISO or another area into their BAA to examine how it affects market power mitigation.

The Price Formation Enhancements Working Group is scheduled to meet again March 18. CAISO also plans to publish an FAQ to address stakeholder questions on issues arising during the Feb. 21 meeting.