SPP’s Board of Directors approved the initial tariff for its Markets+ service offering in the Western Interconnection March 25, clearing the way for its filing at FERC.

Board Chair John Cupparo called the action an important step, but not the last, in continuing SPP’s development of the day-ahead market. Markets+ is just one of several western expansion initiatives, which include SPP RTO West and an imbalance market.

“We don’t know exactly what the outcome is going to be [as] SPP continues to prudently pursue this western expansion, given the long-term potential of this expansion,” he said. “Another way to say that is five, 10, 15 years from now, I wouldn’t want to be in the position of answering the question, ‘Why didn’t you pursue this?’”

SPP is competing with CAISO’s Extended Day-ahead Market (EDAM) to attract western entities to Markets+. FERC already has approved the bulk of EDAM’s tariff, and last week, Portland General Electric and Idaho Power signaled their intent to join the CAISO market. That increases EDAM participants to five members. (See CAISO Wins (Nearly) Sweeping FERC Approval for EDAM and CAISO’s EDAM Scores Key Wins in Contested Northwest.)

“Based on experience in the West, it is always a challenge to completely get our arms around what entities in the West will do and what they’ll ultimately decide,” said Cupparo, a Colorado resident with western utility experience. “We’re still entering that phase right now. There are many variables and diverse perspectives that will influence these decisions.”

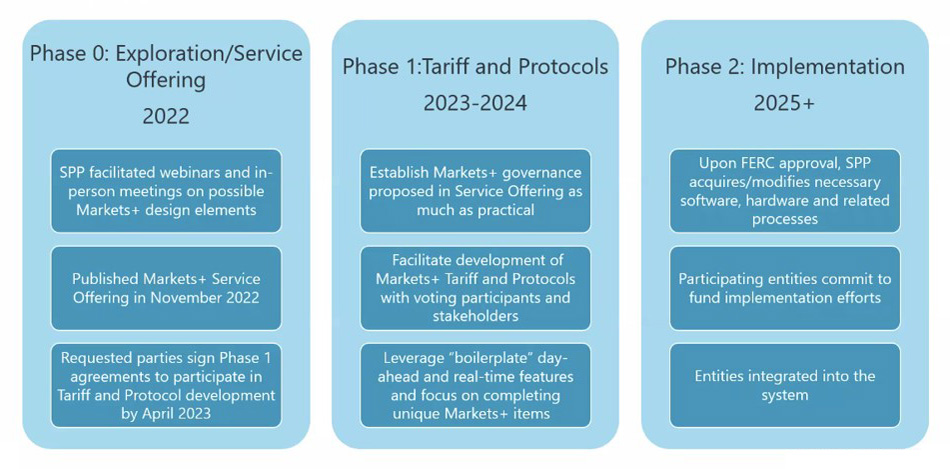

The tariff’s filing will complete the first phase of the Markets+ development. SPP lists 38 western entities as having participated in drafting the tariff and its protocols.

The grid operator hopes to receive FERC approval by year’s end. In the meantime, SPP and interested participants will develop and negotiate funding agreements for the second phase. SPP will file at FERC a financing approach, projected to be about $140 million plus financing costs.

Once FERC has approved the tariff, SPP will begin acquiring and modifying the necessary software, hardware and related processes. Phase 2 work will begin next year after the financing approach is approved.

“I think we’re probably several years away from parties participating in Markets+ and deciding that they’ve gotten comfortable with the regionalization to the level where they’re now interested in pursuing an RTO,” said Antoine Lucas, SPP’s vice president of markets.

The motion to approve the tariff cleared the Members Committee’s advisory vote, 15-1, with four abstentions. The Natural Resources Defense Council’s Christy Walsh cast the lone dissenting vote over concerns the tariff isn’t complete.

Markets+ stakeholders and SPP staff have been working together since last year putting together the tariff’s various pieces. The Markets+ Participants Executive Committee has held 86 votes on tariff language since August, with an average approval rating of 97.72%. Several identified tariff elements were postponed because of the time necessary to resolve them.

Lucas reminded members the tariff they were voting on does not include the second phase. That will include contractual obligations that set cost recovery and financial obligations associated with the market’s implementation.

“This being a standalone service, the funding for that service will be taken care of by the participants in the process itself,” he said.

CFO Sterzing Resigns

SPP CEO Barbara Sugg announced during a break in the call that Deborah Sterzing submitted her resignation March 22 as the grid operator’s chief financial officer.

“We hate to see her go. We certainly wish her well in her continued career within our industry,” Sugg said.

David Kelley, vice president of engineering, has been appointed interim chief financial officer. He is already involved in several financial activities for SPP, Sugg said.

Sterzing joined SPP in February 2023. She replaced longtime CFO Tom Dunn, who retired in 2022 after 21 years at the financial helm.