Two competing day-ahead markets from CAISO and SPP are taking different approaches to resource sufficiency and adequacy, according to presenters at a workshop included in a regulatory effort to help inform NV Energy’s decision on which market to join.

Two competing day-ahead markets from CAISO and SPP are taking different approaches to resource sufficiency and adequacy, according to presenters at a workshop included in an effort that will likely help shape NV Energy’s decision on which market to join.

The Public Utilities Commission of Nevada (PUCN) hosted the workshop April 10 to discuss regional market designs.

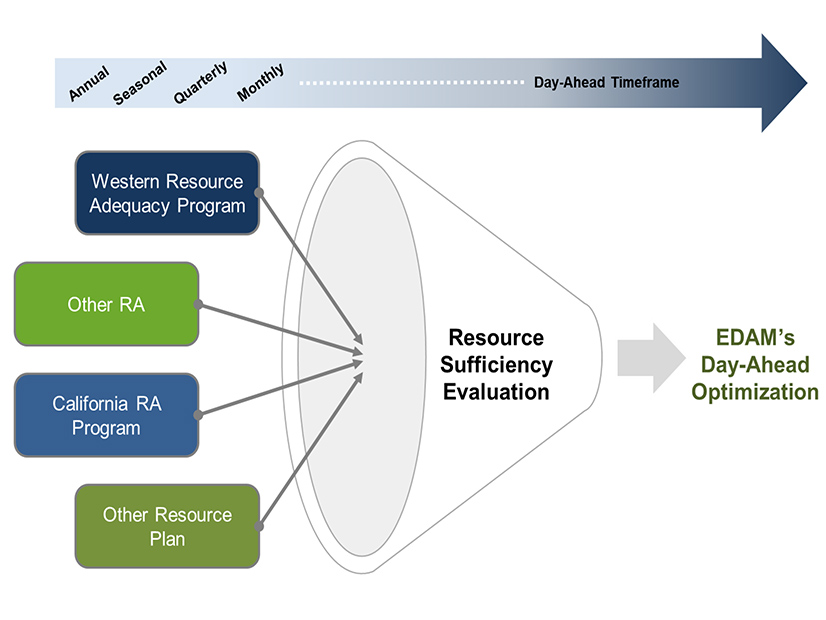

In CAISO’s Extended Day-Ahead Market (EDAM), balancing areas will undergo a daily resource sufficiency evaluation (RSE) ahead of the market’s 10 a.m. cutoff.

The balancing areas will work with their load-serving entities and suppliers to ensure sufficient resources and transmission are available to the market, said CAISO Chief Operating Officer Mark Rothleder. The resources must be enough to meet the demand forecast, plus an operating reserve and an imbalance reserve.

Resources from all participating balancing areas will then be optimized to meet demand across the market and minimize cost, Rothleder said. Entities that don’t pass the RSE will still be able to participate in the market but will be charged a premium.

In contrast, SPP’s Markets+ day-ahead market will not use a daily resource sufficiency test, said Carrie Simpson, SPP’s director of services development.

Instead, all load-serving entities in Markets+ must belong to Western Power Pool’s Western Resource Adequacy Program (WRAP), which SPP runs.

The WRAP includes a forward-showing component that will require participants to demonstrate they have sufficient capacity and 75% of the transmission needed to deliver it seven months before each summer and winter. Those who fail the requirement will face penalties.

Simpson said obligations coming out of WRAP will inform a day-ahead market participant’s must-offer requirement, “so that we ensure that we have sufficient generation offered into the market.”

SPP “heard loud and clear” from entities participating in the development of Markets+ about the need for a uniform resource adequacy program, Simpson said.

“In Markets+, we have a uniform approach so everyone’s on the same playing field,” Simpson said. “To the extent that someone is short today, well, they’re part of the larger program, and we’ll have the capability to have someone else offer for them, and so you get that shared pooling advantage.”

Rothleder, with CAISO, described EDAM’s resource sufficiency evaluation as “a universal adapter” that can accommodate WRAP, California’s resource adequacy requirements or other RA programs.

Resources developed under the RA programs can then be used to satisfy resource-sufficiency evaluations, he said.

“I am not suggesting resource adequacy programs are not important. They are very important,” Rothleder said. “All I’m suggesting is that you don’t have to have a one-size-fits-all resource adequacy program for a day-ahead market optimization to work.”

The RSE may even be a way to compare different resource adequacy programs, Rothleder suggested.

“To the extent that the resource adequacy program is performing less than another resource adequacy program, that will be tested by the resource sufficiency evaluation,” he said.

Competition Heats up

The workshop was part of PUCN’s efforts to find ways to evaluate a utility’s choice of a regional market or RTO. An April 3 workshop focused on studies of day-ahead market benefits. (See Nev. RTO Effort Turns Focus to NV Energy Day-ahead Studies.)

NV Energy and other utilities across the West are drawing closer to decisions on which day-ahead market to join. Some have already chosen.

PacifiCorp, the Balancing Authority of Northern California (BANC) and Portland General Electric are among the entities pursuing EDAM membership. CAISO is aiming to launch EDAM in 2026.

Bonneville Power Administration staff tentatively recommended this month that the agency go with Markets+. (See BPA Staff Recommends Markets+ over EDAM.)

NV Energy hasn’t revealed publicly its day-ahead market choice. The utility was among more than three dozen entities that participated in developing tariffs and protocols for Markets+, in a process SPP calls Phase 1, but a recent study by The Brattle Group found the utility would realize greater financial benefits from joining EDAM. (See NV Energy to Reap More from EDAM than Markets+, Report Shows.)

Phase 2, expected to start next year, will begin Markets+ implementation, with a go-live date projected for early 2027.

Antoine Lucas, SPP’s vice president of markets, said SPP is asking its Phase 1 participants to indicate this quarter whether they’ll be moving forward with Markets+, even if their commitment is nonbinding at this point.

“I know there is some level of … participants looking to each other to see what they might do,” Lucas said during the workshop.

When asked what level of participation would be needed to make Markets+ feasible, Lucas said Phase 1 participants decided that 150 TWh of net energy for load annually and two contiguous balancing areas would be enough to move forward.

WEIS’ Role Clarified

Some entities that join Markets+ might now be participating in CAISO’s real-time Western Energy Imbalance Market (WEIM). In that case, they would leave the WEIM and instead participate in a real-time market that is bundled with the Markets+ day-ahead market.

The real-time market associated with Markets+ is different from SPP’s Western Energy Imbalance Service (WEIS), a real-time market now in operation, SPP officials noted during the workshop.

Current WEIS participants, mainly from Wyoming and Colorado, are expected to join Markets+ or SPP’s planned Western RTO expansion, known as RTO West. At that point, SPP expects to discontinue the WEIS, Simpson said.