Advanced grid technologies can help expand the grid quickly and relatively cheaply, according to a new report from the U.S. Department of Energy.

The Pathways to Commercial Liftoff: Innovative Grid Deployment report, released April 16, focuses on identifying ways to accelerate deployment of commercially available, but underused, advanced technologies over the next five years on existing transmission and distribution infrastructure. The technologies can quickly respond to accelerating grid pressures such as the need to expand capacity in the face of rising demand, enhancing reliability and supporting integration of clean energy.

“The majority of the nation’s transmission and distribution lines are drastically overdue for an upgrade, which is why President Biden’s Investing in America agenda is so critical to bring the grid up to date,” Energy Secretary Jennifer Granholm said in a statement. “DOE’s new Innovative Grid Deployment Liftoff report outlines the existing tools that can be deployed in less than five years to modernize the nation’s power sector, making it more secure and reliable to deliver cheaper, cleaner power to American consumers.”

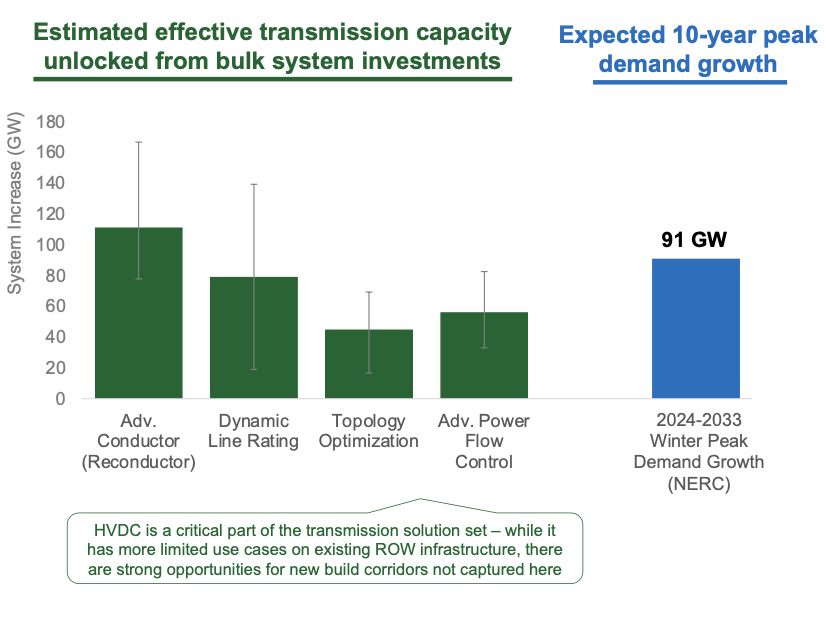

The technologies covered include advanced conductors, high-voltage direct current lines, advanced distribution management systems, dynamic line ratings (DLRs), topology optimization, storage as transmission and distribution, data management systems and others. Deploying the advanced grid solutions could cost-effectively increase the capacity of the grid by 20 to 100 GW of incremental peak demand when installed individually, the report said.

Making sure the grid has enough capacity is important to many of the projects DOE has funded recently, Jigar Shah, director of the agency’s Loan Program Office, told reporters.

“Our other manufacturing and energy generation applicants and grantees need to be able to connect to the grid,” Shah said. “If our applicants can’t connect to the grid quickly, that’s going to meaningfully impact our ability to underwrite their debt.”

The report was developed by staffers from around DOE with deep engagement from the private sector, said Vanessa Chan, director of the Office of Technology Transitions.

“The liftoff report breaks down the value chain of various portions of the economy and sketches a road map for the private sector to deploy the solutions that we need,” Chan said. “So, in basic terms, [the report covers] things like: What cost do we have to hit in order for these technologies to take off? What are the technological and market-driven barriers that we have to overcome? What’s the amount of investment that we need where and by when?”

While the grid needs to be expanded with new transmission and distribution investment, major new lines can take a long time to build and the GETs identified in the report can be deployed much more quickly, said Grid Deployment Office Director Maria Robinson.

“We’re talking about three to five years deployment of key commercially available — but what we believe to be underutilized — advanced grid technologies and applications, and specifically how we can leverage existing transmission and distribution systems,” Robinson told reporters.

Most of the solutions cost less than a quarter of traditional alternatives and can be deployed quickly, since they use existing infrastructure.

DOE thinks the technologies can become a self-sustaining industry within three to five years, with “liftoff” happening when utilities and regulators comprehensively value and integrate advanced solutions as part of grid planning and operations. Pursuing between six and 12 operational deployments across a diverse set of utilities can cut risks enough to scale up the GETs industry, DOE said.

Besides building evidence for how the technologies work and getting utilities and grid operators comfortable with using new technologies, the industry’s economic models and incentives must be updated for GETs to take off.

“For regulated utilities, this will require regulators to lead in aligning utility compensation models with the value generated from, and costs of, advanced grid solutions to deliver ratepayer benefits — e.g., implementing performance-based regulation, allowing some operational expenditures to be capitalized,” the report said. “New mechanisms are needed that allocate costs in ways that better align with beneficiaries and equitably share benefits.”

Grid operators also need to know how to include GETs in system planning and prioritize them for investments, the report said. That requires a comprehensive understanding and method for evaluating the costs and benefits of the technologies.

The grid will benefit if the industry institutes the right reforms to use advanced transmission and distribution technologies to their full potential, it said.

“Using just one-fifth of the current investment in conventional transmission and distribution asset replacement to instead upgrade assets with advanced grid solutions could nearly double industry investment in advanced grid solutions, driving greater grid impacts without increasing costs to ratepayers,” the report said.

Maintaining reliability and keeping the grid’s frequency at 60 Hz are vitally important, and one way of showing utilities and grid operators the technologies can do those things while enhancing capacity is through demonstrations, including one DOE has funded at Philadelphia-area utility PECO, Robinson said.

“A lot of this is just increasing awareness and making sure that the regulators also feel comfortable with taking these approaches as well,” she added.

AES and LineVision Case Study on Dynamic Line Ratings

Segments of the industry have been working on rolling out the technologies, with LineVision and AES releasing a case study April 15 on the use of DLRs on five high-voltage lines across AES’ utility territories in Ohio and Indiana. DLRs can increase reliability by giving operators a better sense of how their lines are operating, LineVision CEO Hudson Gilmer said in an interview.

“It’s providing utilities better data with which to do their jobs,” Gilmer said. “In the absence of monitoring of these lines that are really the backbone of the grid, utilities are guessing; they’re making conservative static assumptions about how much power they can put through the lines. And what this technology does is for the first time, it really allows them to see actual conditions and know precisely how much power they can put through those lines.”

While the case study found that, on average, DLRs can increase a line’s capacity by 9 to 27% in the summer and up to 81% in the winter, Gilmer said they could sometimes help grid operators recognize when their assumptions are too generous and prompt them to dial back a line’s capacity, such as on a hot summer day with no wind.

The case study involved installing LineVision’s monitoring technology on major backbone lines, but results indicated it could benefit lower-voltage transmission as well, although the biggest savings were on the 345-KV lines.

The project involved installing 42 sensors in just eight weeks, with individual installation times of just a half-hour without considering travel time to the location. The quick installation time means they can easily be moved around as the grid changes, but Gilmer believes they might become standard across the entire system in the long term.

“There’s one approach, which is deploying it almost like Band-Aids on that small number of problem lines,” Gilmer said. “But another philosophy is to say, ‘Why wouldn’t I want this data on my entire transmission system?’ So, these are the high-voltage lines that form the backbone of the grid. Wouldn’t your operators want to know exactly how much power they can put through, and if there are any anomalies that they need to be concerned about?”