MISO and SPP on Monday laid out a percentage-based cost allocation for their $1-billion Joint Targeted Interconnection Queue (JTIQ) transmission study that will assign most costs to interconnecting generation.

The grid operators plan to assign 90% of project costs to interconnection customers and 10% to an aggregate of MISO and SPP load. The RTOs said they will allocate a fixed, per-megawatt charge to interconnection customers that have a 5% or greater impact on a facility in the neighboring region to pay for the portfolio.

“We think a 90-10 split would work well for this portfolio and for future portfolios,” MISO’s Andy Witmeier told stakeholders during a JTIQ study teleconference Monday.

National Grid Renewable’s Rafik Halim said he thought a 50-50 allocation between load and new generation would be more suitable. He asked for a rationale behind the cost split.

“If MISO and SPP believe a 90%-10% split is appropriate, we need to see why. This is a billion dollars of investment,” he said.

Halim also asked for an analysis to show how the grid operators arrived at the 5% impact threshold for new generators.

American Clean Power Association’s Daniel Hall seconded the ask for the 90-10 cost allocation’s justification.

The RTOs staff remained steadfast in asserting that the JTIQ’s main purpose is to enable new generation, making it only fair that interconnection customers bear the brunt of the costs. They also said the 5% impact factor is a well-established approach that both grid operators use today.

Other stakeholders asked whether the RTOs plan to create protections that ensure transmission facilities get built should generation developers balk at network upgrade costs and withdraw from the queue. How would the portfolio remain funded, they asked.

SPP’s Neil Robertson said staff’s plan is to assign a fixed, one-time upfront charge to eliminate unexpected sticker shock and cut down on the number of queue dropouts. He said the process will ensure the upgrades’ expense is spread evenly across generation and that no project is encumbered with an eye-popping upgrade bill.

David Kelley, SPP’s director of seams and market design, said the RTOs are confident that enough generation developers will continue to construct projects near the seams and fund JTIQ projects.

The study’s portfolio was initially priced at $1.65 billion. However, it contained two project duplicates with MISO’s recently approved $10.3-billion long-range transmission portfolio. Staff said SPP’s benefits from the projects were negligible and independently pursued the duplicates under its regional process, reducing the JTIQ to about a billion-dollar investment. (See MISO, SPP Finalize JTIQ Results with MISO Tx Duplicates.)

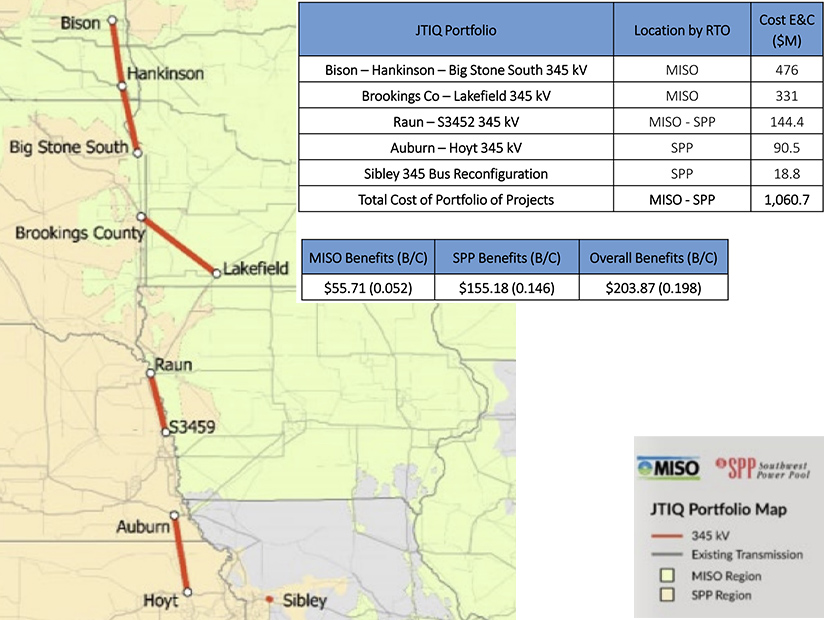

The current JTIQ portfolio includes:

- the $476-million Bison-Hankinson-Big Stone South 345-kV line located in MISO’s footprint that touches both Dakotas and Minnesota;

- the $331-million Brookings County-Lakefield 345-kV line from South Dakota into Minnesota in MISO territory;

- the $144.4-million Raun-S3452 345-kV line on the Iowa-Nebraska border, straddling both MISO and SPP;

- the $90.5-million Auburn-Hoyt 345-kV line from Nebraska into Kansas in SPP’s region; and

- the nearly $19 million Sibley 345-kV bus reconfiguration in SPP’s portion of northwest Missouri.

The RTOs announced in late June that they plan to ditch their current affected systems study process for more interregional transmission studies like the JTIQ study. (See MISO, SPP Commit to Replacing Affected System Studies.)

Robertson said the portfolio began as a “one-off” process and has since evolved into an “enduring, repeatable” design.

The grid operators plan to hold another meeting Sept. 30 to finalize cost-allocation details. Kelley asked stakeholders to send their improvement suggestions for the concept to the RTOs.