CARMEL, Ind. — As it gears up to run its first auctions using sloped demand curves, MISO last week said prices and procurement would have risen had it used them in this year’s auctions.

Over summer, several local resource zones would have experienced a six-fold jump in clearing prices, the grid operator revealed at the Resource Adequacy Subcommittee’s meeting July 10.

MISO used prototype curves that it presented to stakeholders last year to hypothetically redetermine clearing prices and additional supply procurement for the 2024/25 capacity auction. In reality, seasonal sloped demand curves will differ because the RTO will periodically update calculations that draw on historical operating costs of generators in the footprint.

MISO will have sloped demand curves in play for the 2025/26 planning year auctions after FERC last month allowed the RTO to use them in place of the vertical demand curve it had been using since 2011. (See FERC Approves Sloped Demand Curve in MISO Capacity Market.)

For zones 1-4, 6 and 7, clearing prices this year would have jumped from $30/MW-day to $197/MW-day in summer, from $15 to $39 in fall and from 75 cents to $2.40 in winter. In the same zones, spring prices would have dropped from $34 to $32.

MISO South clearing prices would have increased less dramatically in summer, from $30/MW-day to $80/MW-day, but it followed the other zonal prices in the other seasons. MISO’s reenactment of the 2024/25 auction showed the Midwest-to-South transfer constraint binding on its limit, causing the lower summer prices between South and Midwest.

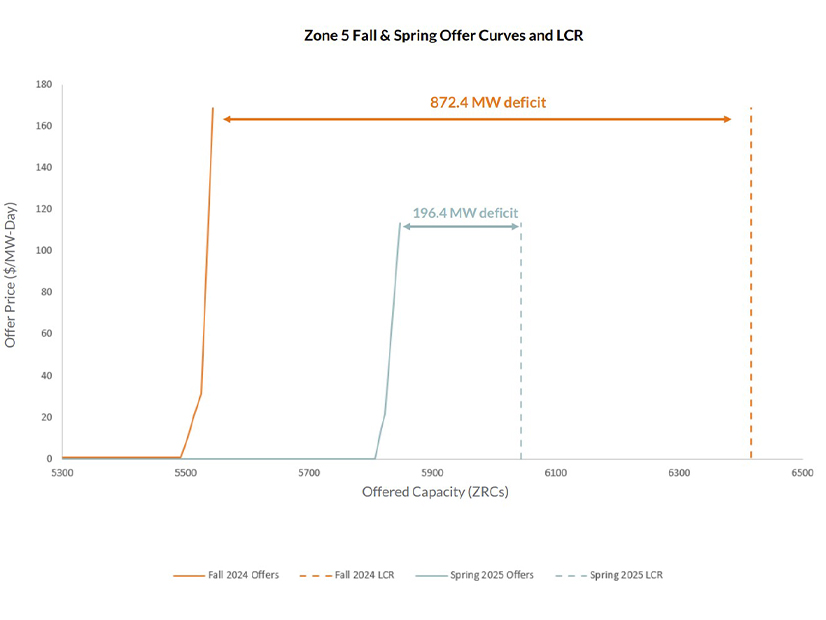

For Missouri’s Zone 5, which this year experienced an 872-MW shortage in fall and a 196-MW deficit in spring, prices would have tracked other Midwest zones in summer and winter but risen from the $720/MW-day cost of new entry (CONE) price limit to $758 in fall and $751 in spring. (See Missouri Zone Comes up Short in MISO’s 2nd Seasonal Capacity Auction, Prices Surpass $700/MW-day.)

MISO did not alter capacity offers made in the 2024/25 auction for its reenactment.

The sloped demand curve design paired with MISO’s new seasonal auctions allows clearing prices to go as high as four times the CONE. The curve is meant to value capacity beyond what’s strictly necessary to meet the one-day-in-10-years loss-of-load expectation.

Alongside the higher prices, an indicative rerun of the 2024/25 auctions showed that with a sloped demand curve, MISO cleared capacity beyond its reliability targets, except in spring: 4 GW more in summer; over 4 GW more in fall; and 3 GW more in winter.

However, spring cleared nearly 127 GW, lower than the nearly 128-GW target. But MISO said the prototype demand curves show that shortages will likely need to be more pronounced in the future to trigger CONE pricing.

MISO staff did not venture a guess as to whether Zone 5 still would have returned a shortage had the sloped demand curve been used in 2024/25. Neil Shah, senior manager of market design, said there were too many factors at play in Zone 5 to say for certain what would have transpired.