Planning Committee

Elevate Reviews CIR Transfer Proposal

Elevate Renewables presented a first read on one of six proposals to revise how capacity interconnection rights (CIRs) can be transferred from a deactivating generator to a replacement resource interconnecting at the same site. (See “Stakeholders Endorse Revisions to CIR Transfer Issue Charge,” PJM PC/TEAC Briefs: June 4, 2024.)

The package would create a fast-track process for replacement resources to use to go through the interconnection process, provided they would have an equal or smaller output and CIR value as the deactivating retiring resource and no material adverse impacts to the grid are identified. Replacement resources would be required to interconnect at the same substation and voltage as the original resource, although use of a different breaker would be permitted.

Elevate envisions a nine-month time frame for most projects to get through the expedited process, with 60 days for initial application review, 180 days for a replacement impact study looking at any potential transmission violations, and 30 days for the interconnection service agreement (ISA) to be approved.

Projects would be allowed to continue through the generation replacement process if minor network upgrades are identified. A 90-day facilities study process may be required before the interconnection agreement can be offered.

Elevate’s Kun Zhu said resolving localized voltage issues would likely be seen as a minor impact, while violations requiring upgrading a line to a higher rating would require projects to shift to the full interconnection process.

The ability for projects to go forward with minor network upgrades stands in contrast to PJM‘s proposal, which would require the replacement resource to go through the standard interconnection process if any upgrades are identified or if available transmission headroom is changed by the addition of the resource.

Proposals have also been sponsored by Gabel Associates, PowerTransitions, MN8 Energy and the Independent Market Monitor.

The Elevate package would also permit standalone battery storage to be eligible for the generation replacement process, unlike PJM’s design. A companion study of the charging phase or separate load study would be conducted to identify any needs prompted by the charging phase. Zhu said the generation interconnection study process was designed solely for resources that would only inject energy into the grid, making the charging phase irrelevant to the CIR transfer eligibility discussion.

PJM’s Ed Franks said standalone storage is not permitted in the RTO’s proposal because that resource would not have been envisioned in the original network upgrade studies done on the retiring resource and the charging phase would conflict with PJM’s requirement that replacement resources have no grid impacts, such as changing line loading. Hybrid resources with a storage component would only be allowed if the battery could not charge off the grid.

Elevate’s Tonja Wicks said PJM has been messaging that new entry isn’t set to keep pace with deactivations and accelerating load growth, driving the need for process to quickly replace retiring generators with new resources. She also noted that only a small subset of projects that have cleared PJM’s interconnection queue in recent years have entered commercial operation, an issue she argued could be helped by focusing on proposals that can be quickly studied and are likely to be assigned minimal network upgrades.

“We need new approaches to address this new problem that we’re seeing as we deploy new technologies,” she said. “We didn’t have reserve deficits 10 years ago.”

Ken Foladare, of the Tangibl Group, said it’s likely to be well into 2025 before the proposal would be implemented if approved by stakeholders and FERC, putting it close to the targeted full rollout of PJM’s new cluster-based interconnection process. He questioned the benefit of the proposal if it is likely to go into effect around the same time that PJM is completing a process to speed interconnection for all resources.

Wicks said the Elevate package would establish a nine-month study process that would remain quicker than the two years she said it would likely take resources to typically clear PJM’s new approach. Not only would that allow some resources to receive ISAs faster, she said, but it would resolve a timing misalignment between when resources deactivate and when their CIRs can be passed on to a new resource.

PJM Proposes Load Analysis Subcommittee Charter Revisions

PJM presented revisions to the Load Analysis Subcommittee (LAS) charter that would shift its focus from collecting and presenting forecast data provided by transmission owners to reviewing the independent forecasts the RTO produces and its methodology.

Much of the status quo charter language focuses on collecting load data and developing forecasts, which PJM’s Molly Mooney said is a legacy of when TOs would submit their own forecasts to the LAS. The revisions instead focus on review of the end product forecasts and the data used to construct them.

“It’s definitely time to review and update our charter. The charter is also a legacy of when the Load Analysis Subcommittee members provided load forecasts to PJM and we gathered those materials and processed them … now PJM does an independent load forecast, so the role of the LAS has changed a little bit,” Mooney said.

Data Centers Challenge Light Load Forecast Case

PJM’s Stan Sliwa presented revisions to the light load case inputs used in the Region Transmission Planning Process (RTEP) load forecast, which aim to reflect the growth of load with flat profiles unaffected by weather and season. The typical example of such load, Sliwa said, is data centers that tend to consume a consistent amount of power throughout the year.

The light load case is designed to create an accurate representation of shoulder periods by scaling load down to 50% of the summer forecast peak using bus-level data provided by transmission owners. The proposal would limit that practice to not include any non-scalable load reported by TOs.

The Manual 14B changes also expand the NERC TPL standards examined during generator deliverability analysis to match current practice, updating the system operating limit (SOL) definition and adding new standards created by NERC.

Transmission Expansion Advisory Committee

3 TOs Negotiate Changes to Component Project in 2022 RTEP Window 3

NextEra Energy, FirstEnergy and Dominion Energy have redesigned the plans for a new 500-kV line between the 502 Junction substation and the new Aspen facility to reduce greenfield development and improve constructability. The project is a component of the $5 billion transmission upgrade package aimed at resolving reliability violations identified throughout Maryland and Virginia. (See FERC Approves Cost Allocation for $5 Billion in PJM Transmission Expansion.)

The proposed changes would replace a NextEra segment of the construction, which follows a greenfield route to the west of the existing 500-kV Doubs-Goose Creek line, with a design to continue the lines farther east towards the Doubs substation. Bypassing Doubs, the line would follow the existing corridor south through the Dickerson H substation and to the Goose Creek substation, where it would terminate, instead of at Aspen.

The reworked design would split the former NextEra component, which would cost $71.2 million, between FirstEnergy and Dominion, increasing the total cost by $167.5 million. NextEra would retain other components of the overall project amounting to $440.9 million, including building a new Woodside substation between the Black Oak and Doubs substations.

FirstEnergy would connect the line to the Doubs-Goose Creek corridor by rebuilding a 16-mile segment of the 138-kV Millville-Doubs line to be capable of supporting 500-kV overbuild. It would also be responsible for constructing an additional 15 miles south towards Goose Creek.

The Dominion portion of the work involves constructing the final 3 miles south into Goose Creek and installing a 500-kV capacitor bank originally destined for that facility to the Aspen substation.

Ratepayers along the revised corridors questioned the decision-making process for choosing which route would be selected and argued the change was shifting the impact from a wealthier area along the NextEra pathway to a different community.

PJM’s Jason Connell said the RTO is focused on arriving at the most optimal engineering solution.

Reliability Analysis Shows Growing Need for West-to-East Transfer Capability

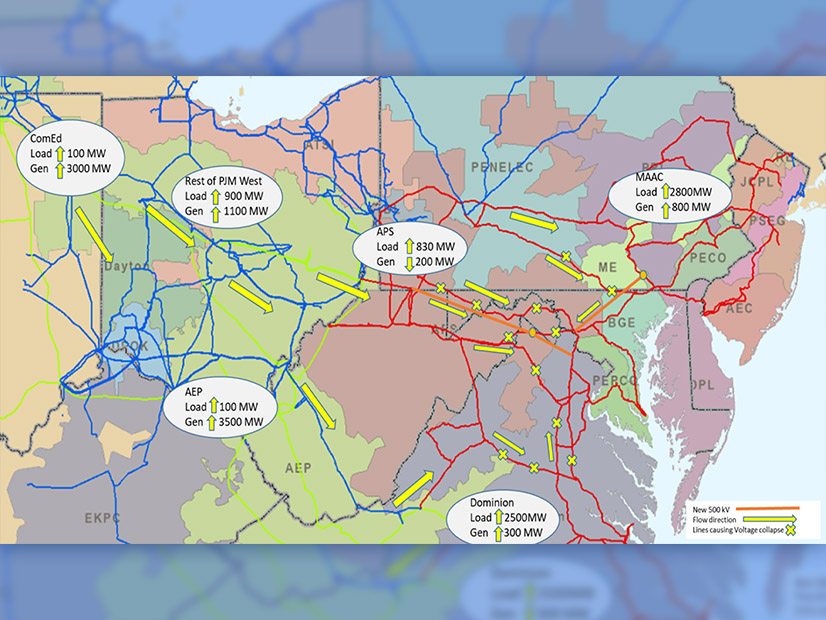

Analysis of shifting load and generation patterns between 2028 and 2029 RTEP models find that rapidly growing load in PJM’s eastern regions could result in increased power flows from the west, where sizeable solar and wind development is expected to occur.

The MAAC region is forecast to see around 2,800 MW of load growth and 800 MW of new generation between the 2028 and 2029 summers, while the Dominion zone should see 2,500 MW in new load and 300 MW of added generation. While adequate generation growth is expected in the ComEd, AEP and Rest of PJM West zones to cover the load in the east, the analysis identified several voltage collapse violations in the summer across southern Pennsylvania, Maryland and Virginia.

PJM’s Jeff Goldberg said the analysis shows that the need for additional transmission linking the east and west is likely to present sooner than expected.

PJM Director of Transmission Planning Sami Abdulsalam said the analysis is meant to identify future needs and does not include any proposed solutions, adding that any transmission proposals are not bound to follow similar designs to past RTEP projects.

Supplemental Projects

Public Service Enterprise Group presented a $169 million project to construct a new 230/69/13-kV substation near Kenilworth, N.J., to address capacity overloads identified at its Springfield Road and Aldene substations. The new facility would be cut into the existing 230-kV Springfield Road-Aldene line and the 69-kV Springfield Road-Roselle line with a projected in-service date in December 2029.

Dominion presented a $42 million project to construct a new substation to serve a data center complex in Bristow, Va., which is projected to consume over 100 MW by 2029. The proposed Devlin facility would cut into the existing 230-kV Dawkins Branch-Vint Hill line and host nine 230-kV breakers configured as a breaker-and-a-half. The project is in the engineering phase and is targeted to come online in June 2026.

The utility presented a $30 million proposal to construct a substation to serve another data center in Mecklenburg County, Va., which is forecast to add 110 MW of load by 2028. The 230-kV Allen Creek switching station would cut into the 230-kV Finneywood-Cloud line. The design is in the conceptual phase with a projected in-service date of Dec. 30, 2025.

Dominion also said that around a dozen new substations will be needed across Virginia to serve data center growth, with most of the new load concentrated in Northern Virginia, including Prince William, Henrico and Charles City counties. The loads are expected to come online between December 2026 and the end of 2028.