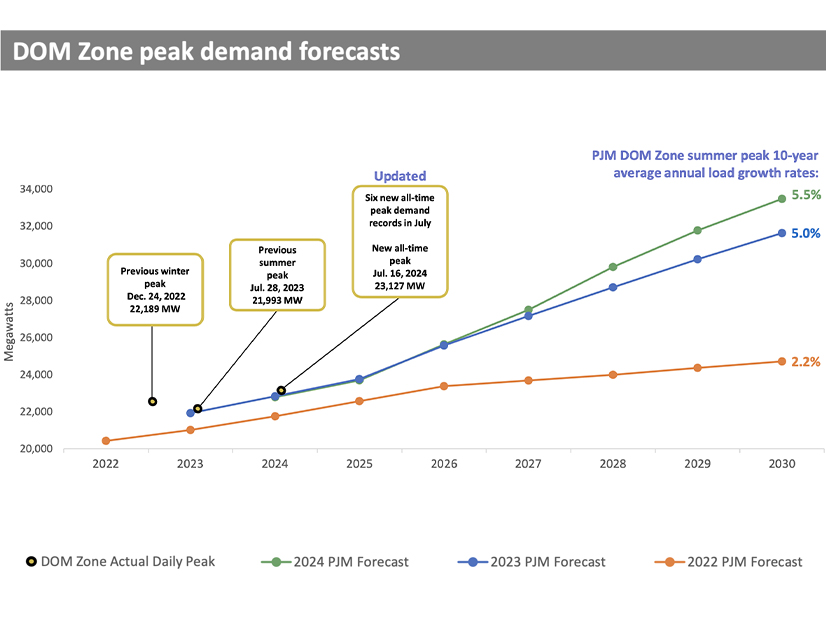

Dominion Energy earned $572 million in the second quarter of 2024 and logged six peak demand records in July on the back of Virginia’s continued electricity consumption growth, the company said during an earnings call Aug. 1.

“For full-year 2024, we expect DEV sales growth to be between 4.5% to 5.5%, driven by economic growth, electrification and accelerating data center expansion,” CEO Robert Blue said during the call.

So far this year, Dominion has connected nine data centers to its system, and it plans to connect an additional six, which will match its recent annual average of 15, Blue said. But the scale of those data centers and their number are growing, while data center developers want them up and running on shorter time frames.

“We’re taking the steps necessary to ensure our system remains resilient and reliable,” Blue said. “We have accelerated plans for new 500-kV transmission lines and other infrastructure in Northern Virginia, and that remains on track. We were awarded over 150 electric transmission projects totaling $2.5 billion during the PJM open window last December.”

The current “open window” for PJM’s competitive planning process is expected to be as big, or even larger, due to data center development in Northern Virginia and other parts of the RTO’s footprint, Blue added.

The growth of data centers has led the Virginia State Corporation Commission to shift around who is paying for wires in the state, Blue said. Since 2020, residential customers’ share of transmission costs has been cut by 10%, while that paid by “GS4” consumers — the largest energy users — has gone up by 9%.

Dominion also is working to expand generation to meet higher demand, looking into small modular nuclear reactors, natural gas storage, and an additional wind farm off the coast of North Carolina once it finishes with Coastal Virginia Offshore Wind (CVOW).

The 2.6-GW wind farm is under construction off the coast of Virginia Beach, with 42 monopiles installed so far this season and 30 more having been delivered to the utility on shore, which represents 40% of the project’s total monopiles.

“After a startup period, during which we successfully calibrated our sound verification process in accordance with our permits, we’ve been able to ramp the installation rate markedly, including achieving two monopile installations in a single day on July 21, and again on July 28,” Blue said.

Other parts of the massive project continue to be on schedule, with Blue saying Dominion should install the first cable to connect the power plant to the grid during the third quarter.

“The schedule for the manufacturing of our turbines remains on track,” Blue said. “Fabrication of the towers for our turbines began in June.”

Dominion will not install its first turbines for the CVOW until 2025, but Blue said that process has begun for the Moray West wind plant off Scotland, which is using the same Siemens Gamesa turbines and already has shipped power to the United Kingdom’s grid.

“The lessons learned from that project will benefit our project installation in the future,” Blue said.