Planning Committee

PJM Models Suggest Capacity Shortfall Possible in 2029/30 Delivery Year

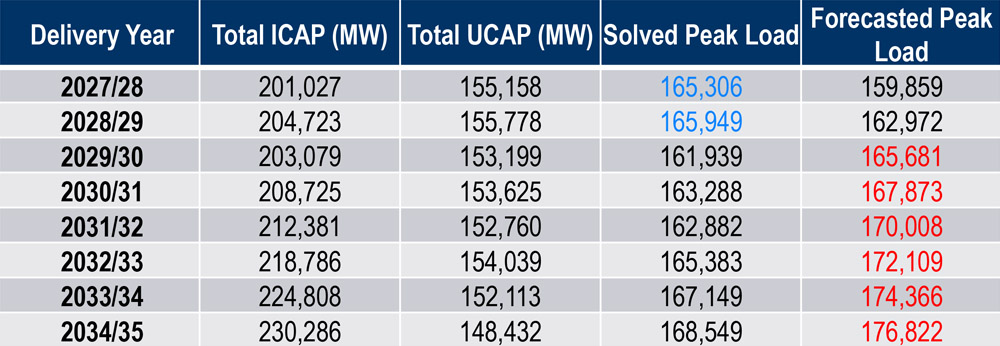

PJM could see a growing capacity shortfall starting with the 2029/30 delivery year, the RTO found after running its effective load-carrying capability (ELCC) model on a generation mix forecast through the 2034/35 DY, PJM’s Patricio Rocha Garrido told the PJM Planning Committee during its Aug. 6 meeting.

Rocha Garrido said adjustments to resource accreditation drive a declining forecast pool requirement (FPR) in the analysis, leading to the forecast peak load surpassing the solved peak load.

In other words, the resources PJM expects to come onto the grid will have a declining marginal capacity contribution each year that, paired with generation deactivations, may lead to accredited capacity falling below forecast peak loads.

Rocha Garrido cautioned that the analysis should not be seen as a forecast and is instead the result of applying its ELCC modeling to a resource mix forecast supplied by a PJM vendor, which carries “significant uncertainty.” While the vendor’s assumed resource mix cannot be released publicly, Rocha Garrido said it can be supplied to individuals upon request.

“We’re getting lower reliability value of the additions,” Rocha Garrido said, adding that the declining capacity value is the driving factor “rather than demand-side adjustments.”

If peak loads were driving the imbalance, Rocha Garrido said the FPR would be trending up in the analysis.

PJM received deactivation requests for combustion turbines that led to a higher CT rating in the 2026/27 Reserve Requirement Study (RRS) after the analysis was initiated, so they are not reflected in the assumed resource mix. (See PJM Presents Revised Reserve Requirement Study Values.)

Rocha Garrido said a decline in the capacity contribution of demand response resources is due to risk modeling concentrating expected unserved energy in winter hours outside the DR availability window.

Paul Sotkiewicz, president of E-cubed Policy Associates, questioned whether the vendor would readjust the resource mix forecast given the spike in capacity prices in the 2025/26 Base Residual Auction. He said it could make sense for generators to undergo retrofits rather than retire, given the possibility of higher capacity revenues, particularly for coal units that could see upgrades to comply with coal combustion residuals requirements becoming economically viable. (See PJM Capacity Prices Spike 10-fold in 2025/26 Auction.)

Several stakeholders questioned the accuracy of the resource mix forecast and urged PJM to conduct additional sensitivities. Rocha Garrido said more sensitivities would be helpful, but staff did not have time for this analysis while preparing the 2026/27 RRS parameters.

Stakeholders Endorse LAS Charter Revisions

The PC endorsed revisions to the Load Analysis Subcommittee (LAS) charter aimed at reflecting a shift in the group’s function toward reviewing the load forecasts produced by PJM and soliciting stakeholder comments on the forecast inputs.

PJM’s Andrew Gledhill said much of the status quo charter language is a holdover from when transmission owners presented their own forecasts to PJM and stakeholders through the LAS. The proposed changes were approved by the LAS on July 29.

Calpine’s David “Scarp” Scarpignato said stakeholders’ role at the LAS goes beyond reviewing PJM’s load forecasts, which he said was the focus of the original proposed charter revisions. He proposed that PJM’s language be amended to reflect that stakeholders provide substantive comments on how the forecast is prepared.

Gledhill said language in the “responsibilities” section of the charter was intended to reflect stakeholder comments and noted that members do not vote on or approve PJM’s forecasts. He accepted a friendly amendment to the revisions from Scarp to add “and is responsible for soliciting stakeholder input and providing review of PJM reports” to the charter’s mission statement.

Monitor Presents CIR Transfer Proposal

The Independent Market Monitor presented its proposal for an expedited process for transferring capacity interconnection rights (CIRs) held by deactivating generators to planned resources in the interconnection queue. (See “Elevate Reviews CIR Transfer Proposal,” PJM PC/TEAC Briefs: July 9, 2024.)

The biggest distinction between the Monitor’s concept and the four competing designs is that CIRs would not be bilaterally traded between market participants but instead would be made available to the next planned resources that could take advantage of the underlying transmission capability. If PJM identified that a deactivating resource would create transmission violations that would require offering the owner a reliability-must-run (RMR) agreement to keep the plant in operation, PJM would initiate an expedited process where it would assign the CIRs to the next resource in the queue that could address the violations.

If PJM did not identify projects within the interconnection queue that could resolve the transmission violations, it would conduct an auction, or a solicitation could be held for project designs.

Scarp questioned what guarantees can be provided to ensure that generation projects selected by PJM through the expedited process are built if they are meant to replace an RMR contract and constitute reliability projects.

“If you’re doing it for RMR purposes, I’m wondering if you need more of a solid commitment more than what is already in the generator interconnection process,” he said.

PJM, Gabel Associates, MN8 Energy and Elevate Renewables also have sponsored packages, differentiated by the resources that would be eligible to receive transferred CIRs, how potential impacts to the grid would be studied and the standard that would disqualify replacement resources from using transferred CIRs due to identified grid upgrades.

PJM’s Becky Carroll said the proposals are slated to go for first reads and an endorsement during the Sept. 10 PC meeting, but voting could be deferred to the Oct. 8 meeting if substantial changes are made over the next month.

Manual 14B Revisions Include Change to Light Load Model

Stakeholders endorsed revisions to Manual 14B: Region Transmission Planning Process to rework the inputs to PJM’s light load case, which is used in the Regional Transmission Expansion Process (RTEP) load forecast to reflect the growth of load with flat profiles unaffected by weather and season.

The light load case is designed to create an accurate representation of shoulder periods by scaling load down to 50% of the summer forecast peak using bus-level data provided by transmission owners. PJM’s Stan Sliwa said practice has been challenged by the growth of non-scalable load, such as data centers. The revisions would remove non-scalable load from the light load case.

The Manual 14B changes also expand the NERC TPL standards examined during generator deliverability analysis to match current practice, updating the system operating limit (SOL) definition and adding new standards created by NERC.

The language is set to go before the Markets and Reliability Committee for a first read Aug. 21 and an endorsement vote Sept. 25.

Transmission Expansion Advisory Committee

PJM Presents Results of 8-year RTEP Model

PJM has updated the needs in its 2024 RTEP Window 1 solicitation to include a longer eight-year model designed to capture issues that might take longer than the typical five-year cycle to resolve.

The additional three years capture the remainder of the New Jersey offshore wind being interconnected through the State Agreement Approach (SAA), the completion of the Coastal Virginia Offshore Wind (CVOW) project and the 1-GW Chesterfield gas generator near Richmond, Va.

Despite the additions, load growth and resource deactivations are expected to cause Dominion and the West regions to each lose over 1 GW of dispatchable energy in the summer, while the capability in MAAC would grow by 2 GW over the 2029 model. Dominion would lose 2 GW in the winter case, while MAAC and West would both gain around 1 GW. Both MAAC and the West likely would export energy as demand grows in Dominion.

PJM’s Sami Abdulsalam said a conservative approach is taken when considering which planned resources are expected to be available in the RTEP analysis. Both Chesterfield and CVOW have advanced queue positions that provide a strong certainty of them coming online, while the New Jersey SAA projects have commitments to PJM from a state backer.

More than 100 new thermal overloads were identified in the longer model, 76 of which were in the summer, 48 in the winter and 40 in the light load case. Abdulsalam said the analysis is meant to allow transmission owners submitting RTEP solutions to right-size their projects to meet the needs identified in the five-year model with an eye toward long-term needs.

The solicitation window opened July 15 and is set to close Sept. 13, but Abdulsalam noted the new analysis was released after the window opened.

Several ratepayers in Northern Virginia called for alternatives to the series of transmission projects built or that are planned to crisscross the region to supply rapid load growth, with residents particularly interested in the concept of an undergrounded DC line. They also questioned whether higher capacity prices will lead to generation development that could reduce the need for transmission projects.

PJM’s Susan McGill said the RTO’s role is to identify needs and it’s up to developers to propose transmission or generation solutions through the RTEP or interconnection queue.

Supplemental Projects

PPL presented a project to interconnect a 1,980-MW load sited near Hazleton, Pa., for $196.55 million. The customer would be supplied by a new 230-kV switchyard named Tomhicken, which would be cut into the Susquehanna-Harwood double circuit 230-kV line, as well as a new Nescopeck 230-kV switchyard.

Tomhicken would be configured as a six-bay, breaker-and-a-half facility with a 125-MVAR capacitor bank for $45 million, and Nescopeck would be configured as a three-bay breaker and a half switchyard for $29.5 million. Nescopeck would be cut into the Susquehanna-Sunbury 230-kV line with a partial rebuild of the portion between the new facility and Susquehanna to upgrade it to be double circuit for that portion. Additional 230-kV lines would be constructed between Nescopeck, Tomhicken and Harwood.

The customer is expected to come online in 2026 starting with a load of 240 MW, growing to 720 MW in two years, 1,440 MW by 2031 and reaching its full consumption in 2033. The project is in the conceptual phase, with a projected in-service date of June 1, 2027.

Exelon presented a $158 million project to provide service to a customer seeking to bring 378 MW of load to the Elk Grove area in its ComEd zone. The customer would be served by a new 138-kV substation with 16 circuit breakers and in a double ring bus configuration and five 138/34-kV transformers. The facility would be cut into the Elk Grove-Schaumburg line.

The project would require a new 345-kV bus in a breaker-and-a-half configuration to be installed at the Elk Grove substation, including 12 new 345-kV circuit breakers. The bus would be cut into the Des Plaines-Lombard 345-kV double circuit line. Two 345/138-kV autotransformers also would be installed.

The customer expects to bring 117 MW of load in December 2026 and reach 333 MW in 2028. The project is in the conceptual phase, with a projected in-service date of Dec. 31, 2026.

Exelon presented an additional $40.6 million project to serve a customer in the Elk Grove region with 260 MW of load. A new 138-kV substation would be built with 15 circuit breakers in a double ring bus configuration with six 138/34-kV transformers. It would be connected to the Elk Grove East substation with new 1.7-mile, 138-kV lines.

Two 345/138-kV autotransformers would be required at the Itasca substation, as well as two 345-kV and two 138-kV circuit breakers.

The customer anticipates 25 MW of load in June 2027, 87 MW in 2028, growing ultimately to 260 MW. The projected in-service date for the transmission upgrades is Dec. 31, 2027.

FirstEnergy presented a $38.7 million project to replace steel H-frame structures along its Perry-Ashtabula-Erie West 345-kV line, reconductor 7.2 miles of the 20-mile line and replace insulators and related equipment. The line is around 60 years old, and the insulators, H-frames and guying are corroded. The line has experienced seven scheduled outages for repairs and four due to equipment failure since 2014. The project is in the conceptual phase, with a possible in-service date of April 9, 2027.

The utility also presented two projects amounting to $15.5 million to replace obsolete and misoperating relay equipment at its Doubs, Ringgold, Lime Kiln and Montgomery 230-kV substations in the APS zone. The work is in the engineering phase, with an estimated in-service date of Oct. 31, 2026, for Lime Kiln and Montgomery and Dec. 31, 2026, for Doubs and Ringgold.

Dominion presented a $180 million project to address reliability violations along its Fredericksburg-Possum Point 230-kV line, as 3 GW of load is expected to come online served by 13 new substations along its length.

A new Allman switching station would be built north of the Fredericksburg substation, with 10 230-kV line terminals in a breaker-and-a-half configuration. It would cut into 230-kV lines between Fredericksburg and the Cranes Corner, Aquia Harbour and Birchwood substations

About 4.5 miles of the line from Allman to Cranes Corner and 0.7 miles of line from Allman to Hospital Junction would be rebuilt with double circuit structures. The Cranes Corner substation would be expanded to support line realignment. The line to Aquia Harbour would be upgraded to double circuit and rebuilt with vacant arm positions to host two additional 230-kV lines to run from Allman, past Aquia and onto Possum Point on a new 7.1-mile double circuit pole line.

The project is in the conceptual phase, with a possible in-service date of June 1, 2029.

Dominion also presented a $30 million project to power a data center customer in Stafford, Va., with a projected summer 2029 load of 136 MW. A new Centreport switching station in a four-breaker ring bus configuration would be cut into the Spartan-Cranes Corner line with 2.5 miles of new double circuit line.