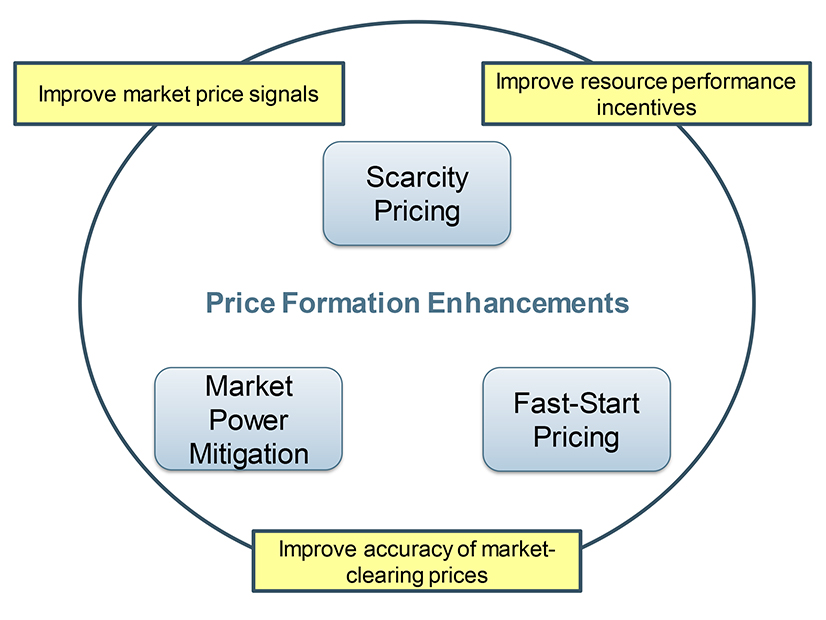

CAISO on Sept. 30 launched Phase 2 of its Price Formation Enhancements Initiative, aimed at addressing issues specific to market power mitigation, scarcity pricing and fast-start pricing in its markets — including the Western Energy Imbalance Market and Extended Day-Ahead Market.

“These enhancements aim to improve the accuracy of our market clearing prices, provide better market price signals, and enhance incentives for resources to perform,” James Friedrich, CAISO lead policy developer, said during a meeting to launch the effort. “It is the general view of the [Price Formation Enhancements] working group that enhancements in these areas could help the market become a more effective steward of reliable outcomes.”

Phase 1 of the initiative hosted 18 working group meetings and resulted in a FERC-approved tariff change that allows hydroelectric and energy storage resources to bid above the ISO’s $1,000/MWh soft offer cap. (See FERC Approves CAISO Request to Lift Soft Offer Cap for Hydro, Storage.)

Scarcity Pricing

Scarcity pricing, a mechanism to determine market prices when supply falls short of demand, came into focus for CAISO following grid emergencies during the summers of 2020, 2022 and 2023, Friedrich said.

The increased risk that comes with declining reserves and a rising loss-of-load expectation should translate into the market’s willingness to pay more for additional reserves to maintain reliability. And while the ISO already relies on a number of different scarcity pricing mechanisms — including the scarcity reserve demand curve, the flexible ramping product and bidding above the soft offer cap — ISO staff and stakeholders saw a need to improve on those mechanisms to ensure more efficient market outcomes and maintain grid reliability.

“It’s important to note that while these mechanisms provide a good foundation for scarcity pricing in our markets, this initiative considers potential enhancements to ensure that they accurately reflect scarcity conditions across the entire market footprint and across all market intervals,” Friedrich said.

Staff and stakeholders have identified four key issues around scarcity pricing.

First, the market is inconsistent in how it procures ancillary services, a function not applicable to the WEIM or EDAM. The real-time market only procures incremental ancillary services for the CAISO balancing authority area (BAA), rather than fully re-optimizing them, Friedrich said. The market also doesn’t re-optimize in the five-minute market, leading to less efficient scarcity pricing outcomes and procurement.

Second, prior working groups also identified potentially outdated penalty prices, which currently are tied to the market bid cap and may not accurately reflect the true reliability value of a resource during scarcity events, Friedrich explained. Stakeholders also expressed concern the prices may be too low to provide effective incentives.

The third issue relates to potential disconnects between market prices and grid conditions during emergencies. The current market design may not adequately reflect the severity of emergency conditions in market prices, Friedrich said, leading to situations in which prices don’t align with the actual scarcity level indicated by emergency operator actions.

The last problem centers around insufficient scarcity signals. The scarcity reserve demand curve and power balance constraint violations in the market only get triggered during actual shortages, Friedrich said, which can result in price spikes that are “volatile and unpredictable.”

“Collectively, these issues point to the need for reform of our scarcity pricing mechanism, and by addressing these problems we aim to improve market efficiency, enhance reliability and provide more accurate price signals that reflect real-time grid conditions,” Friedrich said.

Elaborating on the initiative’s main objectives, Friedrich highlighted three main goals:

-

- to improve market signals during tight supply conditions so that prices accurately reflect the true state of the grid;

- to incentivize resource performance and demand reduction; and

- to align prices with real-time grid conditions across the WEIM.

But two significant hurdles stand in the way of achieving these goals, Friedrich said. The first is the need to address discrepancies in how scarcity pricing applies across different balancing authorities in the market, while the second is the need to identify a “consensus-driven method to scale and anchor penalty prices.”

Market Power Mitigation

Friedrich said CAISO also must change rules around market power mitigation, which prevents the exercise of structural market power when a BAA is price-separated from CAISO.

Three main problems were identified in prior working groups: structural market power may be overestimated in individual BAAs; the CAISO BAA is excluded from the market power mitigation test; and the frequent mitigation during off-peak hours with low prices raises questions about current triggers.

The top priority is to ensure competitive pricing while refining mitigation mechanisms for WEIM and Extended-Day Ahead Market (EDAM) BAAs.

Fast-start Pricing

Friedrich also gave an overview of fast-start pricing, which integrates commitment costs of fast-start resources into market prices.

“Fast-start pricing recognizes that fast-start resources may serve as the marginal resource used to meet the next increment of energy or operating reserves demand,” Friedrich’s presentation said. “However, they often have output levels that prevent them from being fully dispatchable and thus are often ineligible to set the LMP.”

Phase 1 included a stakeholder-requested analysis to determine the potential market impact of fast-start pricing and whether it should be implemented. The analysis demonstrated a “generally moderate” impact, and some stakeholders saw value in continuing to prioritize the topic in discussion, while others didn’t. While members of the working group haven’t reached consensus, they mostly supported a deeper analysis of fast-start pricing.

Supporters of SPP’s Markets+ have pointed to the absence of fast-start pricing as a shortcoming of the EDAM.

The working group’s next Phase 2 meeting is tentatively scheduled for Oct. 23, and the target date for a straw proposal is May 25, 2025.