The addition of new resources and broader support from the Western Energy Imbalance Market (WEIM) led to an “uneventful” summer for the Western grid, industry experts said — despite record peak loads and July being the hottest month ever recorded across the region.

A key factor in that success: more batteries.

“A big benefit that we found from this summer was the growth of battery energy storage within the California ISO,” Scott Olson, director of policy, regulatory and markets at Avangrid Renewables, said during a Sept. 25 Western Energy Markets (WEM) Governing Body panel discussion. “Having 10 gigawatts of batteries … helped us to the uneventful outcome that we actually appreciated.”

Battery storage is playing an increasingly important role as the industry continues to replace conventional resources with intermittent renewables. California will need around 50 GW of batteries to meet its 2045 greenhouse gas reduction goals, according to a CAISO special report, and it’s well on its way. Battery storage capacity in the ISO has grown from 500 MW in 2020 to 11,200 MW as of June 2024, and the WEIM includes an additional 3,500 MW.

“Our growing battery fleet was instrumental in balancing supply and demand throughout the heat wave,” CAISO spokesperson Anne Gonzales told RTO Insider in an email.

Pam Syrjala, senior director of supply and trading at Salt River Project, agreed that while summer was challenging due to extreme heat, conditions were better than the prior summer, largely thanks to battery storage.

“Last summer, we were trying to implement a large number of battery resources into our system, so we were bringing on almost 450 MW of batteries” Syrjala said during the panel discussion. “This summer, we brought on probably over 650 MW of batteries, and it was a night-and-day difference.”

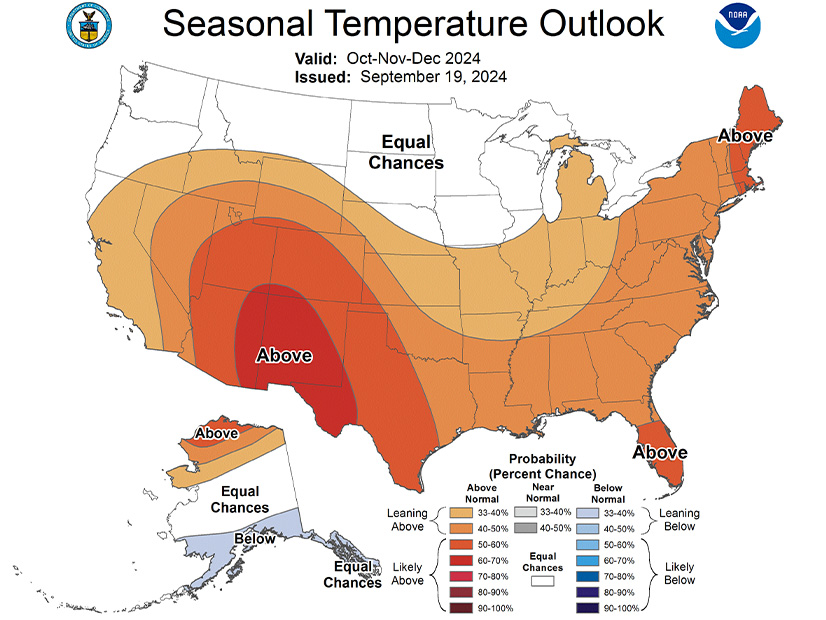

Temperature variation also contributed to more manageable grid conditions, with certain parts of the West, like Southern California, experiencing above-normal but not historically high heat, compared with the central part of the state, which broke temperature records.

“That variation, while small, was enough to tamp down demand and maintain grid reliability,” Gonzales said.

Assistance Energy Transfers

Relying on the transfer capability of the WEIM and on the market as a whole also contributed to smooth summer operations. In a Sept. 25 market update discussing second-quarter performance, Guillermo Bautista Alderete, CAISO director of market performance and advanced analytics, highlighted that WEIM transfers were substantial, and that expansion of the market “unlocked increasing volumes of economic transfers.”

The assistance energy transfer (AET) program, which allows WEIM areas to receive energy transfers when they don’t meet the market’s resource sufficiency requirements ahead of a delivery interval, played an important role this summer. Six WEIM balancing areas opted into the AET program in June, followed by 10 more in July and August, and nine in September. The total surcharges assessed were about $72,000 for all the balancing authorities involved.

WEM Governing Body Chair Rob Kondziolka said that while the ISO discourages BAs from leaning on the AET program too heavily, it helped a lot.

“Assistance energy transfers has been a great benefit, we think, to the market design,” Olson said. “We only use it in small amounts, but, boy, when it’s there relative to the alternative in the real-time market … it’s absolutely a huge benefit to us.”

Kelsey Martinez, manager of system operations at PNM Resources, backed up Olson’s view.

“It just allows you that peace of mind that you’re not going to have to change your operating process in the midst of an energy crisis,” Martinez said.

The AET program was pushed by NV Energy and heavily debated in its beginning stages, said Kondziolka, who expressed satisfaction with its benefits, despite the associated costs.

‘We Can’t Let Our Guard Down’

Even with record peaks and high temperatures, CAISO issued no energy emergency or flex alerts. And while wildfire danger was high, there were no disruptions to the bulk electric system, Gonzales said.

California energy officials — including those at CAISO — entered summer ‘cautiously optimistic’ about grid conditions, and the ISO is approaching fall with a similar mindset, she said. (See Calif. Officials ‘Cautiously Optimistic’ on Summer Reliability.)

“We need to be cautious about the successes of the grid this summer. We can’t let our guard down,” Gonzales said. “We were closely monitoring equipment fatigue and ambient de-rate (reduced output) from the prolonged heat waves. When generators are running at high rates of output for multiple consecutive days, we start to get concerned about equipment failure and outages. And we continue to closely track wildfire activity extending into October.”