Stakeholders on Monday urged New York regulators to defer approval, outright reject or refer to NYISO’s public policy transmission planning process Consolidated Edison’s (NYSE:ED) proposal for a new substation in Brooklyn to integrate up to 6 GW of offshore wind energy (20-E-0197).

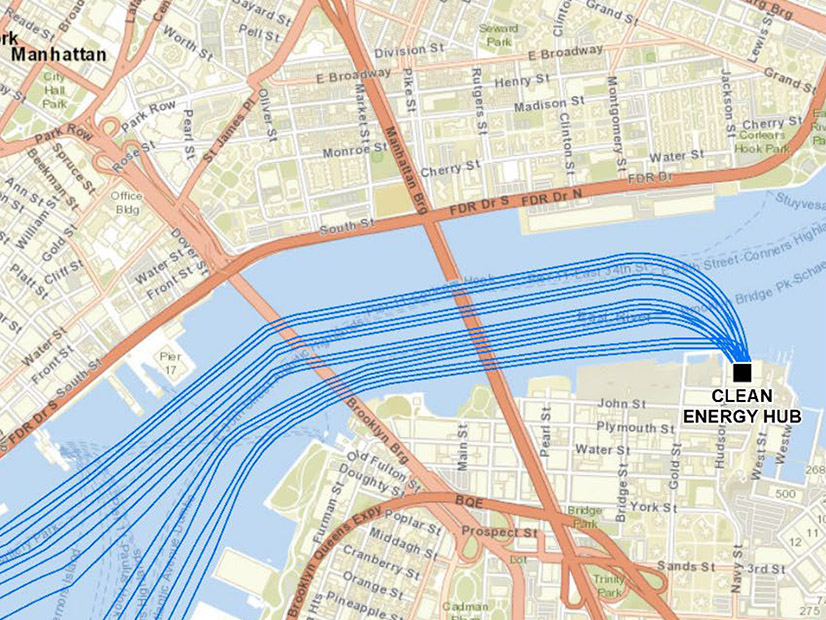

The utility would build the Brooklyn Clean Energy Hub on land it already owns adjacent to its Farragut Substation on the East River waterfront, a move it claims would save time and money, and also reduce interconnection costs compared to alternatives.

Stakeholders claimed that Con Ed’s proposal was long on optimism and short on details; complicated risk assessment for offshore wind developers preparing to respond to an imminent state solicitation; and should go through a competitive bidding process.

The Long Island Power Authority (LIPA) said that Con Ed’s April petition did not address the Public Service Commission’s January order that the utility provide specific information regarding why its existing substations cannot accommodate future offshore wind projects.

“The petition discussed and rejected a few alternative points of interconnection (Gowanus and Staten Island) but did not provide a comprehensive review of alternative points of interconnection (POIs) with associated cost estimates. Although the petition discussed the addition of a feeder and ring bus costs as being time- and cost-prohibitive elements associated with transmission interconnection at Gowanus, it provided few details associated with this analysis,” LIPA said.

In addition, NYISO’s Long Island OSW export public policy transmission need (PPTN) solicitation process is nearly complete and may result in a solution that itself creates interconnection headroom, thereby possibly reducing the need for the new hub. “The commission, therefore, should consider deferring its approval of costs of this magnitude until a PPTN proposal is selected,” LIPA said.

LS Power Grid and NextEra Energy Transmission New York reiterated calls for the PSC to refer Con Ed’s hub proposal to the NYISO planning process as a regional transmission project, calls that the commission rejected in its January order. (See NYPSC Mandates Meshed Offshore Tx Grids.)

While agreeing that the commission has significant authority over planning and siting, the NYISO competitive process nonetheless “is a powerful tool to achieve the goal of meeting [state] mandates at the least cost to ratepayers,” LS Power said.

The project as proposed by Con Ed is infeasible and presents significant challenges for OSW developers to permit and construct the necessary transmission lines, said NextEra.

“Con Edison assumes that OSW developers would utilize HVDC cables to reduce the number of cables required under the Verrazzano-Narrows Bridge and will site multiple converter stations near the water in New Jersey, Staten Island and/or Brooklyn. However, under Con Edison’s assumed scenario, the OSW developers would be required to install up to three HVAC cables from each converter station to connect to the hub project. Moreover, Con Edison assumes that the HVAC cables will connect to the hub project by water,” NextEra said.

To accommodate 6,000 MW of OSW generation, five HVDC and 15 HVAC cables will need to be installed in the Upper Bay; that many cables, as well as the requirement to site and install converter stations near the water as Con Ed has proposed, presents significant coordination, permitting and construction challenges, NextEra said.

“Independent developers should not be ignored in considering the Clean Energy Hub and its many surrounding implications,” said Anbaric Development Partners.

Questioning the merits of interconnecting 4,500 to 6,000 MW of offshore wind “at essentially a single location,” New York City said that a climatic or other extreme event at that location could sever all of the offshore wind connections to the city, perhaps for an extended period of time.

As the state and city become more reliant on renewable resources and shut down its remaining fossil plants, a single interconnection location in Brooklyn for most offshore wind projects “could create unacceptable reliability and resilience risks,” the city said.

Con Ed also “creates a false sense of urgency” to support expedited approval of its petition, claiming the project is the only one that can be in service by 2027, LS Power said.

Even if the project could be completed by 2027, which is far from certain, there would not be anything to connect to it in that year. Rather, an OSW generator selected in the upcoming New York State Energy Research and Development Authority (NYSERDA) solicitation will most likely not be in service until after 2030, LS Power said.

The table lists NYISO published costs of interconnection for major generation facilities as compared to the Brooklyn Clean Energy Hub. | Con Edison

The table lists NYISO published costs of interconnection for major generation facilities as compared to the Brooklyn Clean Energy Hub. | Con EdisonThe New York Offshore Wind Alliance (NYOWA) said the commission should initiate a competitive procurement that examines the costs and benefits of a wider set of solutions, which should run in parallel with the third NYSERDA OREC solicitation, scheduled to be released imminently.

Developers preparing for the upcoming solicitation have been working to identify and de-risk interconnection options, and those efforts should not be overridden, NYOWA said.

Con Ed identified the site of the Hudson Avenue Units 3, 4 and 5 for the location of the project. LIPA said the company did not provide any comparative costs for using other in-city POI “that could be vacated by existing merchant steam plants at Astoria and Ravenswood, upon their future retirement. Consequently, the PSC’s decision would benefit from additional analysis as to whether alternative sites can be economically repurposed to interconnect offshore wind.”

LIPA also encouraged the commission to consider the risk of potential cost overruns, quoting Con Ed calling the new substation “a conceptual project that will require detailed engineering studies.” While the PSC requested an engineering cost estimate for the hub proposal, Con Ed provided no details about the studies behind or confidence level in the $1 billion cost estimate, LIPA said.