CAISO has launched an initiative to improve its congestion revenue rights market by addressing issues such as revenue inadequacy and auction efficiency.

CAISO has launched an initiative to improve its congestion revenue rights market by addressing issues such as revenue inadequacy and auction efficiency.

The ISO held a working group meeting Nov. 14 to kick off the stakeholder process for the initiative. It also released a discussion paper outlining the issues regarding CRRs.

CRRs are intended to provide a hedging mechanism for congestion risks in the day-ahead market. They’re distributed through free allocations to load-serving entities and also are awarded through auctions in which a variety of entities may participate.

But auction efficiency has been a concern. According to CAISO, the CRR auction has been yielding only about 65 cents per dollar of congestion revenue.

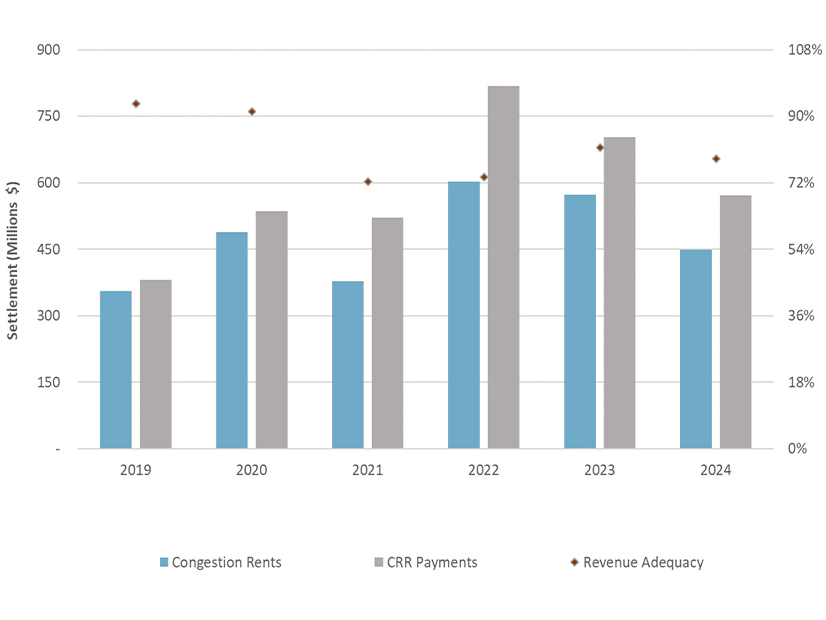

Revenue adequacy is another issue: From 2019-2024, system-level revenue inadequacy was 81%, with a total shortfall of $684 million.

The current effort follows a previous initiative regarding CRR auction efficiency that led to rule changes in 2019.

Since then, losses from CRR auctions have decreased, but have been described as “still very high” by the Department of Market Monitoring (DMM), a longtime auction critic. (See Congestion Revenue Rents Still Underfunded, CAISO DMM Says.)

“The ISO should stop offering CRR positions on behalf of transmission ratepayers at $0 offer prices and enable trades to only take place between willing sellers bidding into a market for these financial contracts,” the DMM said in a presentation during the workshop, echoing an argument it has been making for years. (See CAISO CRRs Still Losing Money, but Less.)

Working Group Timeline

The working group will develop problem statements that will lead to proposed policy solutions. Those proposals will go to the ISO Board of Governors and the Western Energy Markets Governing Body for approval and ultimately be filed with FERC.

For the next steps in the process, CAISO staff have proposed following up the Nov. 14 meeting with one or two workshops in January to provide background information on the CRR market. The sessions would be geared toward those who recently have joined the stakeholder process and others who may need a refresher.

At the same time, CAISO wants to learn more about how different entities are hedging risk through CRRs.

Under the proposed timeline, February would be devoted to analysis, including CRR outcomes since the 2019 reforms. CAISO staff also have offered to provide benchmarking comparisons to CRR-like programs at other ISOs, which go by different names, such as financial transmission rights.

March would feature discussions of proposed problem statements and the scope of the initiative, followed by release of an issue paper from the working group in May or June.

CAISO welcomes comments on the CRR discussion paper and on the initial meeting — including the proposed focus of future meetings. Comments are due by the end of the day Dec. 12.