MISO experienced an 84-GW peak load during an unseasonably warm early October; still, the peak was no match for October 2023’s 99-GW peak.

Despite MISO registering a smaller year-over-year monthly peak, its average October 2024 load remained unchanged from last year at 69 GW, according to the RTO’s monthly operations report. Ahead of the fall, MISO predicted a 95-GW peak during the month.

The system appeared unaffected by an 872-MW capacity deficit for the fall season in Missouri’s Zone 5 due to the permanent closure of Ameren’s Rush Island coal plant Oct. 15. MISO wasn’t forced to issue an alert or warning throughout October. (See MISO Predicts Painless Fall Despite Missouri Capacity Shortfall.)

MISO averaged a $26/MWh real-time locational marginal price during October, less than October 2023’s $31/MWh and half of October 2022’s $52/MWh average. Average coal and gas prices stayed static year-over-year, at $2/MMBtu.

MISO said it fell short of its self-imposed standard on price divergence between its day-ahead and real-time markets over the month. System-wide, the average day-ahead price was $26.71/MWh while the average real-time price was $25.80/MWh.

The RTO usually tries to keep its absolute day-ahead to real-time price difference divided by a day-ahead locational marginal price at or below 22.2%. In October, MISO said the deviation reached 27%.

MISO said congestion and real-time ancillary service product scarcity worsened the divergence. It added that “ramp-up continues to be a challenge, particularly in the evening hours as generation is coming offline.”

The grid operator said day-ahead to real-time price deviation this year also has been poor enough to review in January, April, May, June and July, in addition to October.

For October, real-time congestion cost the footprint about $118 million, lower than October 2023’s $186 million.

Daily average generation outages for the typically maintenance-heavy October climbed to 61 GW this year, compared to 53 GW in October 2023.

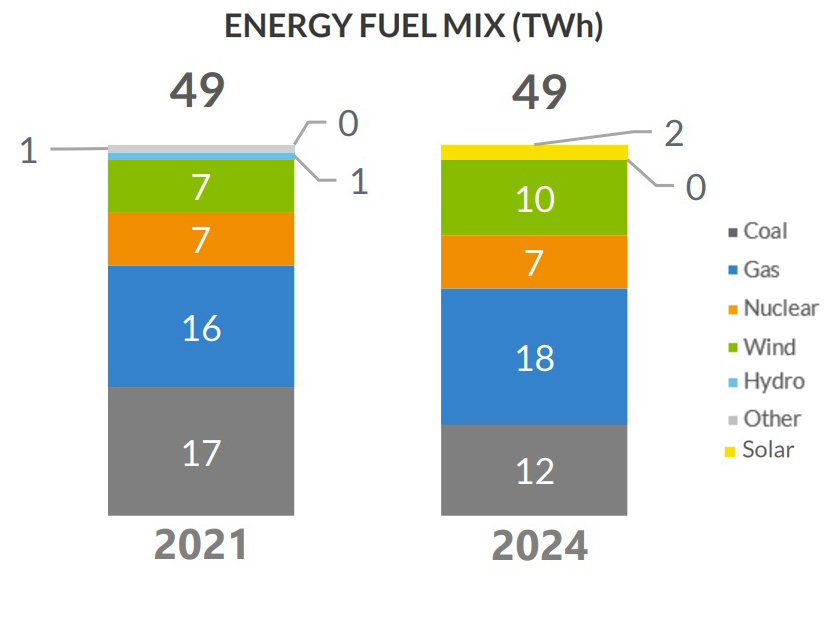

As it’s been doing on a nearly monthly basis, MISO set an all-time peak solar supply record Oct. 16, when solar briefly served a little more than 8 GW, or 16% of load at the time. Solar contributions were significant enough to register on MISO’s total 49-TWh energy fuel mix for the month, where they supplied 2 TWh.