The International Energy Agency concludes in a new global review that high cost, long delays and other challenges must be addressed before nuclear power can experience the sustained growth many people expect.

In its announcement Jan. 16 of “The Path to a New Era for Nuclear Energy,” IEA said the rebound it predicted several years ago is well underway, with 70 GW of nuclear capacity under construction worldwide and a new record for generation likely to be set in 2025.

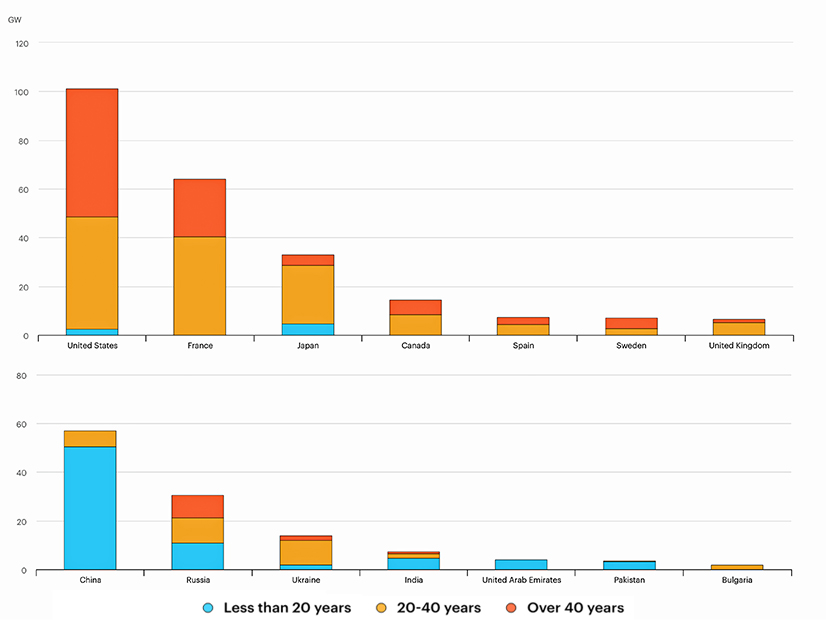

The report also flags a marked leadership transition: Most of the existing nuclear fleet is within countries with advanced economies, and most of it is decades old. The majority of projects under construction are in emerging markets and developing economies, most notably China. Of 52 reactors that have started construction since 2017, 25 were designed in China and 23 in Russia.

China is on course to displace the United States as the leader in installed nuclear capacity by 2030, but many other nations are seeking lesser amounts of capacity of their own.

“More than 70 gigawatts of new nuclear capacity is under construction globally, one of the highest levels in the last 30 years, and more than 40 countries around the world have plans to expand nuclear’s role in their energy systems,” IEA Executive Director Fatih Birol said in a news release.

But enthusiasm alone will not make those plans a reality, he said:

“Governments and industry must still overcome some significant hurdles on the path to a new era for nuclear energy, starting with delivering new projects on time and on budget — but also in terms of financing and supply chains.”

A more diverse fuel supply, shorter development timelines and a pile of money are key to nuclear’s success in its new era, the report says.

More than 75% of mined uranium comes from just four countries and more than 99% of enrichment capacity is concentrated in four countries as well — one of them Russia. Diversifying this key supply chain “needs to be given much greater attention,” the report urges, particularly by nations that import enriched uranium.

Cost and schedule overruns are equally thorny problems, and they are intertwined: The predictability of return on investment is key to attracting private capital. And private capital will be needed, the reports states, because public funding alone would be insufficient to create a new nuclear era.

Small modular reactors could be a solution to the issue of speed and cost, the report indicates, if their promise of standardization comes to pass.

Many people already are betting on SMRs, years before they come to market: IEA reports that 25 GW of plans in varying degrees of maturity already have been floated publicly.

If the evolution of the technology and the business model is successful, IEA writes, far more SMR capacity could be built:

“With the right [government] support, SMR installations could reach 80 GW by 2040, accounting for 10% of overall nuclear capacity globally. However, the success of the technology and speed of adoption will hinge on the industry’s ability to bring down costs by 2040 to a similar level to those of large-scale hydropower and offshore wind projects.”