President Donald Trump presented the World Economic Forum with his desire to power the U.S. AI revolution: behind-the-meter generation co-located with data centers and built rapidly under his National Energy Emergency executive order.

This scenario could avoid the yearslong delays of siting and permitting, he said, and would bypass the transmission grid, which he said is aging and vulnerable to attack.

Trump spoke virtually Jan. 23 to the annual gathering of global leaders and decision-makers in Davos, Switzerland.

In response to a question from TotalEnergies CEO Patrick Pouyanne about U.S. LNG exports, Trump segued from fast-tracking LNG facilities to fast-tracking new power generation.

“I’m going to get them the approval,” he said. “Under emergency declaration, I can get the approvals done myself without having to go through years of waiting. And the big problem is we need double the energy we currently have in the United States — can you imagine? — for AI to really be as big as we want to have it.”

Powering major consumers through on-site generation rather than through the grid is a very old concept, but Trump claimed the idea of doing it with a data center is new.

Trump, a vociferous critic of renewable energy, said new plants could run on whatever fuel the developers like, but he suggested “good clean coal,” if only as a backup fuel.

Trump’s comments come as the U.S. power sector scrambles to meet what is expected to be a huge increase in power demand from reindustrialization, data center expansion and societal electrification.

Some experts are skeptical the demand will increase as much as the largest projections indicate, but some increase appears inevitable: artificial intelligence is a heavy power draw, and Trump is pushing to make the U.S. a leader in AI.

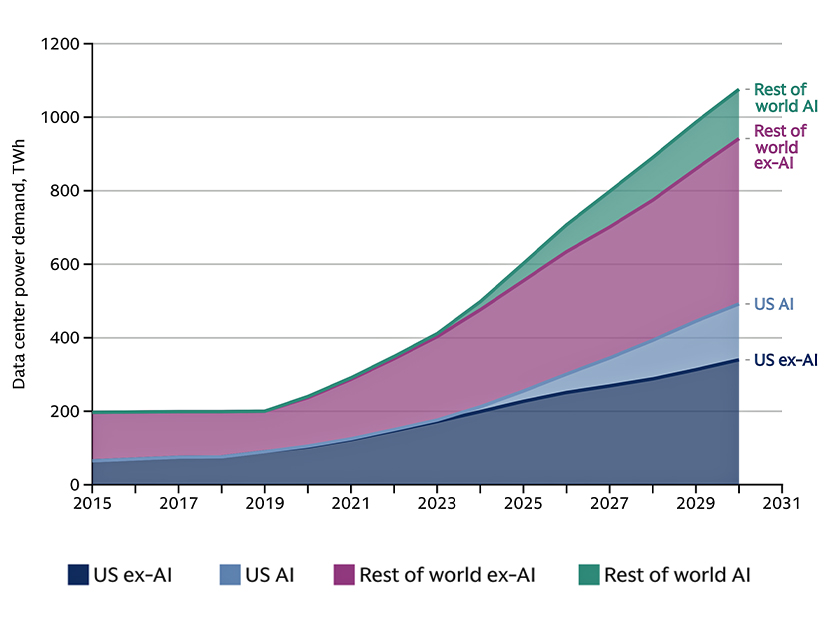

The newest projection of AI data center power needs was offered the same day as Trump spoke, when Goldman Sachs Research estimated the facilities’ power consumption would increase more than 160% from 2023 levels by 2030.

There has been keen interest in powering data centers with nuclear power, thanks to its near-constant output and near-zero emissions.

But Goldman Sachs Research concludes it would be impossible to meet the near-term needs entirely with nuclear. To do so would require 85 to 90 GW of new capacity by 2030, and only a small fraction of that amount is expected to be online by then.

Relying instead on fossil generation would ratchet up greenhouse gas emissions, the report’s authors write.

Instead, they suggest a mix of fossil, renewable, storage and nuclear power in the short term.

“Our conversations with renewable developers indicate that wind and solar could serve roughly 80% of a data center’s power demand if paired with storage, but some sort of baseload generation is needed to meet the 24/7 demand,” said Jim Schneider, a digital infrastructure analyst at Goldman Sachs Research.

The authors also note that future innovations could help reduce Big Data’s power needs — from 2015 to 2019, data center workload nearly tripled but electricity consumption was flat, due to increased energy efficiency.

They conclude: “Since 2020, efficiency gains have decelerated, but the team expects more innovations to help lower the power intensity of data centers in future.”