SPP’s Board of Directors approved eight short-term reliability projects (STRPs), a $3.15 billion package with immediate needs for this year through 2028, that were identified in the 2024 Integrated Transmission Planning assessment.

They include the first 765-kV project in SPP’s history, a $1.69 billion, 293-mile circuit in Southwestern Public Service’s territory in Texas and New Mexico. An attempt to pull the project from the list because of its price tag and make it subject to competitive bidding under FERC Order 1000 failed.

The directors followed the language in SPP’s tariff, which defines STRPs as upgrades that meet the criteria for competitive projects but that are needed in three years or less to address “identified reliability violations.” In that case, STRPs are not considered competitive upgrades under the tariff.

The board’s Feb. 4 approval means the incumbent transmission owners will receive notifications to construct for the projects.

“As a transmission-dependent utility and representing many transmission-dependent utilities, there’s always been a lot of concern over … circumventing the Order 1000 process,” the Oklahoma Municipal Power Authority’s Dave Osburn said during the discussion preceding the vote. “We’re saying all these projects are required this year, and we know they’re not going to be done. Bringing $3 billion worth of lines with a need date of this year, something about that doesn’t sit well.”

Renewable interests and developers and cooperatives made their opposition known during a 30-day comment period earlier this year after staff’s designation of the STRPs. They said the projects would not be subject to the cost controls and schedule guarantees that competitive projects face, leading to a risk of delays. Previous directly assigned projects have been delayed without current means of holding the assignees accountable, they also said.

Transmission owners supported the designated projects, saying they complied with the tariff and FERC precedent, that they would address persistent operational needs and eliminate the need for load shed during future winter storms.

“I don’t believe that this is circumventing Order 1000,” Evergy’s Denise Buffington said, responding to Osburn. “I think Order 1000 and the compliance filings that were in front of FERC contemplated the scenario that there would be times when there are projects that are immediate needs and that need to be done soon for reliability reasons. Load shedding is not a mitigation … I don’t think any incumbent transmission owner that has customers potentially going in the dark are going to wait on these projects. These projects are going to be the highest priority, and we are going to get them done as soon as is possible.”

Director Ray Hepper thanked members for their comments and said the board had an “incredibly important and challenging discretion” to determine whether the projects should be competitive or directly assigned.

“For me, this creates a real challenge. What criteria should I use to guide my vote?” Hepper said. “On one hand, I can simply say all these projects are needed within three years and therefore, they meet the terms of the tariff. On the other hand, I can argue that FERC has concluded that competition is good and therefore all these projects should go out for bids. These are the relatively more straightforward bookends of the discussion.”

Board Chair John Cupparo advocated the directors consider establishing clear mechanisms to avoid a similar situation in the future. He said should the board agree, it will engage staff and stakeholders to gather necessary input before the 2025 ITP is released in October.

“It’s my understanding that the board has full discretion over how to treat the short-term reliability project list, and it’s our role to determine how we want to treat it each time it comes before us,” Cupparo said. “In my opinion, we are obligated to evaluate and understand all reasonable options and the benefits and impacts on the entire SPP footprint and its 18 million residents.”

The Members Committee’s advisory vote rejected the motion to designate the 765-kV project as a competitive project, 7-11, with three abstentions. It approved the designation for all eight STRPs, 14-6, with one abstention. The board sided with both votes.

The STRPs were culled from the 89 potential projects in the 2024 ITP. The board in December approved 12 of those as winter-weather projects, with 11 staged on or before Dec. 1, 2025, to resolve the remaining winter reliability needs.

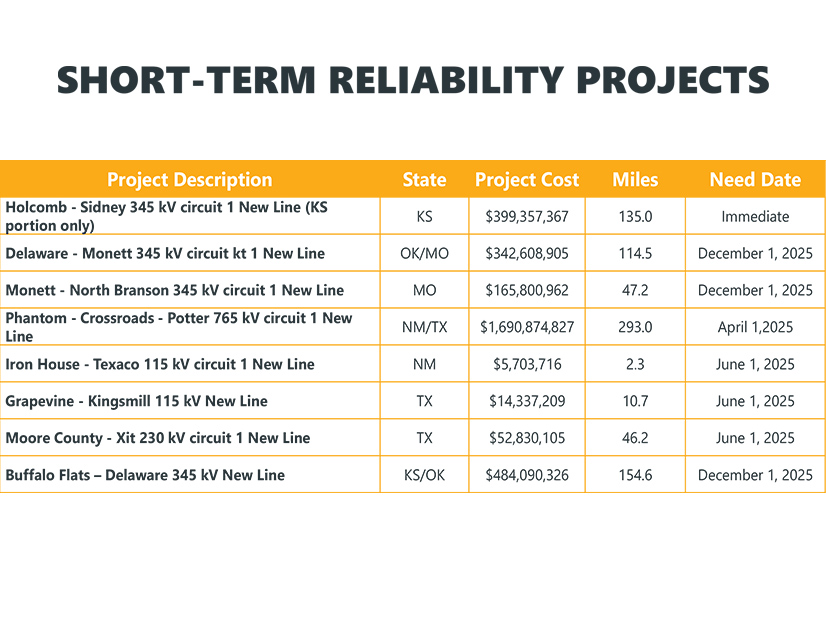

The eight STRPs are:

-

- Holcomb-Sidney (Kansas), new 345-kV line, 135 miles.

- Delaware-Monett (Oklahoma and Missouri), new 345-kV line, 114.5 miles.

- Monett-North Branson (Missouri), new 345-kV line, 47.2 miles.

- Phantom-Crossroads-Potter (New Mexico, Texas), new 765-kV line, 293 miles.

- Iron House-Texaco (New Mexico), new 115-kV line, 2.3 miles.

- Grapevine-Kingsmill (Texas), new 115-kV line, 10.7 miles.

- Moore County-XIT (Texas), new 230-kV line, 46.2 miles.

- Buffalo Flats-Delaware, new 345-kV line, 154.6 miles.

Three of the projects — Phantom-Crossroads-Potter, Grapevine-Kingsmill and Moore County-XIT — have been assigned to SPS, which is facing unprecedented demand from new manufacturing, oil and gas growth, and its communities.

Xcel Energy, the parent company of SPS, said all three lines are “crucial” for maintaining a reliable electricity supply. It said the Phantom-Crossroads-Potter line is “especially important” in supporting load growth.

“I understand the concern about one project being a significant cost in the portfolio. The alternative could have been multiple other lines in which this discussion may not be revolving around a single project, but it could have been multiple other projects,” SPS’ Jarred Cooley said during the board discussion. “SPS has a very strong track record of building projects on time and under budget. The last eight 345-kV projects in our footprint have done that, and we definitely would be ready, willing and able to build this line as soon as given the go-ahead.”

The eight projects completed over the past seven years added 318 miles to a high-voltage transmission network that now exceeds 8,000 miles.

Adrian Rodriguez, president of SPS, said in a statement Feb. 5 to RTO Insider that the utility is “honored to be entrusted with these critical projects.”