Fossil Fuels

After a long decline in the U.S., coal-fired generation is enjoying strong policy support in the second Trump administration.

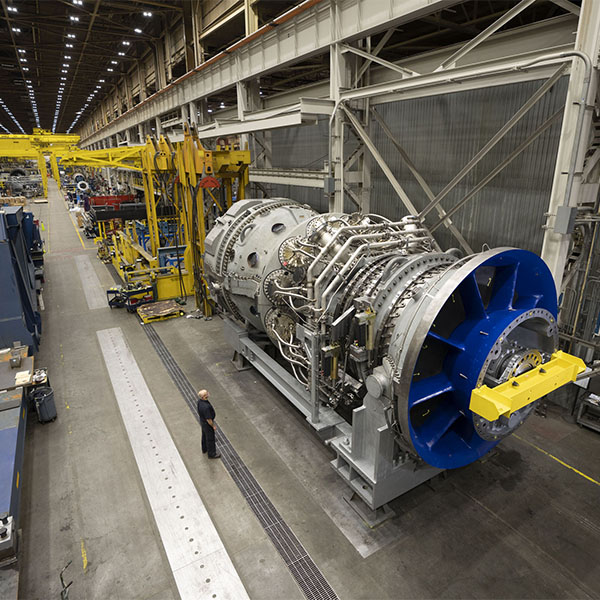

With support from the Trump administration and demand from data centers, 2025 and now 2026 are high times for the U.S. natural gas sector.

DOE is exceeding its authority by using Federal Power Act Section 202(c) to keep the J.H. Campbell coal plant in Michigan running under several consecutive “emergency” orders, opponents argued in recent court filings with the D.C. Circuit.

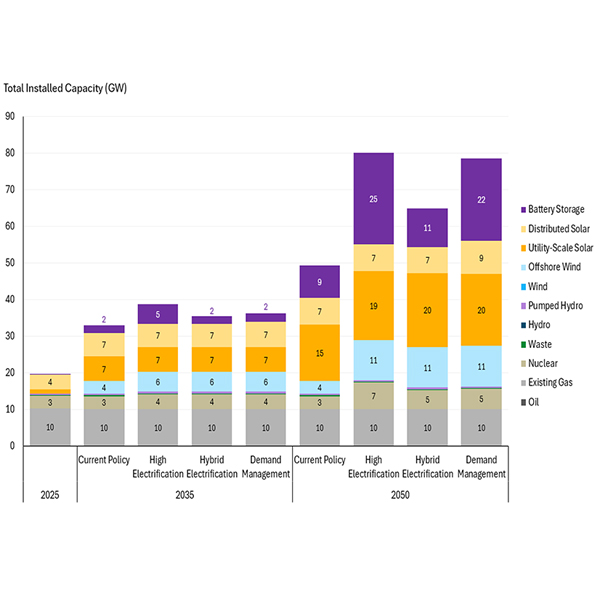

The newest iteration of New York’s energy road map maintains a zero-emission grid as a target but acknowledges an uncertain path to that goal, and likely a longer reliance on fossil fuels.

House Republicans amended the SPEED Act on its way to a floor vote, in order to allow the Trump administration to keep repealing Biden-era permits for offshore wind, which led renewable energy groups to drop support for the bill.

Data center developers’ imperative of speed to market not only stresses the power grid but also is felt on the ground as the giant facilities — often paired with onsite generation — spring up in neighborhoods overburdened by pollution.

In New England, increasing winter reliability concerns are driving questions about how long the region’s aging fleet of oil-fired power plants can, or should, remain on the system.

New Jersey should continue to pursue a strategy of heavy reliance on clean energy to head off the state’s looming energy shortage, with no increase in natural gas generation, says outgoing Gov. Phil Murphy.

The Virginia SCC approved a smaller rate request than Dominion Energy asked for, but it also approved its plan to set up a new rate class for large customers and new natural gas units to meet rising demand.

Energy affordability and regional collaboration dominated talks at the New England-Canada Business Council's annual Executive Energy Conference.

Want more? Advanced Search