Transmission & Distribution

The New York Public Service Commission issued new interconnection rules for distributed energy resource developers and utilities aimed at capturing as many expiring Inflation Reduction Act tax credits as possible for wind, solar and storage projects.

NextEra Energy Resources brought 7.2 GW of new generation and storage into operation and added 13.5 GW to its backlog in 2025.

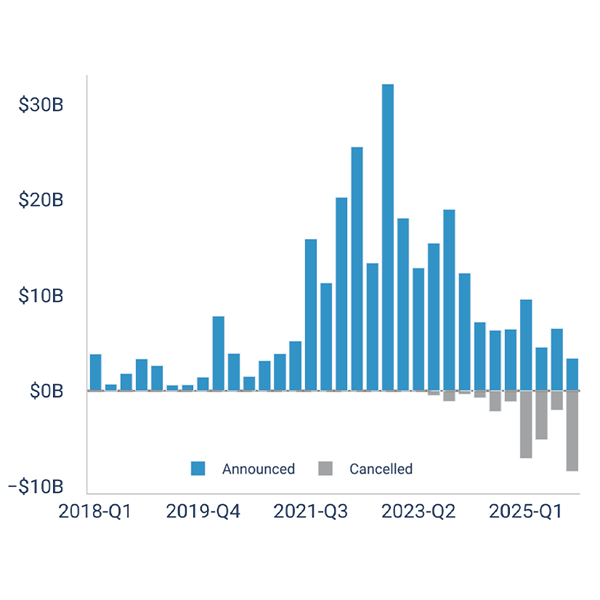

In late 2025, U.S. cleantech manufacturing investment cancellations reached their highest level of any quarter in the eight years a database has been tracking such announcements.

New Jersey Gov. Mikie Sherrill signed two sweeping executive orders that sought to control the state’s aggressively rising electricity rates through ratepayer credits and generation expansion.

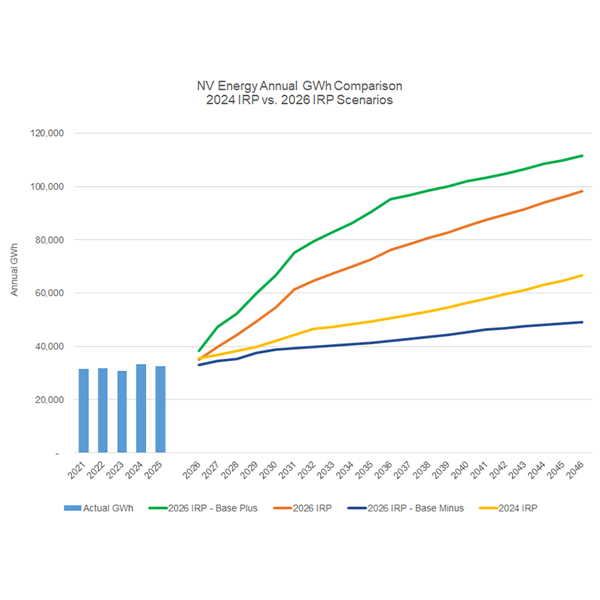

Facing surging electricity demand from data centers and artificial intelligence, NV Energy might soon be struggling to meet Nevada's renewable portfolio standard.

Illinois became the 13th state to adopt a procurement target for storage after Gov. JB Pritzker signed a new bill aimed at shoring up reliability and affordability.

Flexibility will be a core attribute of the various scenarios and solutions being discussed to meet the snowballing estimates of U.S. electric power demand, says columnist K Kaufmann.

In 2026, utility-scale energy storage projects in the U.S. will face headwinds that could slow the pace of a technology that is fast becoming a global grid staple, warns columnist Dej Knuckey.

The demand for energy storage capacity is driving a flurry of proposals for new pumped storage hydropower while proposals for new conventional facilities are limited to small-scale projects.

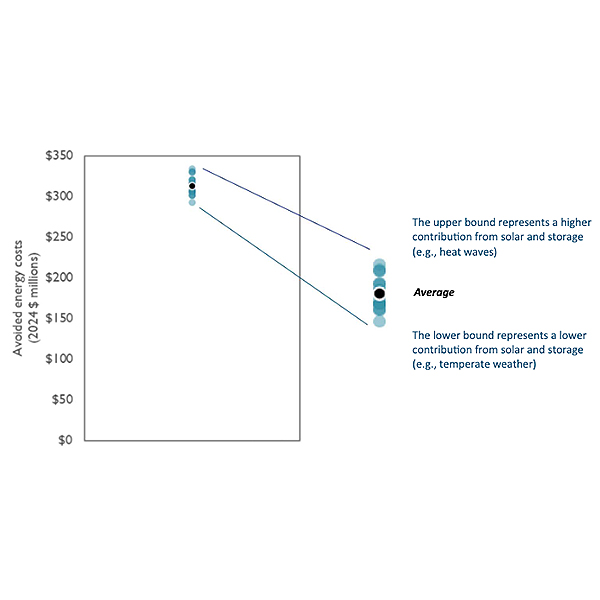

A new report estimates that solar and battery storage growth in New England between 2025 and 2030 could reduce wholesale energy costs across the region by about $684 million annually by 2030.

Want more? Advanced Search