Connecticut

Debates about affordability continue to dominate state-level energy policy debates throughout New England, shifting the focus away from decarbonization, a panel of experienced lobbyists said.

Two new studies released by advocates on opposite sides of the clean energy debate reach opposite conclusions about the economic benefits of renewables.

Representatives of Connecticut, Maine, Massachusetts and Vermont have selected a cumulative 173 MW of new solar generation through a coordinated procurement process.

The forthcoming resignation of Connecticut Public Utilities Regulatory Authority Chair Marissa Gillett has created high-stakes questions around the state’s adoption of a comprehensive performance-based regulation framework.

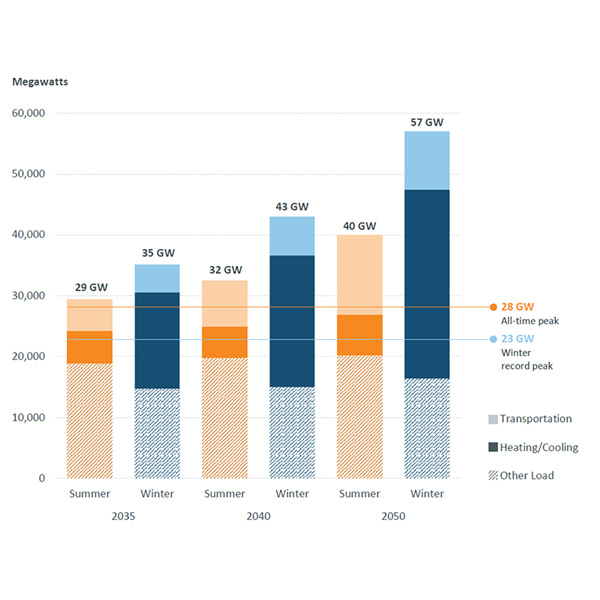

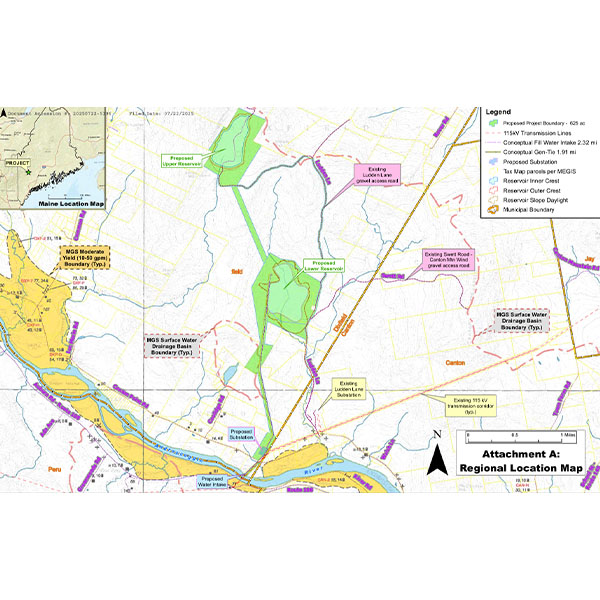

A developer in Maine is evaluating whether pumped storage – one of the oldest generation technologies still used on the New England grid – could play an increased role in the grid of the future.

Revolution Wind’s developers are seeking an emergency injunction against the federal stop-work order slapped on the offshore wind project.

ISO-NE warned any significant delay of the Revolution Wind project will increase risk to the reliability of the New England grid and undermine the region’s economy.

New England’s offshore wind ambitions were dealt a further setback as contract negotiations under way for most of the past year were extended again, potentially into 2026.

New England utility regulators warned that knee-jerk reactions to backlash over high winter costs could create long-term consequences for customers.

Government officials and industry executives discussed how to mitigate rising energy costs in New England at the NECPUC Symposium.

Want more? Advanced Search