Western Energy Imbalance Market (WEIM)

The next phase of the Price Formation Enhancements Initiative will look to address issues around market power mitigation, scarcity pricing and fast-start pricing.

CAISO focused on CRRs when it served up the latest volley in the ongoing dispute over what played out on the Western grid during the January cold snap that forced Northwest utilities to import high volumes of energy to avoid blackouts.

The CAISO Board of Governors and Western Energy Markets Governing Body passed two proposals that address different issues within Western markets.

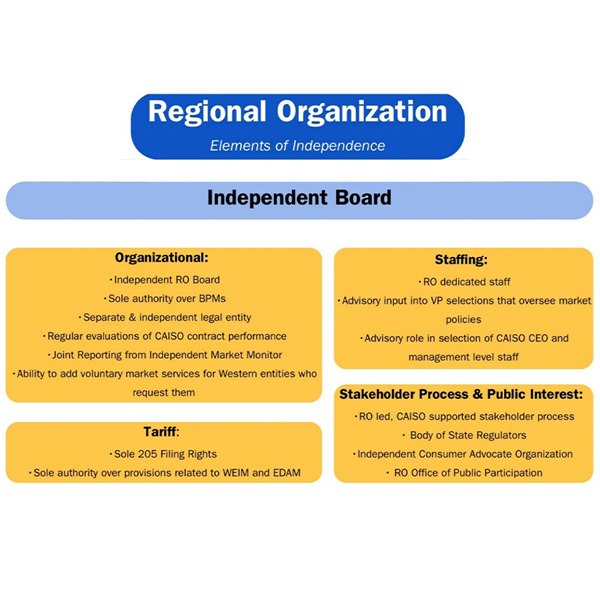

Pathways released its Step 2 draft proposal for dividing up functions between CAISO and the new “regional organization” that initiative backers are seeking to create to oversee the ISO’s Western real-time and day-ahead markets.

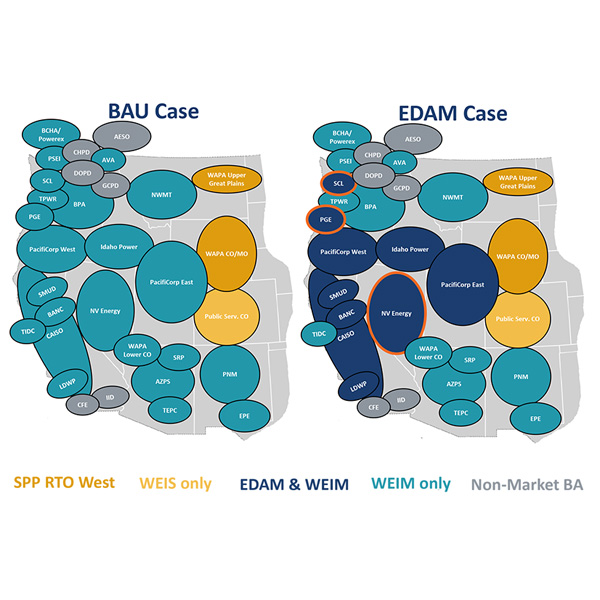

PacifiCorp is poised to realize up to $359 million a year in net benefits from participating in CAISO’s EDAM, nearly double a previous estimate, according to a newly updated study by The Brattle Group.

FERC largely approved Order 2023 compliance filings for four utilities in the West and Texas, directing them to submit further compliance filings within 60 days.

Proponents of SPP’s Markets+ contend in their latest “issue alert” that the framework provides a much more equitable solution to tackling market seams than under CAISO’s EDAM.

CAISO’s adoption of the Pathways Initiative’s “Step 1” changes won't overcome BPA’s objections to the governance of the ISO’s EDAM, Administrator John Hairston told U.S. senators from the Pacific Northwest.

The Western Resource Adequacy Program’s key stakeholder body approved a plan that would postpone the start of its penalty phase by one year, to summer 2027.

Enhanced protections against uncompetitive market behavior are among several tools to ensure fair and accurate pricing under a Markets+ framework, according to the latest "issue alert" from entities that back its development.

Want more? Advanced Search