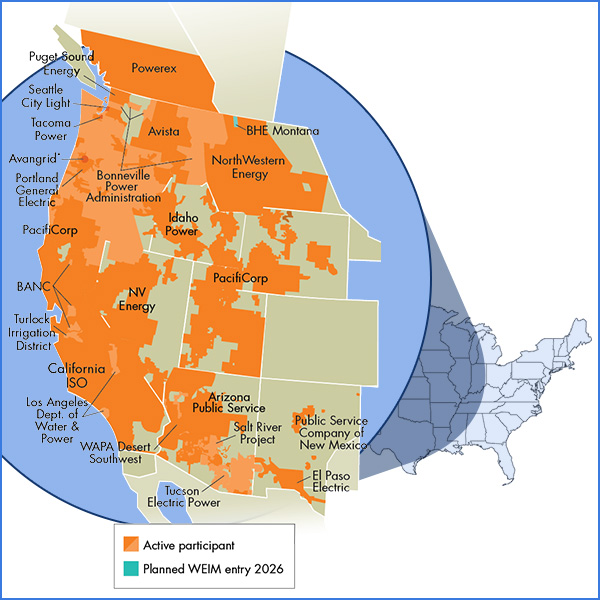

Western Energy Imbalance Market (WEIM)

The WEIM Governing Body voted to change its name to the “Western Energy Markets” Governing Body to better reflect its full scope of responsibility since it began overseeing CAISO’s EDAM.

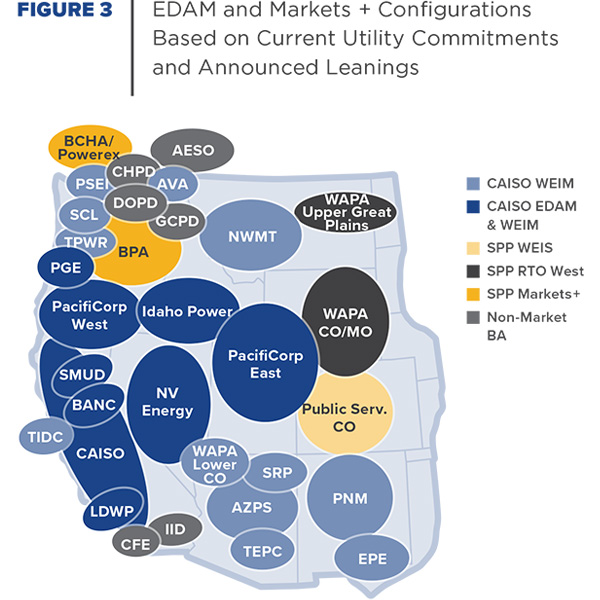

The West faces a “pivotal” opportunity to develop a fresh approach to managing its electricity markets, one that could update RTO governance to better accommodate the public policy.

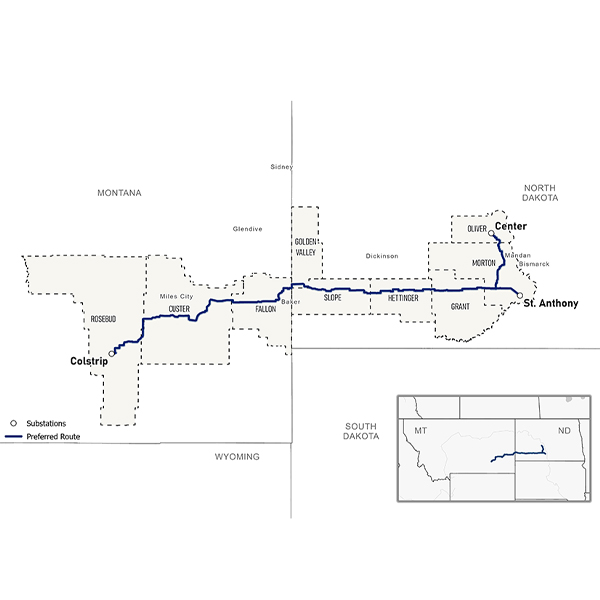

High-voltage transmission developer Grid United says its proposed North Plains Connector would provide significant reliability capacity benefits to interregional transmission, according to a study.

Portland General Electric became the second entity in the Western U.S. after PacifiCorp to sign an implementation agreement for the Extended Day-Ahead Market.

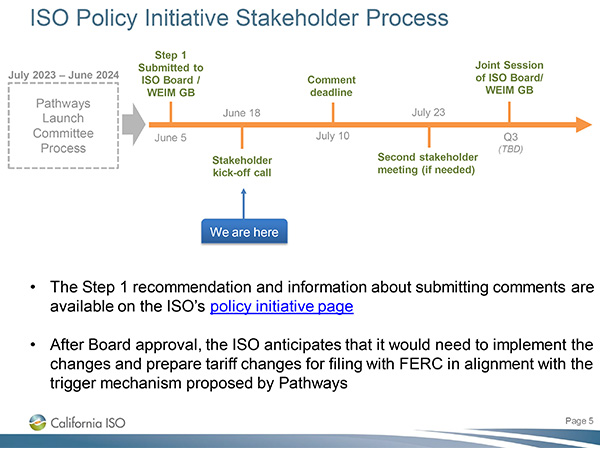

Participants in the West-Wide Governance Pathways Initiative face a busy meeting schedule this summer as the group’s leaders look to advance on parallel fronts to develop a Western “regional organization.”

As NV Energy moves forward with plans to join CAISO’s Extended Day-Ahead Market, Nevada regulators have laid out a framework for how the company can seek approval for EDAM participation.

A new study commissioned by Renewable Northwest says Powerex is poised to benefit if the West ends up divided between CAISO’s EDAM and SPP’s Markets+.

CAISO kicked off the West-Wide Governance Pathways Initiative stakeholder process required to shift the ISO’s governance structure to an independent entity within the Extended Day-Ahead Market.

Arizona regulators are under fire for decisions on the expansion of a UNS gas-fired plant and third-party IRP audits.

FERC approved CAISO tariff revisions that will allow transmission owners to recover transmission revenue shortfalls attributed to transitioning their assets into the Extended Day-Ahead Market.

Want more? Advanced Search