Capacity Market

Heading into 2026, New England is counting on an increasingly collaborative approach to energy policy as federal opposition to renewable energy development threatens affordability, reliability, and decarbonization objectives in the region.

MISO has indicated that new generation to serve data centers and other large loads will be mission critical over 2026 and said it will take pains to interconnect units.

NYISO's Installed Capacity Working Group's final meeting of 2025 focused on proposed manual changes for several projects.

FERC told PJM to change its rules to allow for co-located load at generators, with new transmission services and other tweaks.

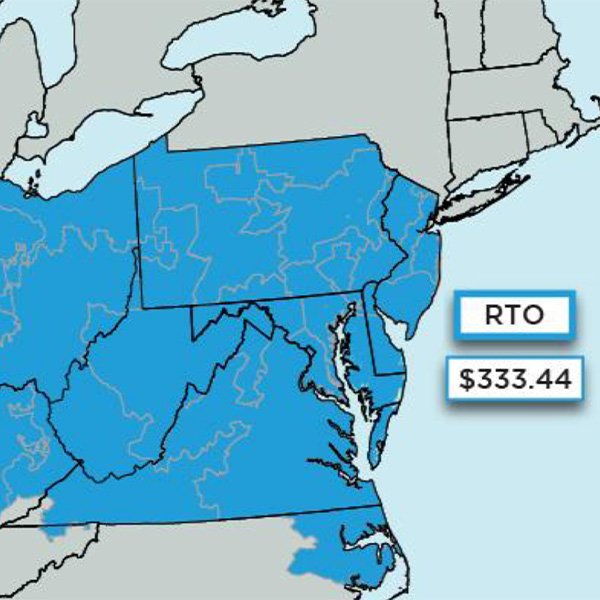

PJM’s 2027/28 Base Residual Auction procured 134,479 MW in unforced capacity at the $333.44/MW-day maximum price, falling 6,623 MW short of the reliability requirement and setting a clearing price record.

FERC approved an SPP tariff change that adds real-time dispatchable interchange transactions to its Integrated Marketplace, extending the current day-ahead market dispatchable transaction model into the real-time balancing market.

A trade group representing multiple MISO power producers has lodged a complaint against retroactive pricing revisions in MISO’s 2025/26 capacity auction, joining Pelican Power in calling the repricing unlawful.

MISO ended its 10-year run allowing energy efficiency in its capacity market, as FERC allowed the change to take effect.

MISO and its Monitor tracked a rise in energy consumption in fall 2025 and reviewed some operational rough patches, while the RTO explained why its machine-learning risk predictor remains a work in progress.

Reply comments to the Department of Energy’s Advance Notice of Proposed Rulemaking to FERC on large loads offered differing paths for the commission to potentially take.

Want more? Advanced Search