Energy Market

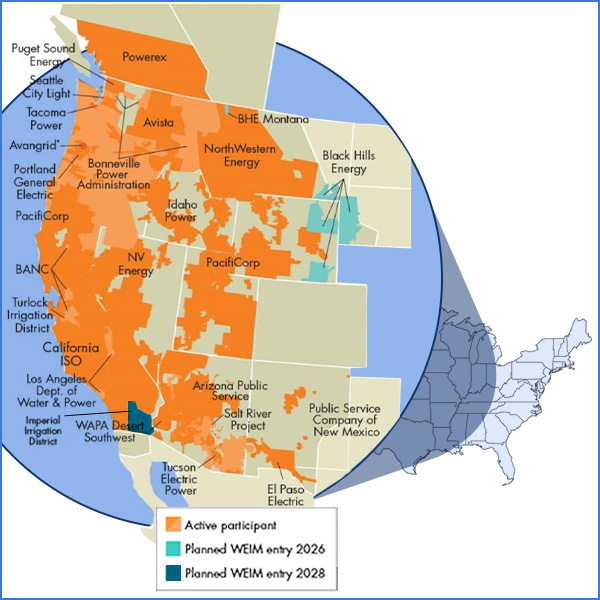

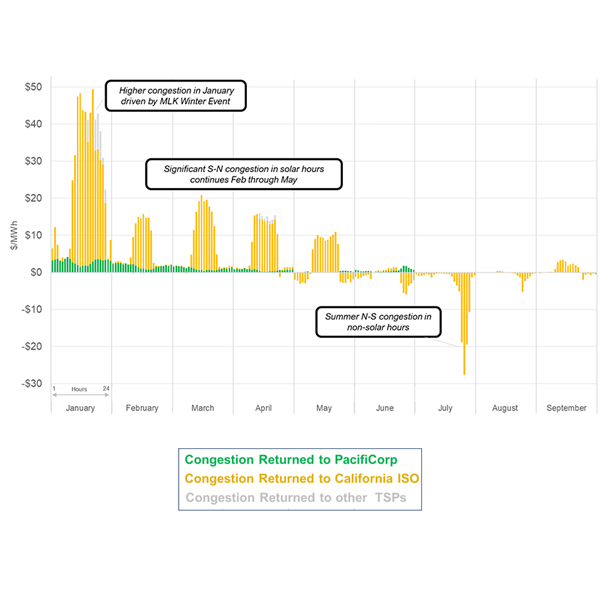

The formation of two competing day-ahead markets will create seams across the West, but at least one utility representative is more worried about seams resulting from the fracture of CAISO’s real-time Western Energy Imbalance Market.

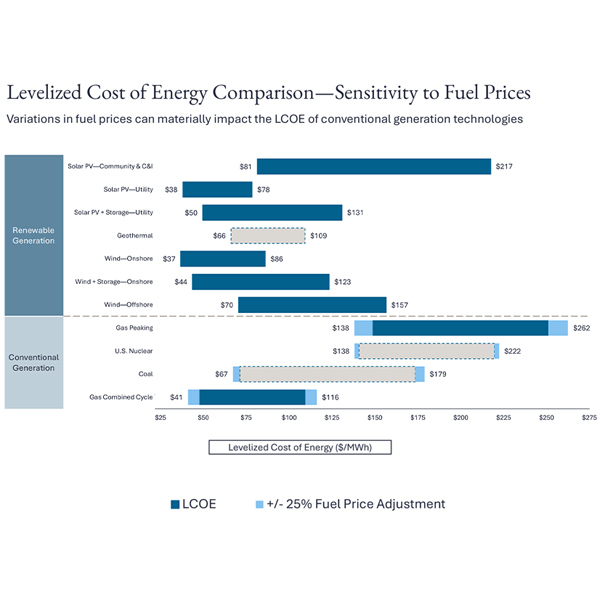

Lazard’s latest analysis of the levelized costs of energy concludes that wind and solar are the least-expensive new-build power generation for the 10th year in a row.

Increased weather volatility isn’t just grabbing headlines; it's reshaping how we generate and trade electricity, writes Upstream Tech CEO Marshall Moutenot.

Energy storage resources and solar capacity helped reduce ancillary services costs and tight system conditions in the ERCOT market during 2024, according to a recent market report.

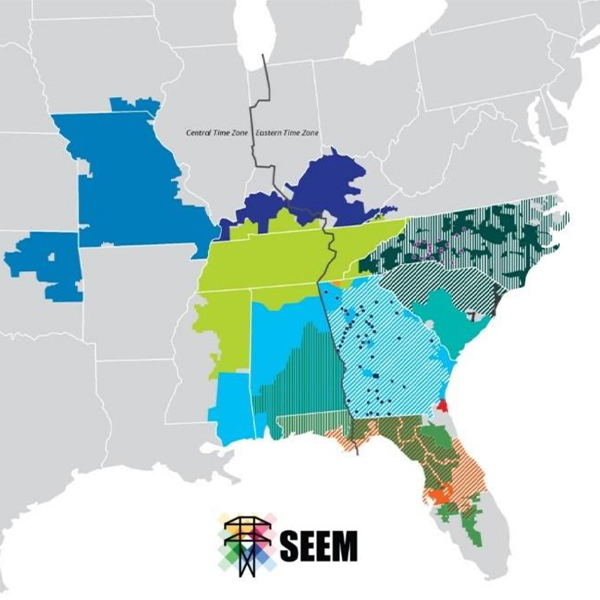

FERC responded to critics of the Southeast Energy Exchange Market, clarifying its use of the comparability standard to justify the market.

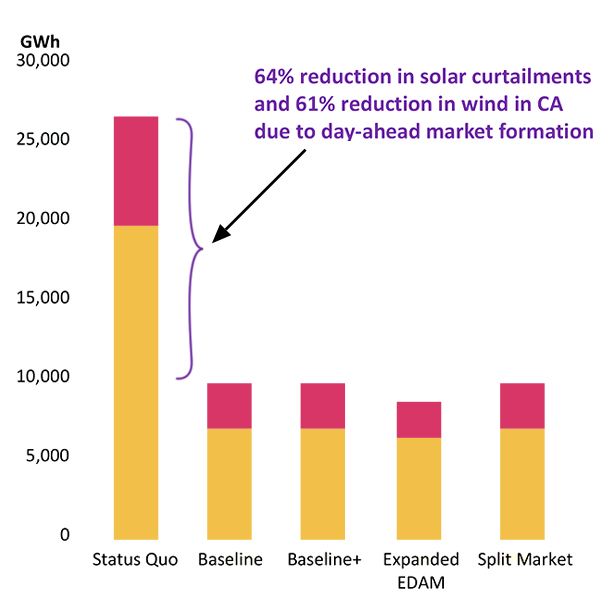

California Energy Commission staff presented a study on the size of CAISO’s Extended Day-Ahead Market, finding more benefits as the market’s footprint increases.

The PJM Market Implementation Committee discussed a proposal to allow demand response resources to participate in the regulation market when there are energy injections at the same point of interconnection to the distribution grid.

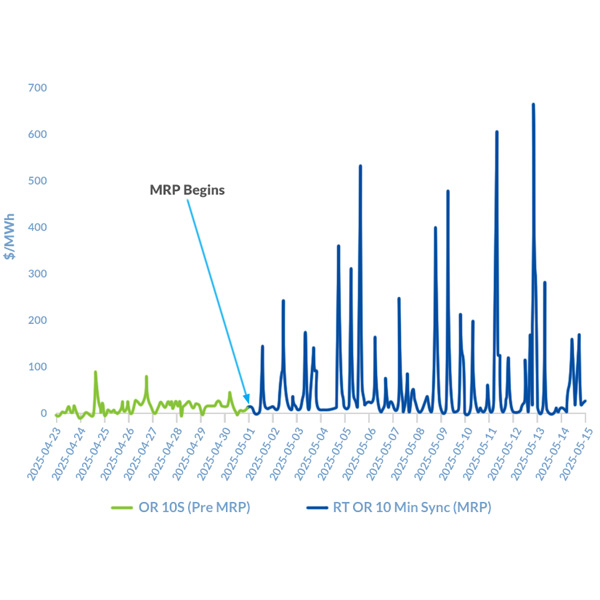

The opening of Ontario’s nodal market has been marked by real-time volatility and unusually high operating reserve prices.

Want more? Advanced Search