Energy Market

The PJM Markets and Reliability Committee voted to endorse a proposal to create an expedited process to study some interconnection requests.

FERC rejected SPP’s proposed tariff revisions to implement a multiday economic commitment process, agreeing with the MMU that it introduces a potential gaming opportunity.

The Pathways Initiative drew praise from many quarters with the vote to approve its “Step 2” proposal, but it was quickly apparent the development will do little to sway Markets+ supporters.

The West-Wide Governance Pathways Initiative received a significant financial boost when DOE awarded nearly $1 million to underwrite its efforts to establish a Western “regional organization” to oversee CAISO’s WEIM and EDAM.

ISO-NE’s regional energy shortfall threshold will rely on a pair of metrics intended to capture the intensity and duration of energy shortfall risks in extreme weather scenarios, the RTO told the NEPOOL Reliability Committee.

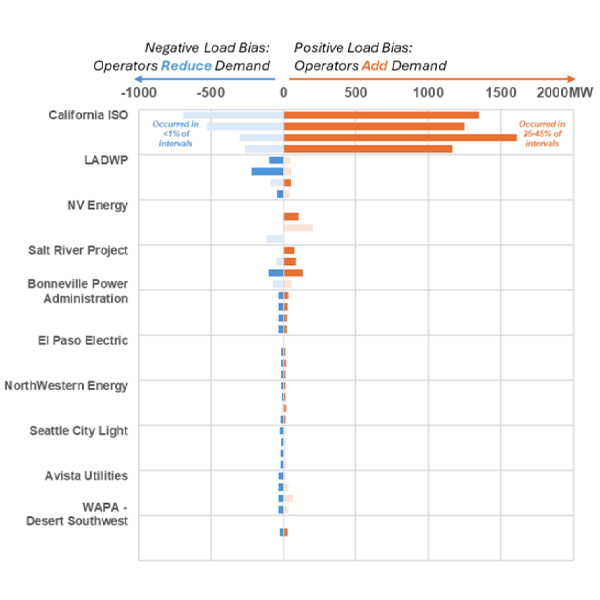

CAISO will be inherently compromised in its role as an operator of a deeper Western market because of its conflicting responsibilities as BA within that market, a group of entities that support SPP’s Markets+ argue in their latest “issue alert.”

The Bonneville Power Administration says following through on its $25 million funding commitment to the development of SPP's Markets+ is simply a matter of preserving choice.

BPA’s insistence on favoring joining SPP’s Markets+ over CAISO’s Extended Day Ahead Market is “alarming” and could lead to $221 million in economic advantages going up in smoke, Seattle City Light argued.

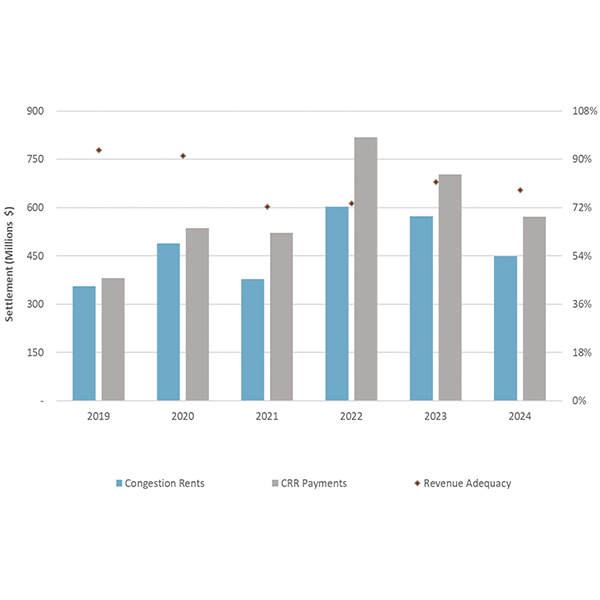

CAISO has launched an initiative to improve its congestion revenue rights market by addressing issues such as revenue inadequacy and auction efficiency.

The Pathways Step 2 proposal offers a blueprint for divvying up functions between CAISO and the RO that backers envision will provide an independent framework for governing the ISO’s Western markets.

Want more? Advanced Search