Energy Market

FERC approved a PJM proposal to overhaul how generators can represent variable operating and maintenance costs in their energy market offers.

The PJM Market Implementation Committee overwhelmingly voted to endorse manual revisions to put limits on when generators can submit real-time values.

Panelists at the CREPC-WIRAB spring meeting argued over whether the West would benefit more from a day-ahead market run by CAISO or with another run by SPP.

ERCOT stakeholders have thrown their support behind staff’s recommended changes to the ORDC that will serve as a bridge to regulators' proposed market design.

ERCOT said it will pay Austin Energy a $2.86 million to settle an alternative dispute resolution stemming from the February 2021 winter storm.

With MISO still years away from allowing DER aggregators to fully participate in its markets, the RTO hosted experts to discuss best practices and data sharing.

Texas lawmakers have advanced several bills that favor new gas generation, threatening to upend the ERCOT market and punish renewable energy.

Thirty-one utilities, public interest groups and other entities have joined SPP's effort to develop and launch its Markets+ offering.

ERCOT is looking at a revised operating reserve demand curve and additional ancillary services to bridge the proposed performance credit mechanism.

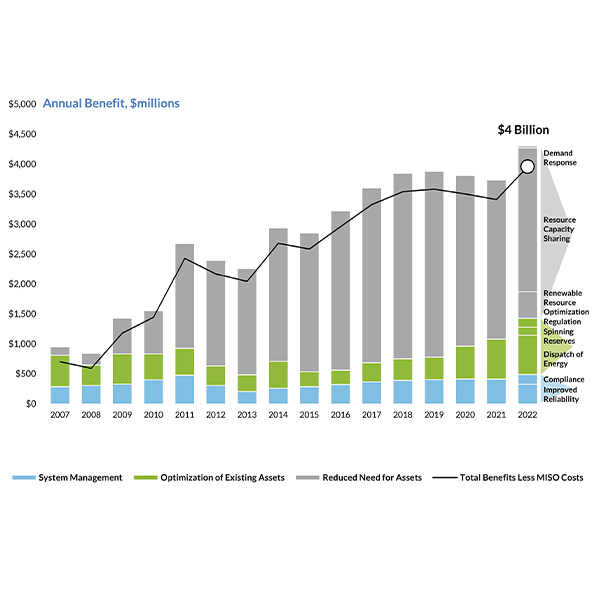

MISO said it created more than $4 billion in value for its members during 2022, with most of the savings related to its large geographic footprint.

Want more? Advanced Search