Reserves

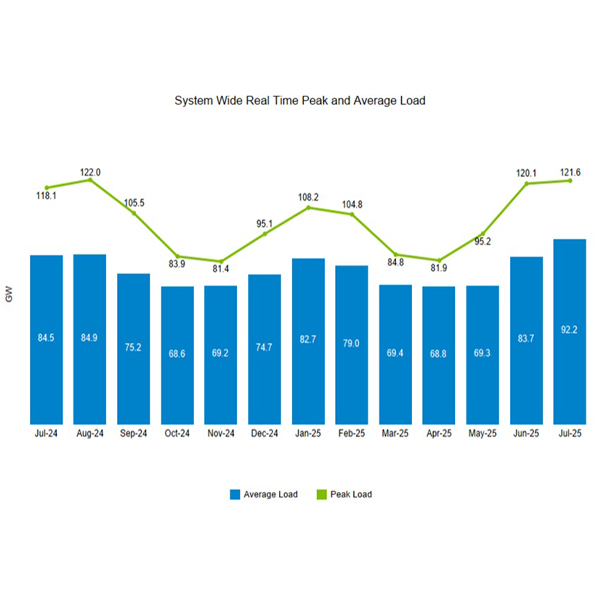

MISO is poised to close the door on summer with an almost 122-GW peak while issuing several capacity advisories for MISO South.

NYISO shared a detailed analysis of New York’s late June heat wave, in which significant operating reserve shortages elevated energy prices.

IESO opened discussions on new rules for storage facilities and hybrid resources that will enable the provision of regulation service.

FERC approved Constellation's purchase of Calpine, which will create an even bigger IPP with nearly 60 GW around the country, with the biggest share of that in PJM.

ERCOT CEO Pablo Vegas has gone public with the grid operator’s internal terminology that is shaping the market’s path forward, defining it for his Board of Directors and stakeholders.

MISO Midwest entered emergency status during the RTO’s first serious heat wave of the summer.

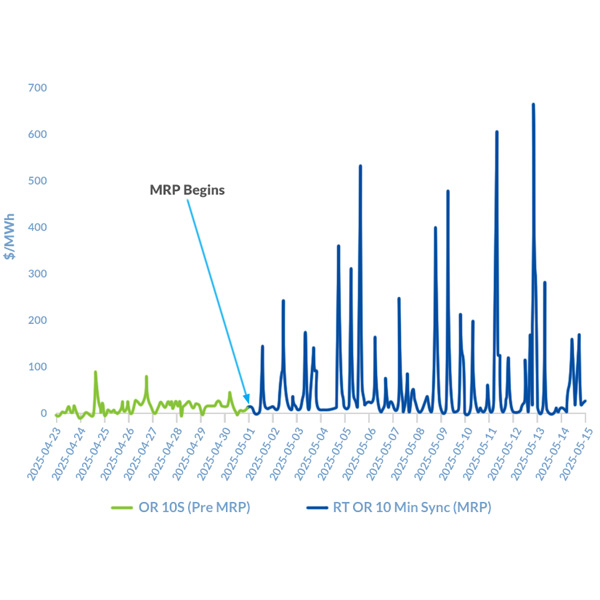

The opening of Ontario’s nodal market has been marked by real-time volatility and unusually high operating reserve prices.

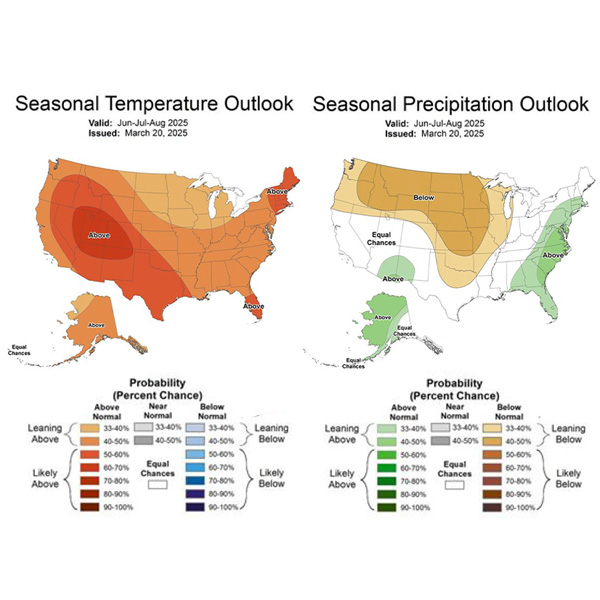

SPP expects to have a “high probability” of enough generation to meet demand during peak-use hours this summer, despite predictions of higher-than-average temperatures in the RTO’s footprint.

Stakeholders expressed confusion and concern with the most recent updates to NYISO’s operating reserves performance penalty proposal.

PJM’s Market Implementation Committee discussed a proposal to revise its governing documents to allow DR resources to participate in the regulation market when there may be energy injected at the customer’s point of interconnection

Want more? Advanced Search