Nevada

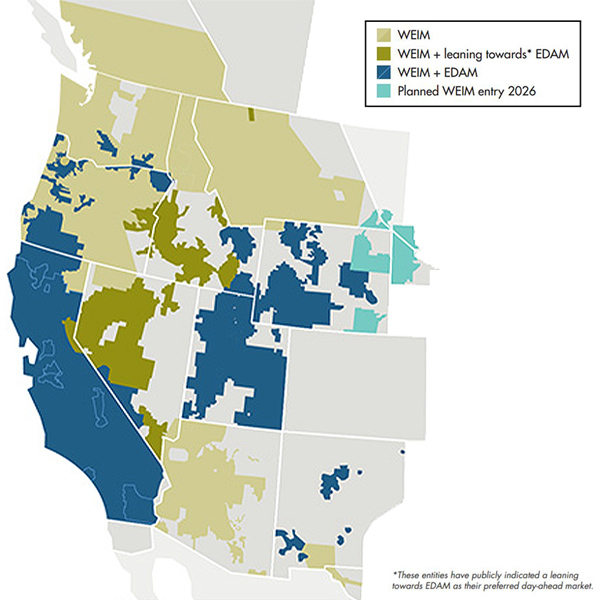

Some parties are urging Nevada regulators to wait until initial results are in for CAISO's Extended Day-Ahead Market before deciding whether to allow NV Energy to join.

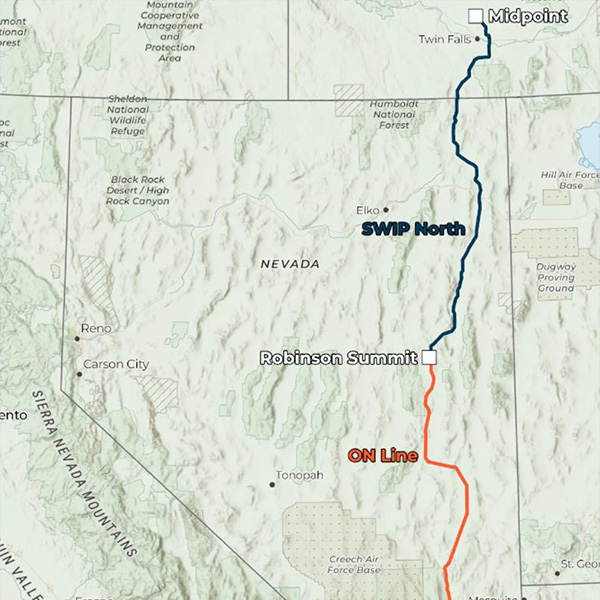

Nevada regulators approved a construction permit for the SWIP-North transmission line, keeping the project on track for a 2028 operation date.

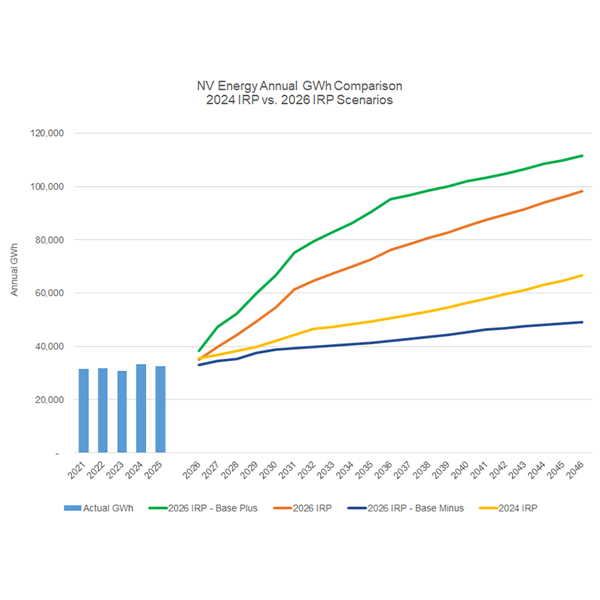

Facing surging electricity demand from data centers and artificial intelligence, NV Energy might soon be struggling to meet Nevada's renewable portfolio standard.

As NV Energy prepares to file its next integrated resource plan ahead of schedule in April, the company says it will take longer than previously planned to reduce its reliance on short-term market purchases.

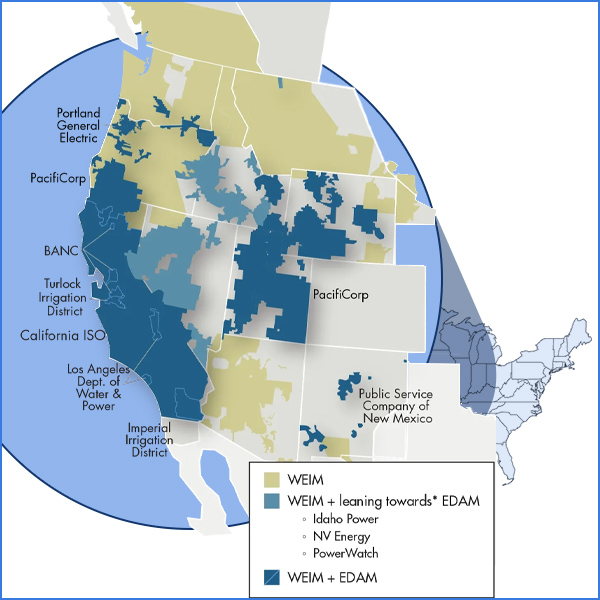

NV Energy has asked Nevada regulators for permission to join CAISO’s Extended Day-Ahead Market, which would fill in a central piece of the market's footprint.

NV Energy said it is discussing a potential new resource adequacy program with other participants in CAISO’s Extended Day-Ahead Market.

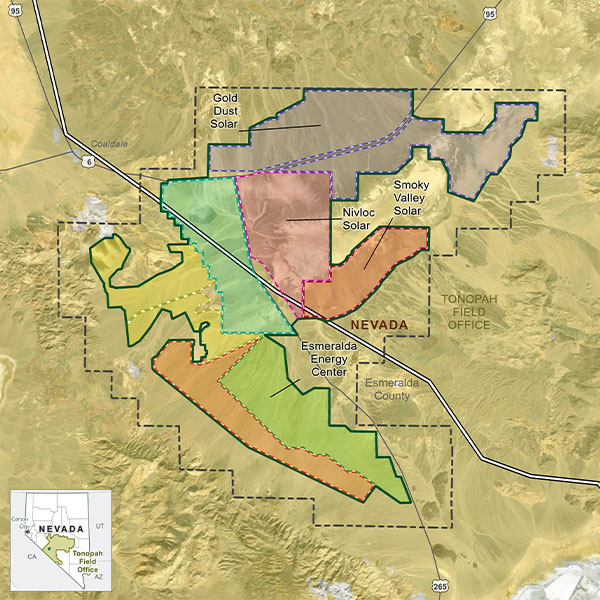

The fate of a 6.2-GW cluster of solar energy projects in western Nevada is uncertain following the Bureau of Land Management’s decision to break the group into individual projects for review.

The Bonneville Power Administration faces monumental challenges in implementing actions to meet the Pacific Northwest’s needs once it lifts its pause on transmission planning.

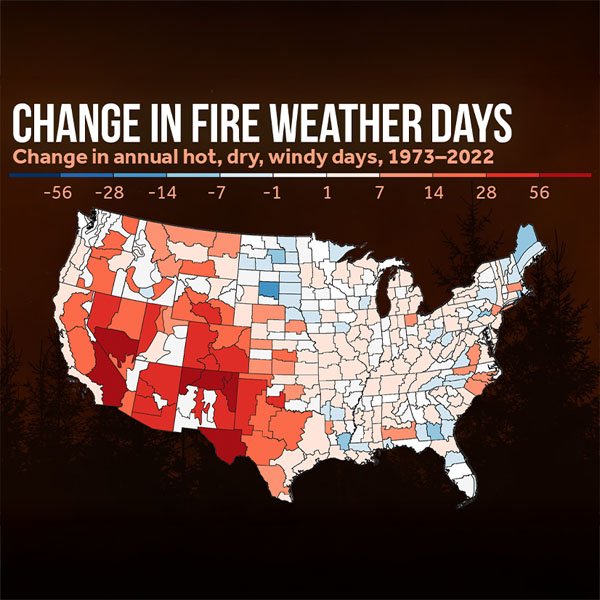

With the risk of catastrophic wildfire growing in Nevada and across the West, NV Energy is seeking approval for a $500 million wildfire liability self-insurance policy.

Nevada regulators have approved NV Energy’s clean transition tariff, a framework developed in partnership with Google that will allow the utility’s existing large-load customers to receive power from new clean energy resources.

Want more? Advanced Search