In studies predicting NV Energy would benefit more from joining CAISO’s Extended Day-Ahead Market than SPP’s Markets+, a key factor is the benefits the utility would lose by leaving the Western Energy Imbalance Market, a consultant said.

If NV Energy joins Markets+, it would drop out of the WEIM, the real-time market run by CAISO, and join SPP’s Western Energy Imbalance Service (WEIS).

Leaving the WEIM would create a loss of nearly $100 million for NV Energy, according to John Tsoukalis with the Brattle Group, which conducted the market analysis for NV Energy.

“So even when you replace that with the gains you see from joining Markets+ and the gains you see by the Markets+ real-time market … it’s not as beneficial as the EDAM cases you see,” Tsoukalis said during a Public Utilities Commission of Nevada (PUCN) workshop April 3.

Leaving the WEIM would reduce NV Energy’s access to excess renewables from CAISO in real time, and the utility’s prices for real-time sales would fall, according to the study.

Other WEIM participants also might feel an impact if NV Energy leaves CAISO’s real-time market, Tsoukalis told RTO Insider, although he noted Brattle hadn’t done calculations for other utilities.

“I would assume the breaking apart of the WEIM would have a negative impact on the other current WEIM [participants],” he said in an email.

Market Choice Evaluation

The PUCN opened a docket last year to explore ways to evaluate a utility’s choice of a regional market or RTO. (See Nev. Regulators to Weigh Approaches to RTO Membership and RTO, Day-ahead Choice Closely Linked, Nev. Effort Shows.)

The April 3 workshop focused on cost-benefit studies for market participation; a workshop to discuss different market designs is slated for April 10 at 10 a.m.

The latest workshop featured presentations on an Energy+Environmental Economics (E3) cost-benefit analysis that was part of the wider Western Markets Exploratory Group (WMEG) study and Brattle’s study for NV Energy, which the utility released last month. (See NV Energy to Reap More from EDAM than Markets+, Report Shows.)

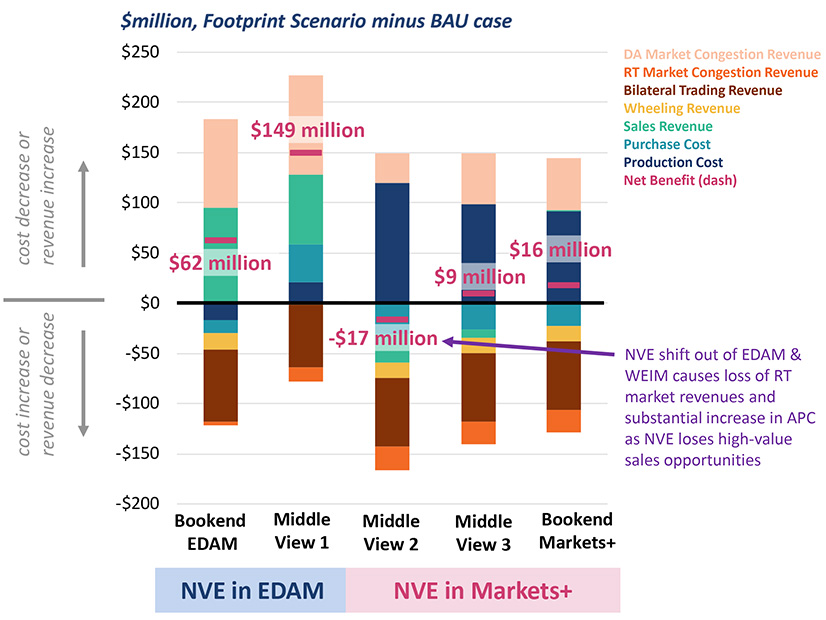

The Brattle Group study found that joining EDAM would grant NV Energy $62 million to $149 million in annual benefits. Results of the company joining Markets+ would range from a $17 million loss to a $16 million benefit. The study looked at two scenarios in which it joins EDAM and three in which it joins Markets+, calculating benefits expected in 2032.

In a scenario that Brattle calls the EDAM bookend case, NV Energy and almost all other Western Electricity Coordinating Council (WECC) utilities join EDAM.

NV Energy’s trading volumes would nearly double in that case, as the utility would serve as a central hub for trading between California and the Southwest and facilitate transfer of low-cost generation from California and the Southwest into Idaho Power and PacifiCorp East. NV Energy’s annual benefit in the EDAM bookend is estimated at $62 million.

But the utility’s annual benefit would be even higher — an estimated $149 million — in a scenario called Middle View 1.

That scenario assumes NV Energy, Idaho Power and Seattle City Light join EDAM, along with entities that have announced an EDAM choice, which now includes Portland General Electric. (See CAISO’s EDAM Scores Key Wins in Contested Northwest.)

In Middle View 1, the Bonneville Power Administration and most of the Northwest’s publicly owned utilities, Puget Sound Energy, and all Arizona BAAs would join Markets+.

Middle View 1 gives NV Energy access to more resources that are “bottled up” in a smaller EDAM footprint, Tsoukalis said.

“[During] midday hours in most of the year, you can actually buy power when you need it at almost no cost,” he said. “Whereas in the EDAM bookend case, you kind of have to share that with the Southwest and the Pacific Northwest.”

Markets+ Scenarios

If NV Energy joined Markets+ rather than EDAM, NV Energy’s generation costs from EDAM participants would rise and trading with those entities would decrease. Instead, the utility would do more trading with Northwest and Southwest BAAs under a Markets+ bookend case. It would gain $16 million annually in that scenario.

If NV Energy joined Markets+ but Idaho Power went with EDAM — in a scenario Brattle called Middle View 2 — NV Energy would lose $17 million annually, as the scenario cuts off a major Northwest-Southwest artery for Markets+.

“Being in the WEIM alone with almost the full WECC in that footprint is more beneficial for NV Energy specifically than this kind of bifurcated case,” Tsoukalis said.

Brattle also calculated WECC-wide results for different NV Energy scenarios.

The greatest WECC-wide benefit, $985 million, was seen in the EDAM bookend case. The least benefit was $682 million in the Middle View 2 case, in which NV Energy chooses Markets+ but Idaho Power goes with EDAM.

“All of these cases do create for the West as a whole a benefit,” Tsoukalis said. “Even in the cases where things are bifurcated and you get multiple day-ahead markets, the presence of those day-ahead markets does create customer savings relative to the business-as-usual case.”