Demand Response

The PJM Market Implementation Committee endorsed a package of revisions to Manual 18.

Curtailment service providers Voltus and Mission:data have filed a complaint with FERC seeking changes to PJM's data requirements for demand response.

PJM has withdrawn its non-capacity backed load proposal, shifting the focus of its solution for rising large load additions to creating a parallel resource interconnection queue and reworking price-responsive demand.

Rising demand and power bills are giving an extra push to expand demand-side management programs, but experts said the industry needs to do more to educate consumers to take advantage of the resources.

Energy experts and officials stressed the importance of proactive transmission planning, interconnection reform and increased demand-side flexibility at Raab Associates’ New England Electricity Restructuring Roundtable.

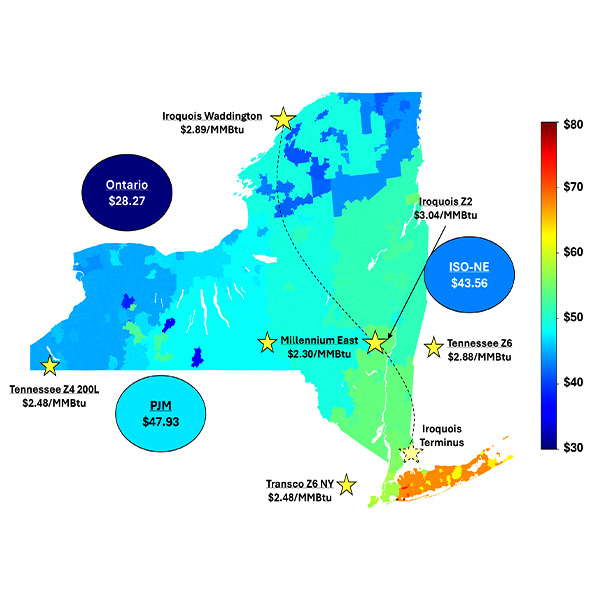

As NYISO continues its Capacity Market Structure Review, the Market Monitoring Unit used its second-quarter State of the Market report to highlight potential issues with how the ISO forecasts resource availability.

The California Public Utilities Commission is preparing to overhaul its demand response programs, policies and data systems to ensure uniform DR standards statewide and better position the Golden State to meet its energy policy and emissions goals.

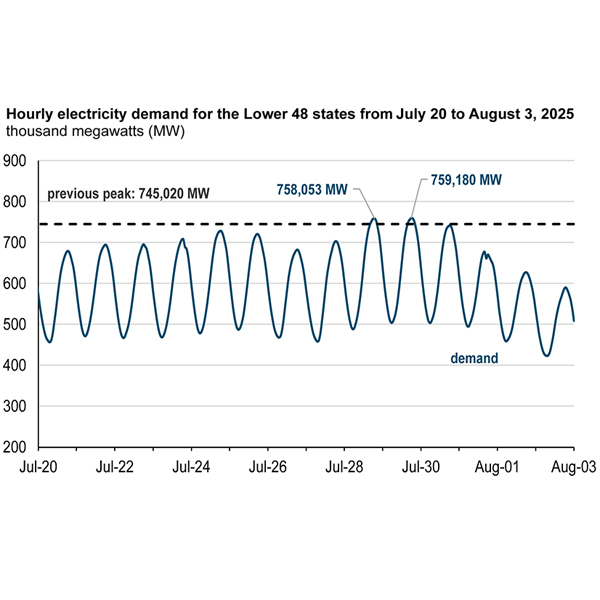

MISO said 2025 was the most demanding summer since 2012, though it steered the grid with only a single maximum generation event.

PJM revised elements of its proposal to create a non-capacity backed load product for large loads as the Critical Issue Fast Path embarks on determining how to address the reliability challenges posed by accelerating data center load growth.

Heat affects the full length of the electric supply chain: from generation, through the grid, to utilities’ customers, says columnist Dej Knuckey.

Want more? Advanced Search