Nuclear Power

PJM assured Pennsylvania legislators that the state has ample power generation for its needs and cautioned that fuel diversity will not ensure reliability.

New Jersey lawmakers once again voted to advance legislation out of committee that would provide subsidies to the state’s nuclear fleet.

Exelon executives expressed confidence during a fourth-quarter earnings call that other states will adopt zero-emission credit (ZEC) programs this year.

NextEra Energy accused the Nuclear Energy Institute of “extortion,” saying it was spitefully denying the company access to a database used to screen workers.

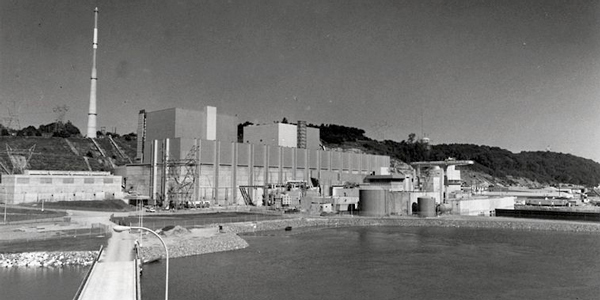

California utilities and other parties say they have reached a new settlement over the costs of shutting down the San Onofre nuclear power plant.

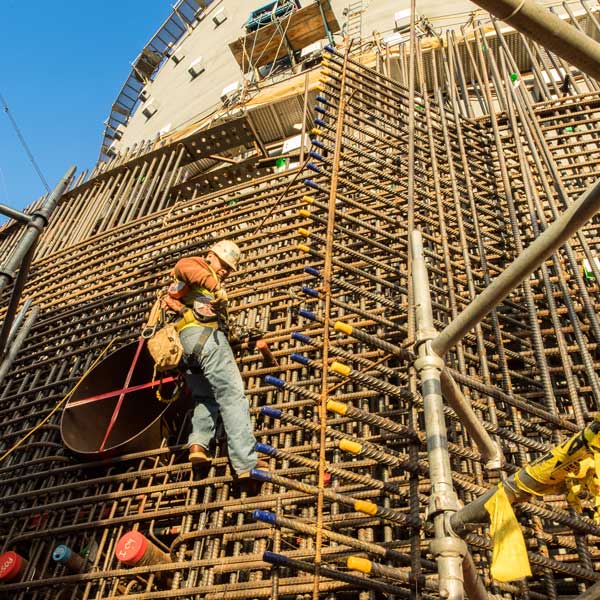

Columnist Steve Huntoon criticizes the Georgia Public Service Commission and its handling of the Vogtle nuclear plant's construction.

Georgia regulators voted to allow Georgia Power and its partners to complete the two nuclear reactors under construction at the Vogtle plant.

Columnist Steve Huntoon criticizes FirstEnergy's efforts to subsidize its Davis-Besse nuclear plant in the name of grid resilience.

PSEG and Exelon would receive hundreds of millions in subsidies under legislation introduced in the New Jersey Senate.

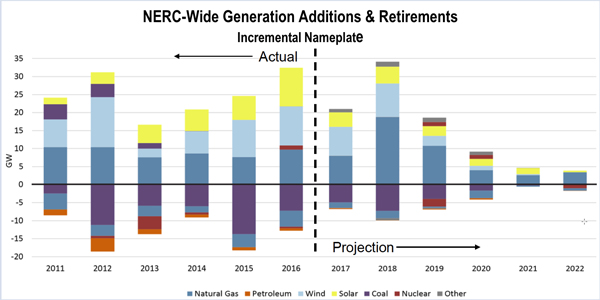

NERC released its annual Long-Term Reliability Assessment, urging preservation of “essential reliability services.”

Want more? Advanced Search