Utility-scale Solar

After a decade of intensive policy work and billions of dollars expended, the state’s grid was more reliant on carbon-based fuels in 2024 than in 2014.

NextEra Energy Resources brought 7.2 GW of new generation and storage into operation and added 13.5 GW to its backlog in 2025.

New Jersey Gov. Mikie Sherrill signed two sweeping executive orders that sought to control the state’s aggressively rising electricity rates through ratepayer credits and generation expansion.

A report from the American Clean Power Association argues that slowing down renewable development in PJM could cost ratepayers $360 billion over the next decade.

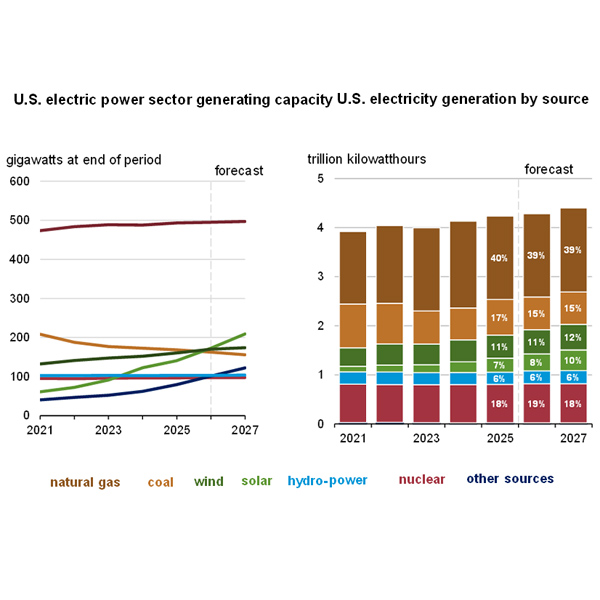

The U.S. Energy Information Administration forecasts the highest power demand growth in a quarter century in 2026 and 2027, due largely to the proliferation of data centers.

Some of the Bonneville Power Administration’s proposals aimed at resuming transmission planning processes risk pushing study timelines to the point where the agency’s customers could run afoul of clean energy targets in Washington and Oregon, stakeholders say.

The renewable energy industry and its advocates have initiated two more lawsuits against the Trump administration over its continuing campaign against wind and solar energy development.

Heading into 2026, New England is counting on an increasingly collaborative approach to energy policy as federal opposition to renewable energy development threatens affordability, reliability, and decarbonization objectives in the region.

The degree of risk and uncertainty springing from indifferent or outright obstructive new federal policies in 2025 has trimmed planned solar deployment.

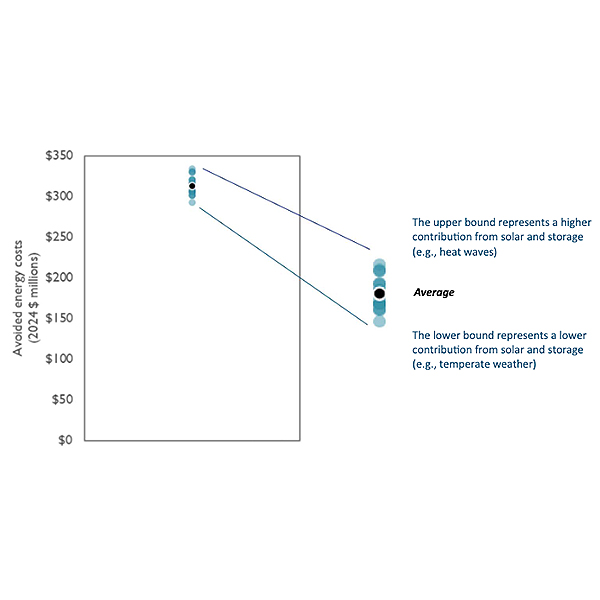

A new report estimates that solar and battery storage growth in New England between 2025 and 2030 could reduce wholesale energy costs across the region by about $684 million annually by 2030.

Want more? Advanced Search