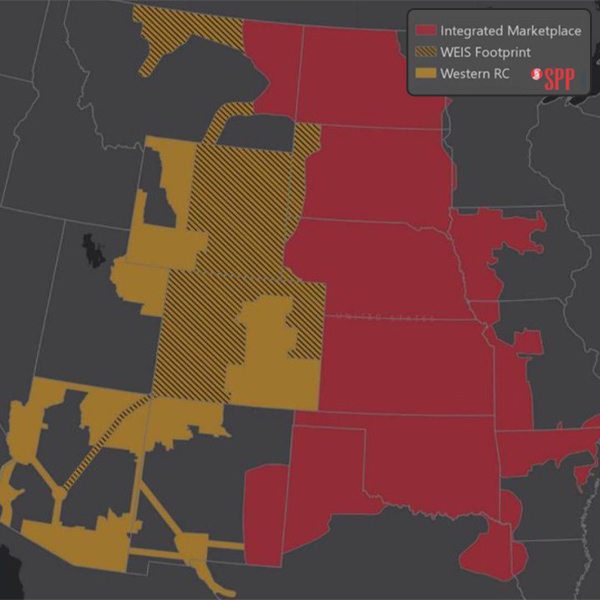

Western Energy Imbalance Service (WEIS)

Black Hills Colorado Electric has filed an application with Colorado regulators to join SPP's Markets+, saying it has no choice because it is embedded in a balancing authority that will be a Markets+ participant.

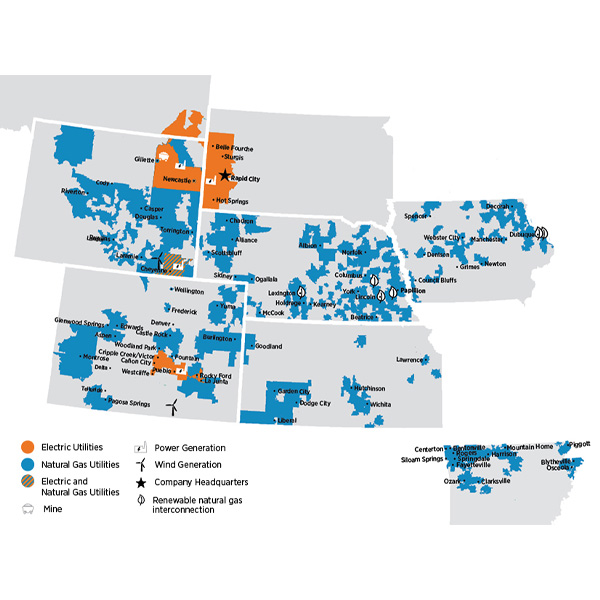

Former SPP COO Carl Monroe's decades of outreach to Western Interconnection entities are evident in the RTO's various markets and service offerings in the West.

FERC accepted SPP's tariff revisions to its Western Energy Imbalance Service market that allow market holds for reliability-based concerns when requested by a balancing authority.

SPP named Carrie Simpson, a key figure in its expansion efforts in the Western Interconnection, as its vice president of markets, effective April 1, replacing incoming COO Antoine Lucas.

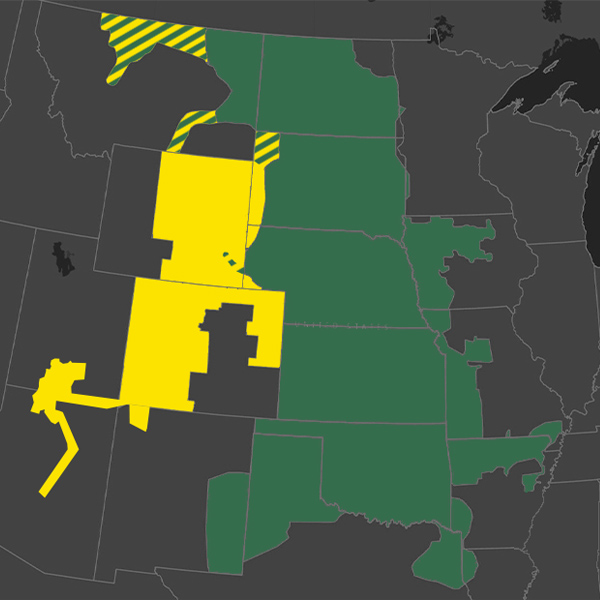

CAISO scored a geographically small but symbolically significant victory with the announcement that two Black Hills Energy subsidiaries will move to the ISO’s Western Energy Imbalance Market.

FERC accepted SPP’s revisions to its WEIS market tariff related to the residual supply index and ensuring that affiliated market participants’ resources are evaluated together.

SPP's western stakeholders have endorsed large chunks of tariff language that define how the day-ahead Markets+ will handle market transmission use, congestion management, transmission capacity obligations, market manipulation, and confidentiality.

Many at the joint conference focused on the eventual result of the contest between CAISO's Extended Day-Ahead Market and SPP's Markets+ to organize the West's electricity market.

The competition for organized markets in the West grew Friday as the Bonneville Power Administration launched a process to choose between day-ahead markets proposed by CAISO and SPP and regulators from five Western states urged the establishment of a new, independent RTO covering the entire West.

The proposed governance structure for SPP's Markets+ service offering and resource adequacy are two key differences with CAISO's RTO proposal.

Want more? Advanced Search