PORTLAND, Ore. — The competition for organized markets in the West grew Friday as the Bonneville Power Administration launched a process to choose between day-ahead markets proposed by CAISO and SPP and regulators from five Western states urged the establishment of a new, independent RTO covering the entire West.

“This group proposes the creation of an entity that could serve as a means for delivering a market that includes all states in the Western Interconnection, including California, with independent governance,” regulators from Arizona, California, New Mexico, Oregon and Washington wrote to the chairs of the Western Interstate Energy Board (WIEB) and the Committee on Regional Electric Power Cooperation (CREPC).

The entity “could provide a full range of regional transmission operator services, utilizing a contract for services” with CAISO including eventual “assumption” of CAISO’s proposed Extended Day Ahead Market (EDAM) and its real-time Western Energy Imbalance Market (WEIM).

The letter cited studies that have shown the greatest economic and environmental benefits for the West would come from a single Western RTO. A state-led market study in 2021 found that development of an RTO covering the entire U.S. portion of the Western Interconnection could save the region $2 billion a year in energy costs by 2030.

“We have identified a common commitment in seeking the benefits shown in multiple studies that demonstrate the most favorable electricity market for consumers is one that includes a West-wide market footprint,” the letter said. “Such a market would avoid the issue of ‘seams’ from separate markets across major portions in the West and result in optimized use of resources to meet loads across the entire interconnection.”

“In announcing our commitment, the group is inviting all Western states and associated stakeholders to join the effort and help shape the approach,” it said.

The planning process will begin this year, and implementation will start in early 2024 “with the formation of the independent entity, the seating of an initial founding board of directors, exploration of the relationship with CAISO for future services and the expectation of a small independent staff being put in place,” the letter said.

‘A Breakthrough’

The prospect of a single West-wide RTO has been growing less likely as CAISO and SPP compete for market share for their proposed day-ahead offerings, and SPP is making inroads on the development of a Western version of its Eastern RTO called RTO West. (See Western Day-Ahead Markets Debated at CREPC-WIRAB.)

At the same time, the latest legislative effort to allow CAISO to become a Western RTO appears to have stalled. Assembly Bill 538 was held by its author in committee in May because of staunch opposition from powerful labor unions in California.

The bill would let CAISO create a governing body free from oversight by California politicians. Currently, the state governor appoints members to the ISO’s Board of Governors, and the state Senate approves them. (See CAISO Regionalization Bill Put on Hold.)

In the past, lawmakers have refused to relinquish control of CAISO, and other Western states have said they will not join an RTO dominated by Californians.

The regulators’ proposal could offer a way out of the stalemate and an alternative to Western entities thinking of joining SPP’s RTO West. “The letter represents a breakthrough in efforts to advance the regions’ energy landscape and is key to creating a market that fosters collaboration, improved reliability and economic growth,” Advanced Energy United, a national clean-energy trade group, said in a statement. AEU is part of a coalition of business and environmental groups called “Lights on California” that advocates for creation of a Western RTO.

The Environmental Defense Fund also is a coalition member.

“The positive thing to me is that this is the loudest signal to date that the West is organizing, and that is extraordinarily exciting and encouraging,” said Michael Colvin, who leads EDF’s work on California energy policy. “It’s an alternative to the SPP front. Whether it goes this way or the CAISO way, it recognizes that the most affordable and reliable way to achieve our energy goals and to decarbonize is through collaboration.

“It is a signal to all the folks that are thinking of jumping ship to SPP that the West is here for you.

In a statement to RTO Insider, CAISO CEO Elliot Mainzer said, “We are pleased that utility regulators from around the West have come together to discuss how they can work more closely together to enhance reliability and benefit ratepayers throughout the region. … CAISO stands ready to support their efforts and work with a broad range of stakeholders to develop a long-term approach that meets the needs of California and the entire Western U.S.”

SPP Vice President of Markets Antoine Lucas struck at diplomatic note in his comments on the development, saying the RTO understands that Western regulators want to “explore every available option” in their efforts to ensure that regionalization occurs with the interests of ratepayers in mind.

“SPP is confident in its ability to provide an independently governed market designed such that it will help states ensure electric reliability, reach their renewable goals, and enable equitable trade across the Western Interconnection,” Lucas said. “We stand ready to prove the integrity and value of our proposed Markets+ service and to meet the needs of Western stakeholders.”

BPA: Markets+ vs. EDAM

The commissioners’ letter came just hours after BPA kicked off a public process at its Portland headquarters to determine whether it will participate in a day-ahead market and, if so, which option to choose: SPP’s or CAISO’s.

BPA operates about 70% of the transmission in the Northwest and is the region’s largest electricity supplier.

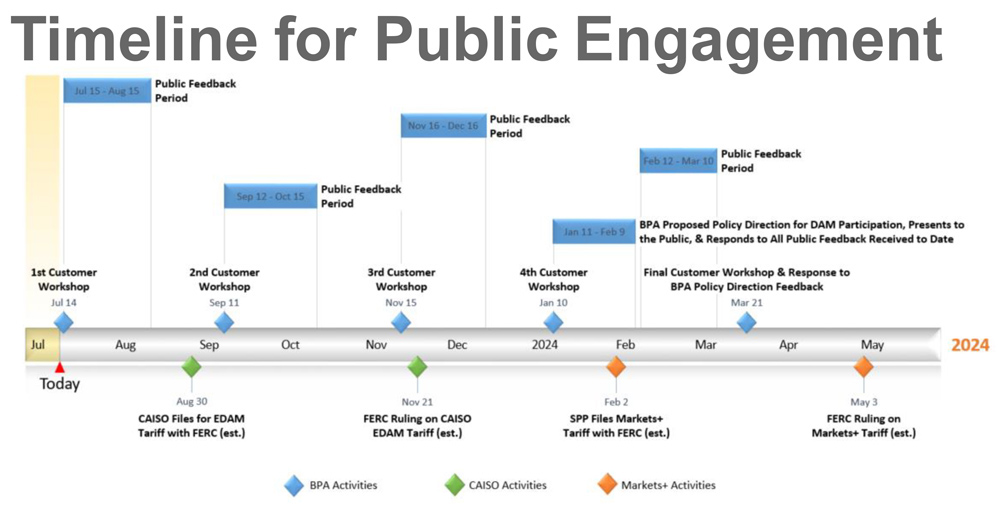

Friday’s workshop was to be the first of five such meetings to be held every other month through the beginning of next year, with each followed by a public comment period. BPA plans to propose a “record of decision” on the issue shortly after SPP files its Markets+ tariff with FERC in February 2024. It expects to conclude with a final workshop to discuss its decision and address the last round of feedback.

“This is an open-ended process; BPA has not decided to join a day-ahead market,” Russ Mantifel, BPA’s director of market initiatives, told workshop participants Friday.

But multiple sources involved in Western regionalization efforts, who asked not to be quoted because they’re not authorized to speak for their organizations, told RTO Insider that BPA is leaning toward Markets+. They cite a number of factors that put BPA in the SPP camp, including more favorable treatment for hydroelectric generation in Markets+, a CAISO bias in favor of California load that restricts wheel-throughs in the ISO during critical periods and the unresolved issues around the lack of independent governance for CAISO.

Governance is an especially intractable issue for BPA, which, as a federal power marketing agency, cannot cede its authority to a state-run organization, prohibiting it from participating in a CAISO-run RTO that is not overseen by an independent board.

And while membership in a full RTO is not on the table, Mantifel pointed to the importance of joining a day-ahead market that eventually can integrate more functions — such as resource adequacy — as conditions evolve in the West.

“One of the things we think about [regarding] governance, market design, etc., is which options create the opportunity to create more verticality, potentially going to an RTO or adding these functions as part of it, and which ones have had that sort of limitation,” Mantifel said.

Alex Swerzbin, director of transmission and markets for PNGC Power, a Portland-based generation and transmission cooperative owned by 16 utilities in seven Western states, agreed on the need for “verticality.” He encouraged BPA to consider the “end state” of its decision, which is future participation in an RTO. Swerzbin said the WEIM can be viewed as “sunk cost to a degree” because real-time trading still constitutes a small percentage of the market.

“Once we move to a day-ahead market, that is a much larger footprint. It is much harder to transition from one day-ahead market to a separate [market] to get to an RTO/ISO,” Swerzbin said.

But Fred Heutte, a senior policy analyst with the Northwest Energy Coalition, urged BPA to put aside an “A-to-B” comparison between EDAM and Markets+ in favor of considering the “big-picture question” of whether to have one or two markets in the West.

“The issue is going to be delivered value,” Heutte said. “If we have two markets, the likelihood, at least initially, from what we can see, is to have a significant reduction in delivered value in terms of cost, in terms of reliability and in terms of longer-term issues” such as transmission planning and resource adequacy, “no matter how good each of the market offers may be.”

Heutte said “the really big picture” is the impact of two markets on the diversity inherent in the Western Interconnection.

“If you look forward with the changing resource mix, with changes in extreme weather conditions, the changes in demand profile, as we see more large loads and more decarbonization load coming on the system, the resource and the load diversity of the West is a really critical factor,” he said.

“The more diversity, the fewer seams you have, the more effective [a market is] going to be — I can’t disagree with that,” Mantifel said. “I think … the other reality is what it takes to get there, and sort of the sacrifices and compromises people are willing to make in order to achieve that, and whether that’s ultimately viable.”

BPA has scheduled its next day-ahead market workshop for Sept. 11-12.

CAISO is expected to file tariff language with FERC on EDAM next month. It has been promoting the day-ahead market among potential participants as it faces stiff competition from SPP.

On Thursday, CAISO said it would co-host a market forum on EDAM with NV Energy, PacifiCorp and others in Las Vegas on Aug. 30.

“The forum, which aims to foster a dialogue on the evolution of the EDAM in the West, will bring together leadership from regional utilities to discuss and share their thoughts on the factors and processes in considering their participation, as well as utility regulators from across the West, who will share their perspective on the next step in market evolution and how they are actively engaging in its development,” CAISO said.