SPP has posted a Markets+ draft service offering that lays out the RTO’s proposal to “modernize and enhance” operation of the Western grid.

The document provides the proposed governance structure, market design and other key features of Markets+. SPP describes the service offering as providing Western Interconnection utilities that aren’t ready to pursue full RTO membership a voluntary, incremental opportunity to realize significant benefits.

The governance and design principles are based on feedback SPP has received from the Western utilities with which it hopes to partner. Participants have until Oct. 28 to provide additional input to the service offering.

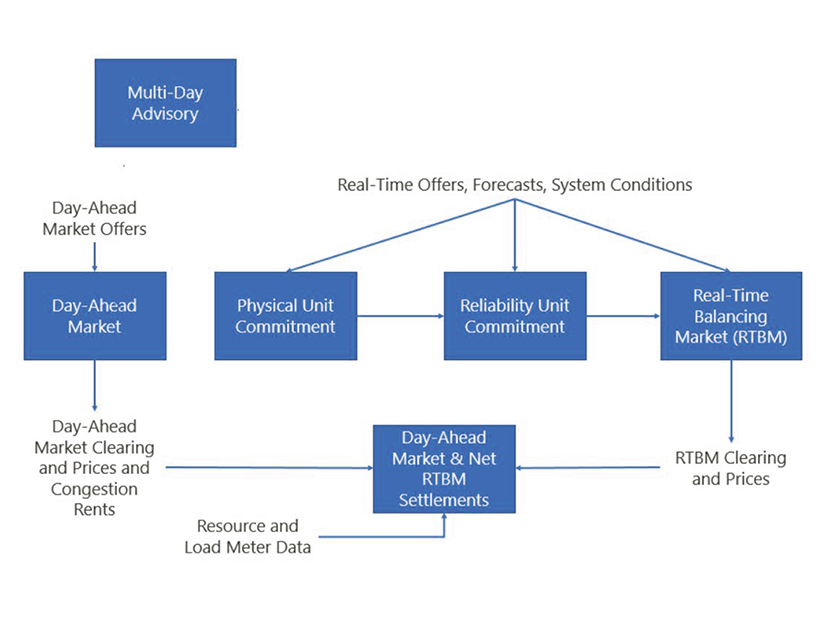

The grid operator said the design sessions have narrowed the day-ahead market’s basic structure to two possible implementations: a voluntary, financial market with financially binding day-ahead positions that include physical instructions for resources to start and stop, and a multistage process where a reliability-based, physical resource commitment occurs followed by a purely financial and voluntary day-ahead market.

SPP will host a Markets+ development update webinar Nov. 1 to discuss funding the tariff development for the offering and commitment agreements. An in-person meeting of the Markets+ development group will be held Nov. 15-16 in Westminster, Colo., before the final service offering is released.

RTO staff and Western utilities will continue their work in two phases. First, potential participants and stakeholders will financially commit to design the market protocols, tariff and governing documents. The second phase will begin with FERC approval.

SPP said it will take 21 months to develop and prepare the FERC package at a fixed cost of $9.7 million. It said staff will work with stakeholders to develop a cost allocation approach for the startup costs before the final service offering is issued. Potential participants will pay a monthly rate of $500,000 to support the responses, technical analysis and research necessary to gain final FERC approval.

Eleven Western entities have already told SPP they are committed to working with the grid operator to build a Western market that includes “both a workable governance framework and a robust market design.” (See SPP’s Markets+ Offering Attracts 6 More Western Entities.)

Staff Drafting JTIQ Policy

SPP staff told stakeholders they are drafting the governing language to allocate costs for any projects identified in their joint targeted interconnection queue study with MISO. The grid operators plan to assign 90% of the $1 billion study’s portfolio to interconnection customers and the remaining 10% to an aggregate of their load, but they were met with some pushback during a Sept. 30 joint stakeholder meeting. (See Stakeholders Not Sold on JITQ Projects’ Cost-Sharing Plan.)

“We’re trying to solidify the principles to where we can build governing language around them and then move it into the regulatory arena,” SPP’s Neil Robertson, coordinator of system planning, told the Seams Advisory Group Friday.

Staff said they plan to post a policy paper this week designed to gain approval for the cost allocation mechanics and methodology that the SPP region will use. They have scheduled meetings with state and federal regulators to secure their buy-in and hope to get approval from the Regional State Committee in January. The goal is to make the necessary changes to the joint operating agreement and file with FERC in the first quarter.