Significant decarbonization of the grid relying on solar, wind and storage is possible, but will be extremely expensive and may require updates to markets and compensation mechanisms, ISO-NE told its Planning Advisory Committee last week, reporting on the policy scenario results from its Economic Planning for the Clean Energy Transition (EPCET) pilot study.

The results highlighted the need for dispatchable generation as weather-dependent renewables come online and found that long-duration storage will become increasingly valuable in the coming decades.

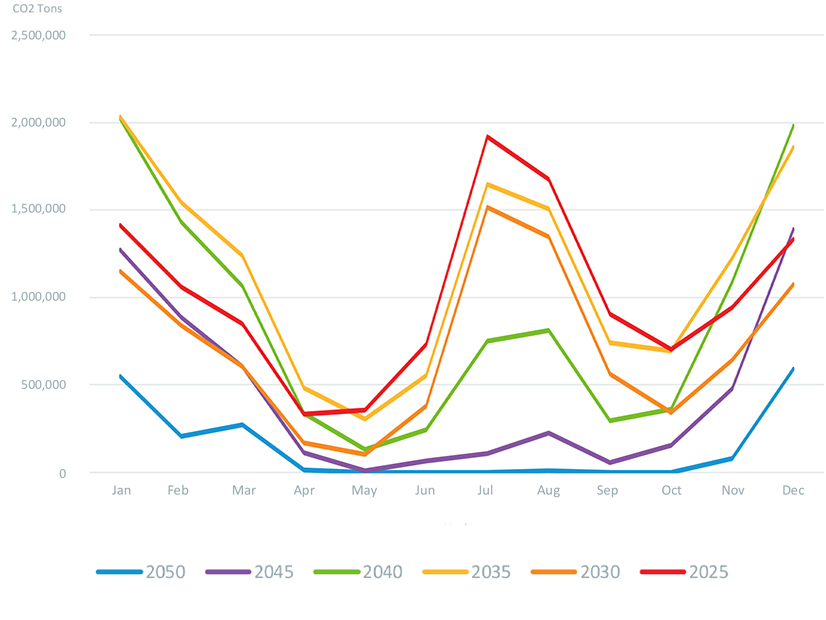

“Longer duration storage becomes more valuable because it is more effective in shifting larger quantities of energy to the declining number of emitting hours,” said Benjamin Wilson of ISO-NE. “Seasonal storage, which could move large volumes of energy from the shoulder months to the winter, would be very useful but would be expensive to compensate.”

ISO-NE said that carbon reductions will become increasingly costly over time as the system decarbonizes.

“Subsequent additions of a given resource type have declining economic and carbon-reduction value,” Wilson said. “Emission reduction becomes an effort to procure new intermittent or energy limited resources to displace peakers.”

The RTO’s model still included some dispatchable fossil fuel generation in 2050, totaling about 1.4 million tons of annual emissions, as well as some generation from municipal solid waste, landfill gas and wood.

“When the majority of generating resources are intermittent and weather-driven, there will be conditions where dispatchable generation must be relied upon,” Wilson said. ““The worst-case reliability hours may not be the highest load hours. Instead, the indicator for worst-case reliability may be hours of dunkelflaute (dark wind lull) which coincide with moderate loads.”

The modeling did not include a significant generation role for low-carbon fuel alternatives, but Wilson said that future EPCET analyses could include these options. The presentation did not compare the energy costs of the carbon-constrained scenario to a business-as-usual case, which Wilson also said could be considered in the future.

The economy-wide costs related to climate impacts of unconstrained emissions are also projected to be extremely expensive — a 2022 white paper by the White House Office of Management and Budget estimates that the financial impacts of climate change to the U.S. could reach $2 trillion annually by 2100, or a 7.1% reduction in federal revenue.

Future Capacity Requirements

ISO-NE also presented an overview of the results from its installed capacity requirement (ICR) and operational capacity analysis to the Planning Advisory Committee on Thursday.

The ICR is the minimum amount of installed capacity needed to ensure grid reliability for the region, while the net ICR — used to determine the amount of capacity procured by the RTO in the Forward Capacity Auction — equals the ICR minus the Hydro-Québec Interconnection Capability Credits.

Projecting out through 2033, the RTO expects the Net ICR, along with the gross peak load, to slightly increase as electrification increases. ISO-NE said this increase in electrification will cause elevated winter reliability risks in the early 2030s.

“With the growing load, primarily due to the increasing electrification forecasted in the 2023 CELT Report, we observed some loss of load risk during the winter, particularly during the later years of the forecast cycle,” said Helve Saarela of ISO-NE.

“Assuming that the amount of CSOs (31,370 MW) procured in FCA 17 stays in-service and assuming additional Sponsored Policy Resources, there should be an adequate amount of capacity to meet the resource adequacy needs,” Saarela added.

Asset Condition Projects

Also at the PAC meeting, Eversource outlined plans to spend approximately $577 million on three asset condition projects:

- Eversource plans to replace two underground 115 kV cables — covering about seven total miles — near Southwest Hartford, Connecticut, with a projected cost of $301.6 million and an in-service date of late 2026. Eversource said the replacement would reduce hazards related to deteriorating infrastructure, improve reliability and increase capacity.

- The utility company proposed to spend $269.9 million to replace over 800 wood structures with steel structures across 10 115 kV transmission lines in New Hampshire. Many of these structures are relatively new laminated wood structures installed between 2000 and 2014. Eversource said this is the final phase of the company’s Laminated Wood Structure Replacement Program and said the new structures would increase resilience and reliability and enable larger conductor sizes in the future. The projected in-service dates ranged from early 2024 to the second half of 2025.

- Finally, Eversource said it plans to spend $5.5 million to replace 15 relays at a substation in Deerfield, Massachusetts, saying suppliers are no longer making replacement parts for the equipment. The projected in-service date is the first half of 2025.