arbitrage

FERC has signaled that it’s done dealing with PJM’s concerns about market participants selling “paper capacity” to arbitrage price differences between the Base Residual and Incremental auctions.

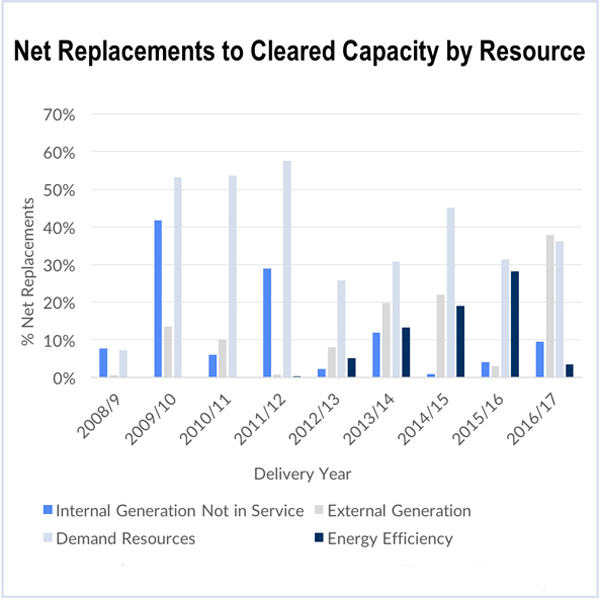

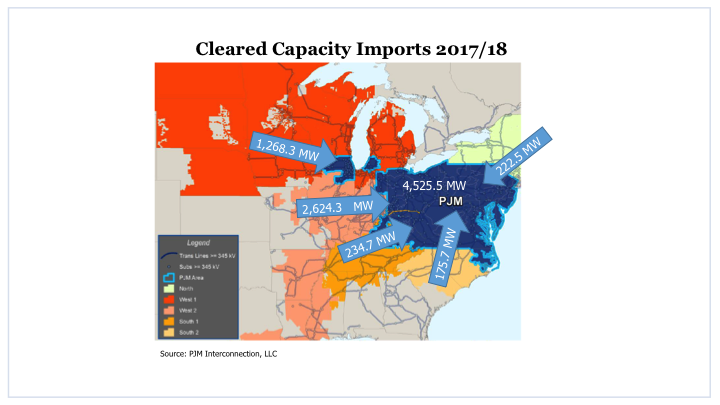

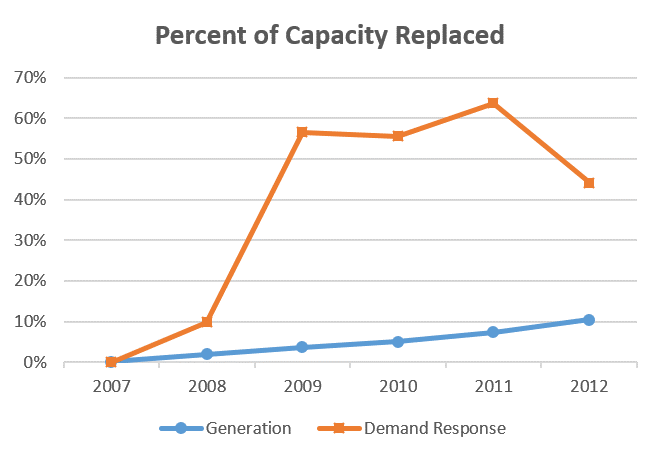

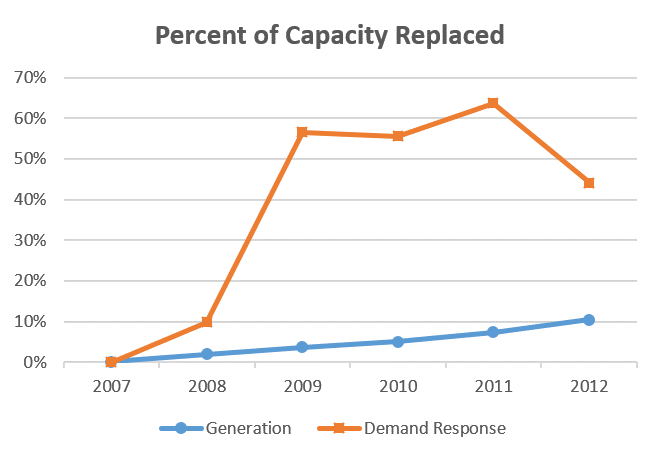

PJM rule changes since last year’s auction resulted in reductions in cleared generation imports and demand response. The mix of DR that cleared also changed, with more annual resources and less summer-only.

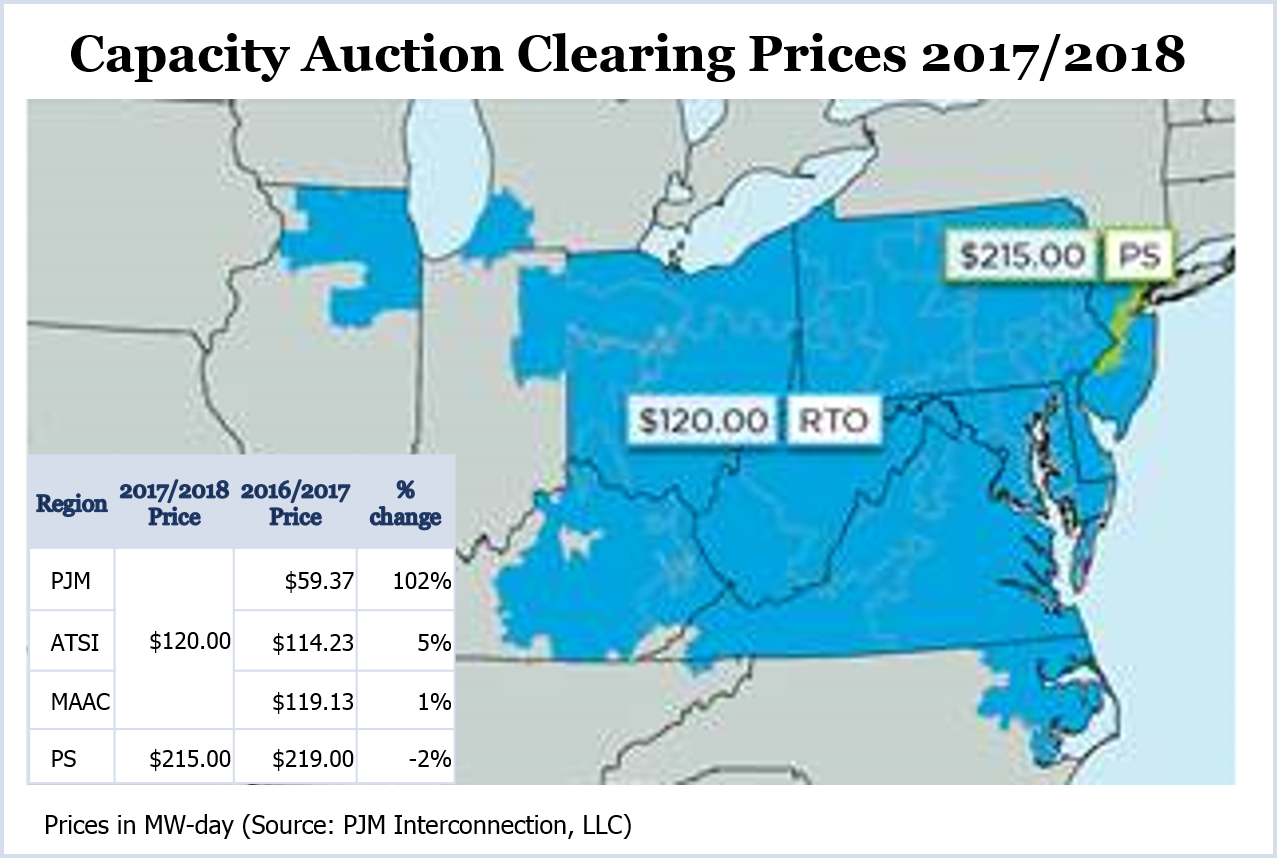

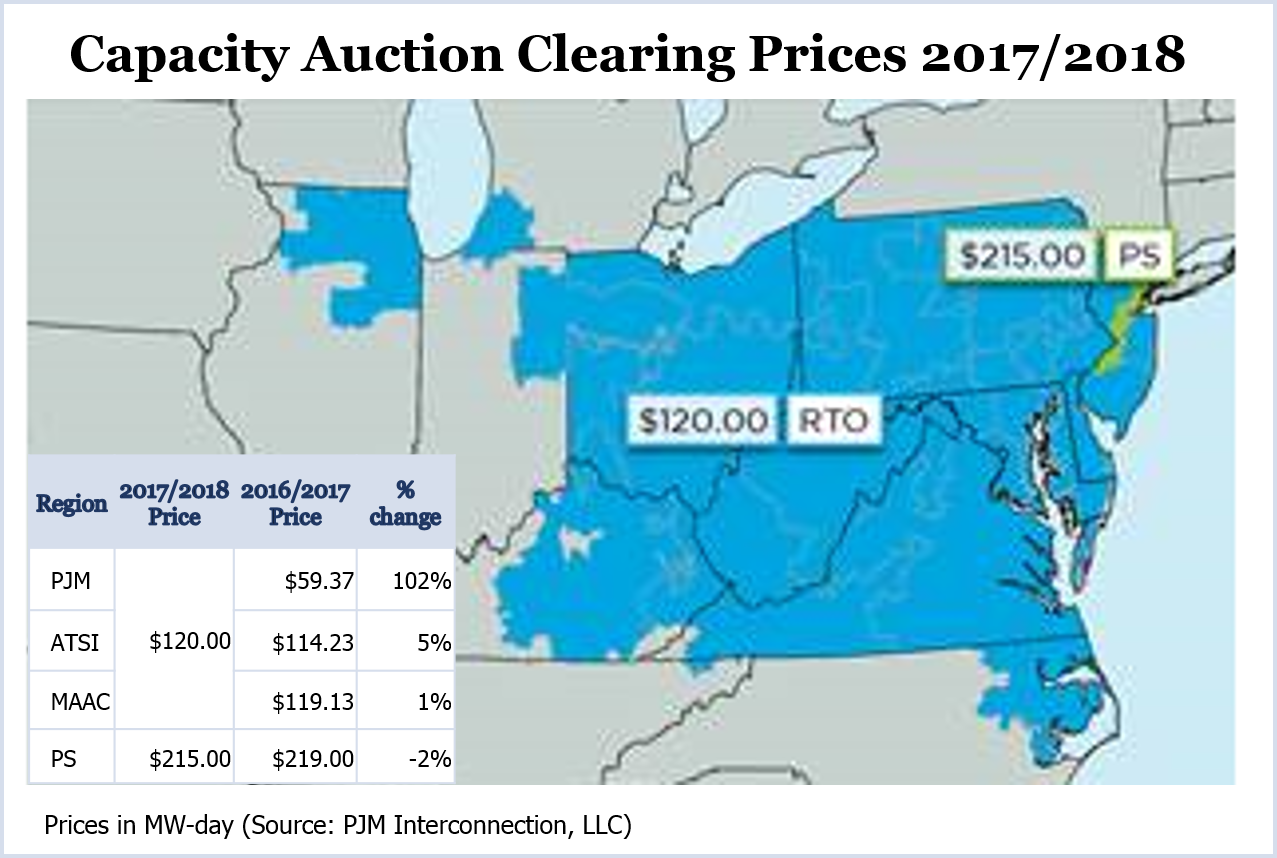

The 2017/2018 capacity auction cleared at $120/MW-day in most of PJM as restrictions on demand response and imports doubled prices in Virginia, West Virginia, North Carolina and much of Ohio. Prices were essentially flat in the East.

The 2017/2018 capacity auction cleared at $120/MW-day in most of PJM as restrictions on demand response and imports doubled prices in Virginia, West Virginia, North Carolina and much of Ohio. Prices were essentially flat in the East.

Stakeholders backed PJM’s proposal to eliminate speculation in capacity auctions, selecting it over four alternatives in a vote announced yesterday.

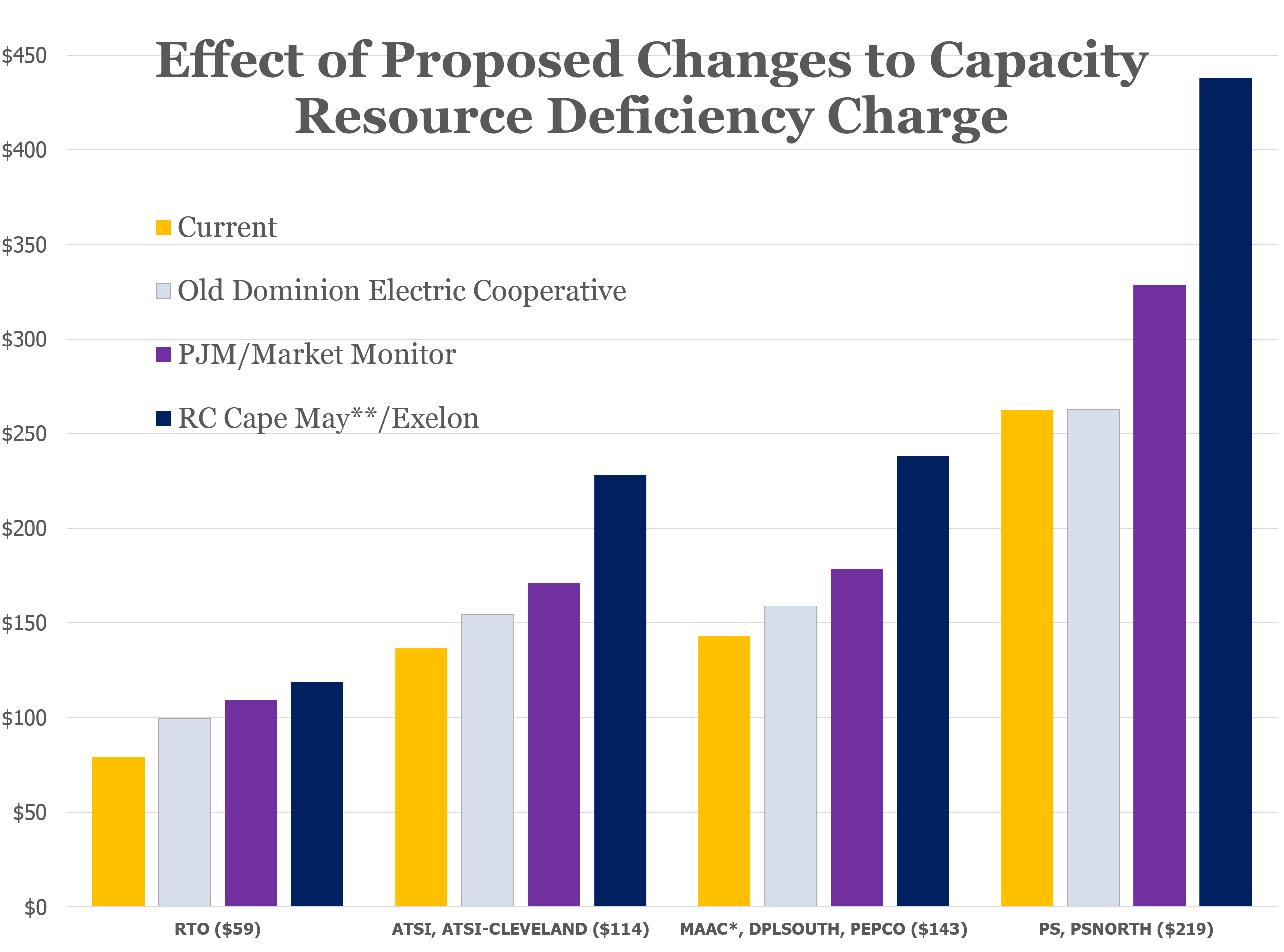

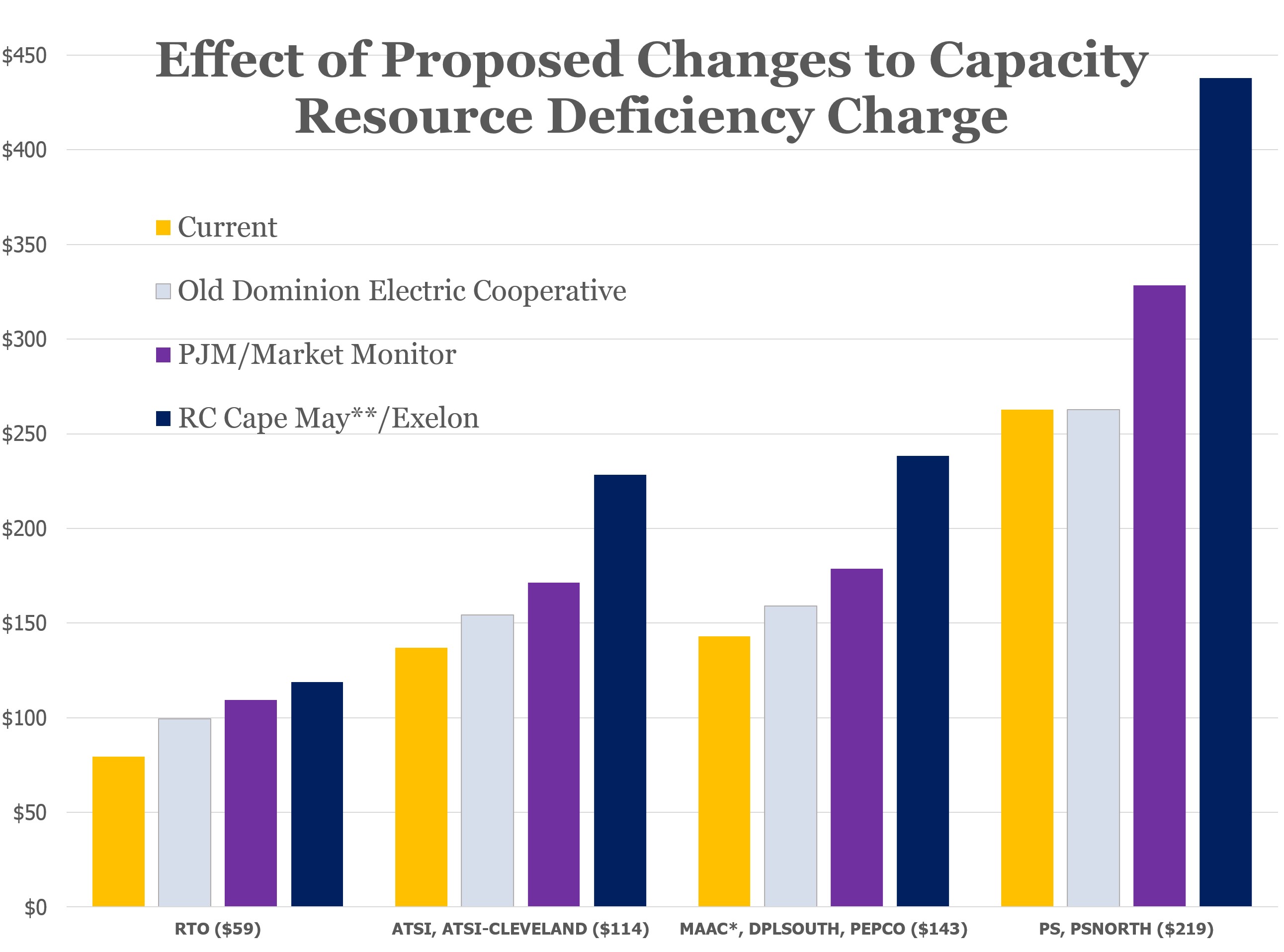

A summary of proposed changes to the PJM incremental auctions.

PJM Stakeholders will hold a formal vote on measures to eliminate speculation in the capacity market this week after narrowing the proposals from seven to six/five in a lengthy meeting Friday.

Time is growing short for PJM stakeholders working towards consensus to address auction arbitrage and ban capacity market speculation before May’s auction.

Lacking consensus, PJM dropped plans for a vote on measures to prevent speculation in the capacity auctions, returning the issue to a lower committee.

Our summary of the issues scheduled for votes at the PJM MRC and MC on 11/21/13. Each item is listed by agenda number, description and projected time of discussion, followed by a summary of the issue and links to prior coverage.

Want more? Advanced Search