Base Residual Auction (BRA)

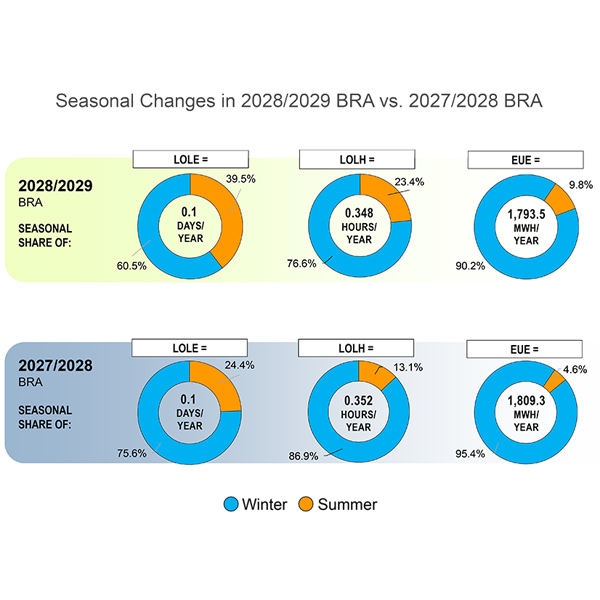

Stakeholders endorsed PJM’s recommended installed reserve margin and forecast pool requirement for the 2028/29 Base Residual Auction at the Markets and Reliability Committee meeting.

PJM and stakeholders laid out their initial thoughts on the structure of the in-development reliability backstop procurement as the RTO looks to meet a September target set out by the White House and all 13 member states’ governors.

PJM's Markets and Reliability Committee and Members Committee will be asked to endorse the recommended IRM and FPR values for the 2028/29 BRA.

PJM stakeholders kicked off discussions on creating a “backstop” auction to be held in September at the insistence of the Trump administration and the governors of the RTO’s 13 states.

A summary of the agenda items scheduled to be brought to a vote at the PJM Markets and Reliability Committee and Members Committee meetings.

The PJM Market Implementation Committee endorsed an issue charge to evaluate whether manual revisions are warranted, among other business conducted in the committee's most recent meeting.

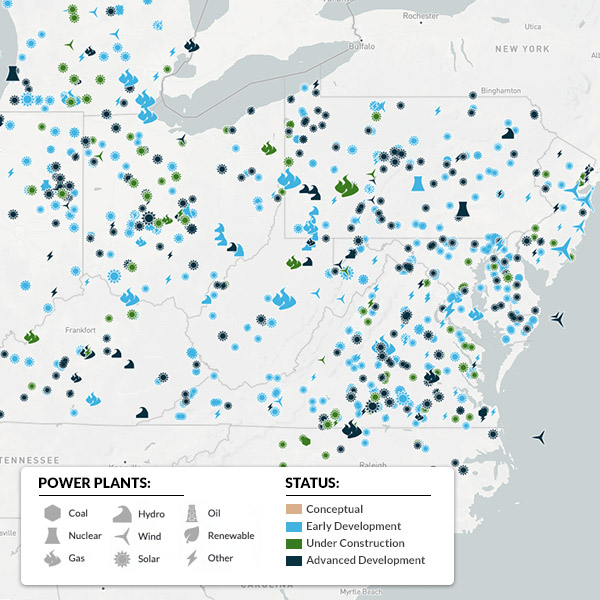

PJM enters 2026 amid several efforts to ward off a reliability gap attributed to accelerating data center load, sluggish development of new capacity and resource deactivations.

FERC and the organized power markets it oversees are facing huge challenges in trying to meet rising demand reliably and affordably.

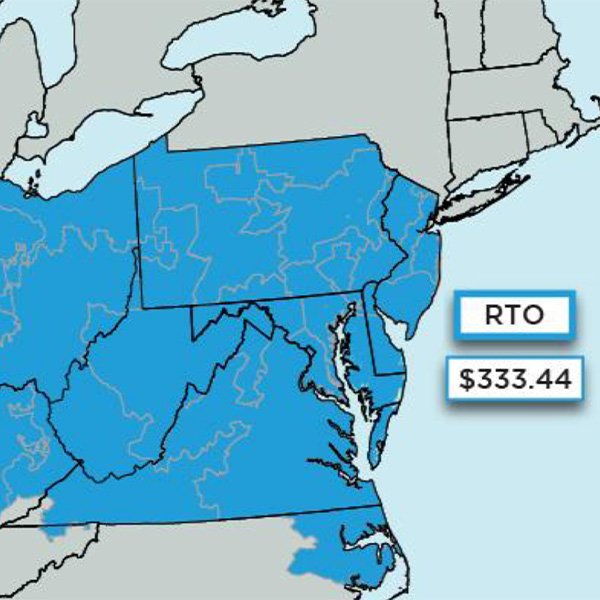

PJM’s 2027/28 Base Residual Auction procured 134,479 MW in unforced capacity at the $333.44/MW-day maximum price, falling 6,623 MW short of the reliability requirement and setting a clearing price record.

PJM stakeholders are to vote on a record-breaking number of proposals on how the RTO should integrate large loads without impacting resource adequacy.

Want more? Advanced Search