capacity auction

MISO is registering and accrediting resources to meet a roughly 2-GW uptick in load for the 2026/27 planning year.

A trade group representing multiple MISO power producers has lodged a complaint against retroactive pricing revisions in MISO’s 2025/26 capacity auction, joining Pelican Power in calling the repricing unlawful.

MISO ended its 10-year run allowing energy efficiency in its capacity market, as FERC allowed the change to take effect.

Louisiana-based power generator Pelican Power is the first to register a complaint over MISO’s yearslong miscalculation in its capacity auctions in an effort to stop the RTO’s retroactive pricing corrections.

MISO signaled an openness to alter its 31-day planned outage rule for units that signed up to be capacity resources.

MISO said a yearslong software error caused it to clear more capacity than intended in past capacity auctions and which has resulted in an approximate $280 million impact to market participants in this year’s auction.

MISO members largely agreed that MISO’s new capacity auction structure — featuring individual seasonal auctions and a sloped demand curve — is better for the health of the system.

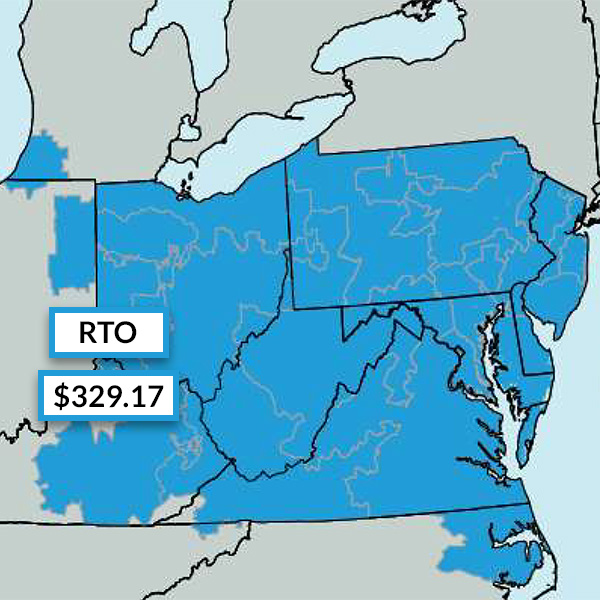

The clearing price is the highest in PJM history and an increase of $59.22 (22%) from last year’s record for the RTO.

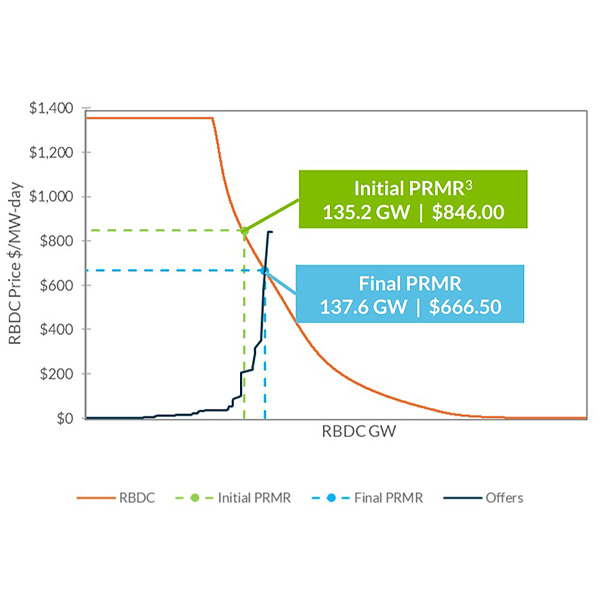

Stakeholders continue to ask MISO to crunch hypothetical auction clearing prices absent the RTO’s new sloped demand curve that sent prices past $660/MW-day for summer.

MISO CEO John Bear put a positive spin on the grid operator making do with little cushion in its supply.

Want more? Advanced Search