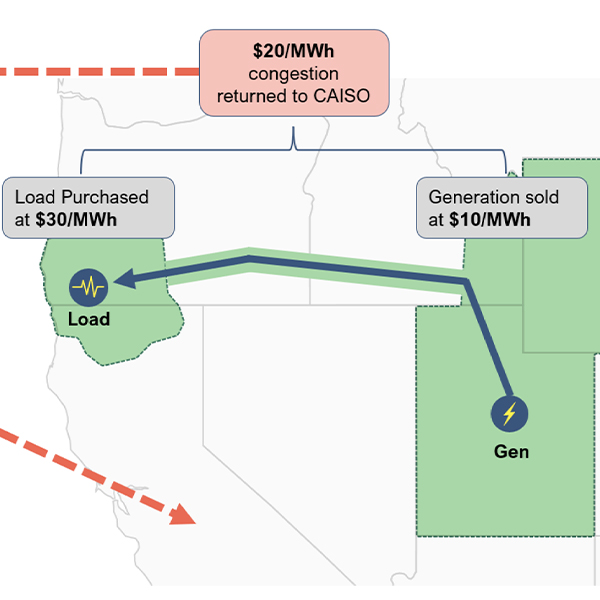

congestion revenue rights (CRRs)

CAISO continues to work to revise the rules around how congestion revenues will be allocated to participants in the ISO’s Extended Day-Ahead Market, which will be launched in spring 2026.

CAISO staff showed how the grid operator plans to implement certain parts of its Extended Day-Ahead Market, with stakeholders asking for more time to comment on what they said crossed into potential policy revisions.

ERCOT says all systems are go — or more specifically, green — and early market trials have been successful as the Real-time Co-optimization plus Batteries project barrels to its Dec. 5 go-live date.

CAISO delayed its final decision on how to allocate congestion revenues in its Extended Day-Ahead Market after receiving comments from stakeholders asking for more analysis.

Stakeholders and state energy officials continue to raise concerns about a draft proposal that would adjust how congestion revenues are allocated in CAISO's EDAM, with the ISO aiming for a vote on the final plan in the coming weeks.

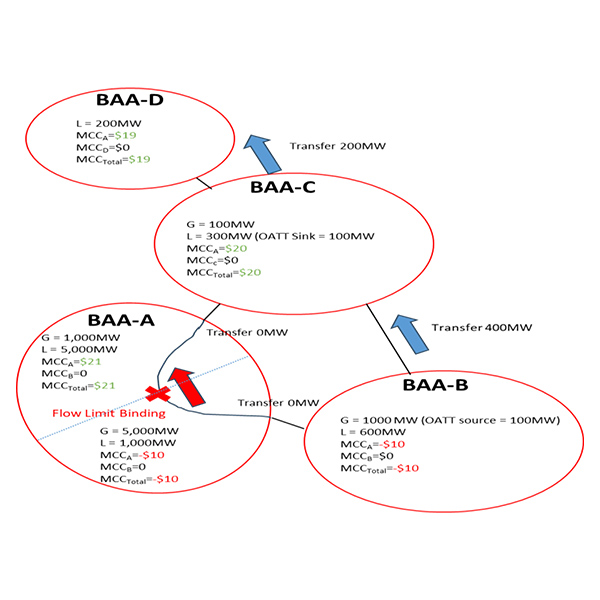

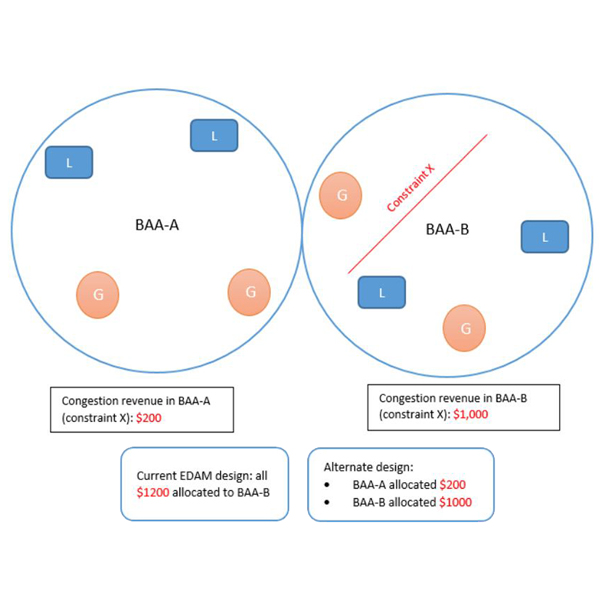

The complex issue regarding congestion revenue allocation in CAISO’s Extended Day-Ahead Market continues to raise questions and cause some confusion for market participants.

The dispute over how CAISO’s Extended Day-Ahead Market will allocate congestion revenues to market participants continues, even as the ISO moves to address stakeholder concerns.

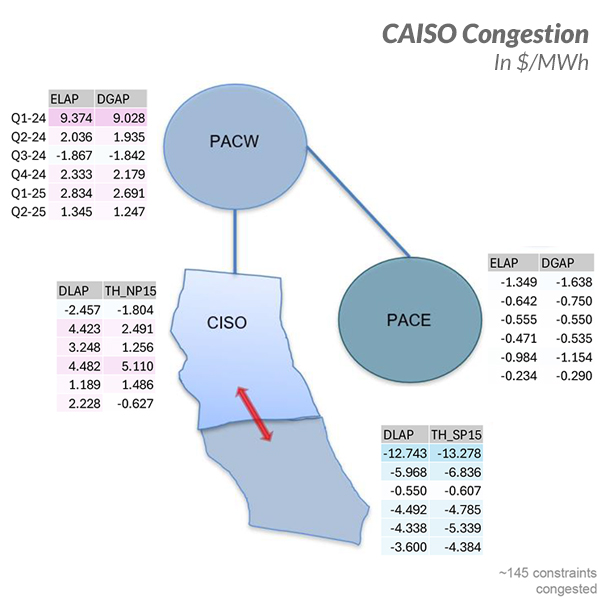

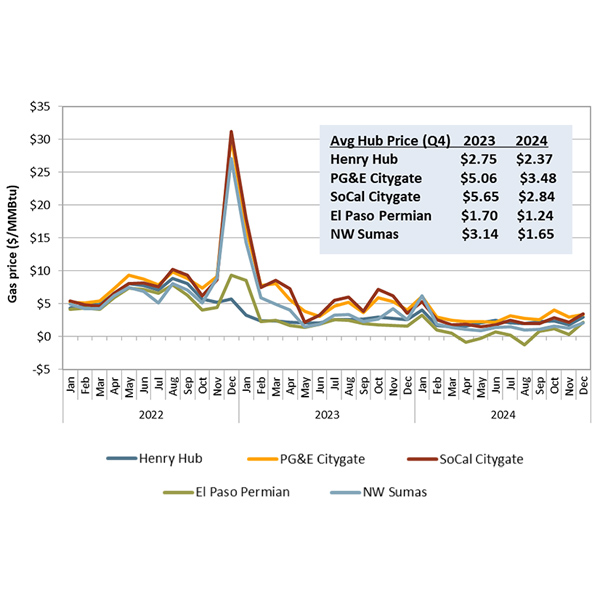

CAISO's Department of Market Monitoring found lower natural gas prices helped drive down energy prices in the WEIM in the fourth quarter of 2024.

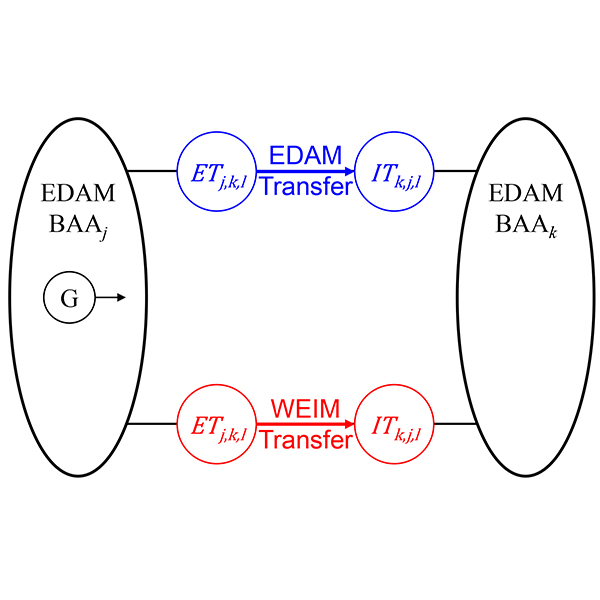

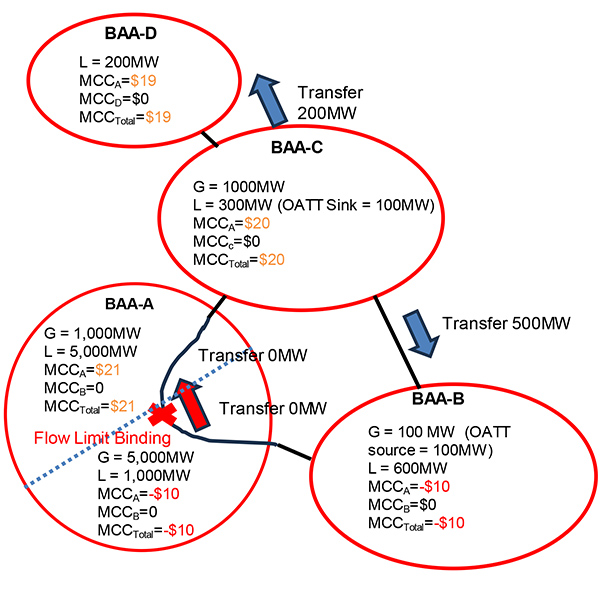

CAISO launched an “expedited” initiative to address stakeholder concerns about how EDAM will allocate congestion revenues when a transmission constraint in one balancing authority area causes congestion in a neighboring BAA.

The new paper from Powerex is likely to reignite the debate between supporters of CAISO’s Extended Day-Ahead Market and SPP’s Markets+ just as the competition between the two markets approach critical junctures.

Want more? Advanced Search