cost of new entry (CONE)

The PJM Markets and Reliability Committee endorsed an RTO proposal to increase the maximum number of bids a single corporate entity can enter into FTR auctions.

PJM's MIC deferred a vote on adopting a problem statement and issue charge to discuss combined cycle modeling in the market clearing engine.

MISO is releasing preliminary design details as it angles for a sloped demand curve in its capacity auction.

PJM defended the proposed capacity auction parameters in its quadrennial review before FERC against two protests from the generation sector.

The MIC overwhelmingly adopted an issue charge to explore whether PJM should account for local issues that may impact the net cost of new entry in a region.

The 2023/24 Base Residual Auction held by PJM in June yielded competitive results, the RTO’s IMM announced in a report released last month.

MISO broadcast to stakeholders that it’s ready for a sloped demand curve in its capacity auction.

The MIC endorsed a PJM proposal to bar critical gas infrastructure from DR programs that could jeopardize the reliability of gas-fired generators.

FERC rejected the Coalition of MISO Transmission Customers’ proposal to allow some load to exit the the RTO system penalty-free.

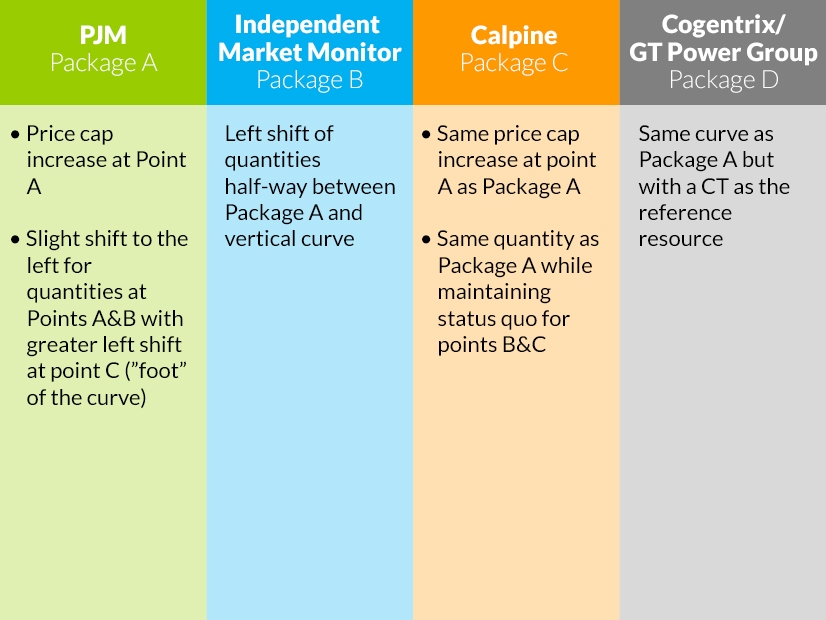

PJM members failed to find consensus on any of four proposed sets of capacity auction parameters, with the RTO’s proposal falling short of the necessary votes.

Want more? Advanced Search