FERC ordered PJM last week to remove the 10% cost adder for the reference resource used to establish the variable resource requirement (VRR) curve in the RTO’s capacity market (ER19-105).

In a 4-1 decision at its monthly open meeting Thursday, the commission said it determined there was “insufficient record evidence to support PJM’s proposed inclusion of a 10% adder,” reversing its original decision in April 2019. Commissioner James Danly dissented.

The D.C. Circuit Court of Appeals in July rejected FERC’s logic for approving the adder, ruling that the commission “did not provide a satisfactory explanation for its approval, which reasoned decision-making requires” (20-1212). (See DC Circuit Rejects FERC Logic on PJM 10% Adder.)

PJM argued that the 10% adder was necessary “based on the uncertainty of natural gas costs” and the “differences between the key assumptions made for the reference resource relative to actual attributes of a similarly situated representative resource.”

“Based on a thorough review of the record, we find that PJM failed to meet its burden of demonstrating that inclusion of the 10% adder in modeling energy market offers for purposes of calculating the E&AS [energy and ancillary services] offset for its VRR curve is just and reasonable,” FERC said. “The record fails to support PJM’s central argument for including the adder: that a 10% adder should be included in the modeled energy market offers of the reference resource during all hours of the year because tariff provisions governing energy market sellers’ cost-based offers permit such adders to be included.”

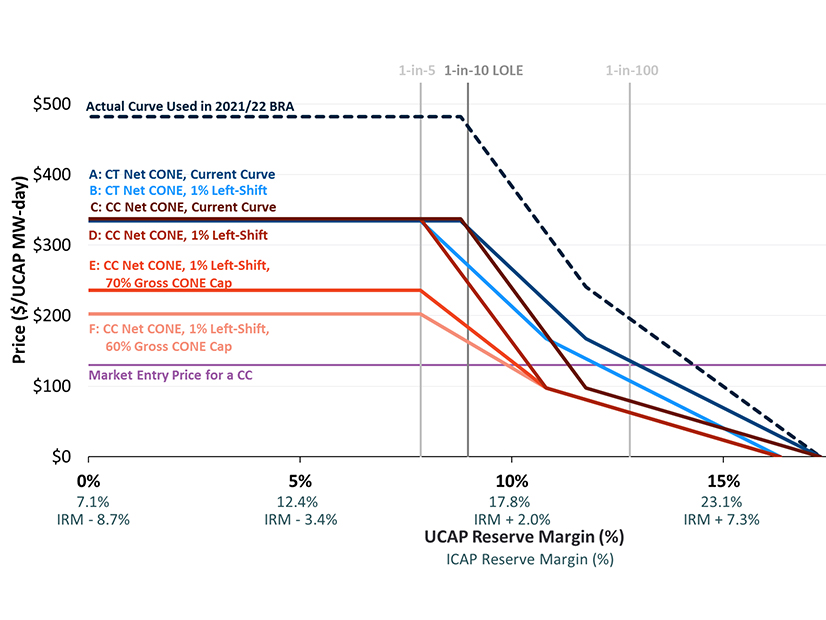

PJM must remove the adder from the determination of the VRR curve beginning with the 2023/24 Base Residual Auction and submit a compliance filing within 30 days with tariff revisions reflecting the removal.

The commission said although it rejected the adder, it remained “mindful” that the VRR curve is partially based on calculation of the reference resource’s estimated cost of service, which is used to determine the resource’s net cost of new entry (CONE) and “necessarily require the use of assumptions.”

“PJM, however, has not demonstrated that adding 10% to the reference CT’s costs, which raises the net CONE used to develop the VRR curve, is a reasonable assumption that results in a more accurate representation of such costs compared to an estimate without a 10% adder (i.e., PJM’s prior method of calculating the E&AS offset),” FERC said in its order.

Glick Comments

FERC Chairman Richard Glick discussed the decision with reporters after the meeting, saying the adder has been an “ongoing discussion” in PJM for several years and that there was “no justification” for it. Glick dissented on the original order, with former Commissioners Neil Chatterjee, Cheryl LaFleur and Bernard McNamee making up the majority.

Glick said there have been “constant proposals” from PJM, stakeholders and the commission to make “pretty significant changes” to the RTO’s capacity markets.

“We all like to think that there are competitive markets out there, but they’re called market constructs for a reason,” Glick said. “They require a lot of administering, whether it be through the Independent Market Monitor, through PJM or FERC.”

Glick said there’s been an “obsession” by some stakeholders in trying to increase revenues for generators, with some believing they haven’t been able to recover enough revenue and making “constant” proposals that “blatantly increase prices” without any clear justification, citing the minimum offer price rule as the biggest example.

“In some cases, I felt like we were just making stuff up in order to increase prices,” Glick said. “I think it’s very important that we go back to basics and figure out what is truly just and reasonable and not focus extensively on bolstering uneconomic generation.”

Danly Dissents

In his dissent, Danly admonished the majority, arguing that the adder was being removed shortly before a scheduled auction “that had already been delayed to accommodate other recent commission intrusions into PJM’s market design.”

“The fact is, a new commission with different membership has decided to reverse itself, which it is entitled to do, but in so doing, it discounts the evidence submitted by PJM and the market participants in support of the 10% adder,” Danly said. “But since not all generators will include the adder every time, we jettison it. Forget that PJM easily met their burden for a [Federal Power Act] Section 205 rate filing.”

Dany said he also disagreed with the process leading to the dismissal of the adder, noting PJM detailed “numerous reasons” why it should not be eliminated for the 2023/24 delivery year, including that it would have to recalculate the E&AS offset, net CONE and net avoidable-cost rate.

“These are not minor details, but fundamental changes we now require after critical auction deadlines have already passed,” Danly said. “I am not certain it is possible for the commission to make any more of a muddle of the PJM capacity market. I suppose if we really wanted to cause trouble, we could delay the auctions again but, wait … we already have.”

MSOC Decisions

The commission also ruled on two issues regarding PJM’s market seller offer cap (MSOC).

In the first, FERC rejected 10 individual filings each requesting commission approval of letter agreements between capacity market sellers and the Monitor (ER22-474). The agreements concerned alternative MSOCs for each seller’s offer into the 2023/24 BRA.

The commission determined that the agreements did not identify offer cap values, failing to comply with PJM’s tariff requirement that any alternative offer cap must be filed with FERC for approval.

“We find that, when filing these letter agreements, it is insufficient to merely reference the existence of a nonpublic offer cap posted by the IMM,” the commission said. “We cannot evaluate an offer cap value that is not before us.”

The order also instituted a show-cause proceeding in a separate docket on the justness and reasonableness of the tariff provision that allows sellers and the Monitor to agree on and file an alternative offer cap that is inconsistent with the PJM tariff (EL22-22).

FERC also ruled on the Monitor’s request for waiver or clarification to update the net E&AS offsets used in the calculation of default and unit-specific MSOCs for the 2023/24 BRA, dismissing the issue as moot (EL19-47).

The Monitor had requested waiver of four of the revised pre-auction deadlines pertaining to the offer caps in November. But last month, the commission partially reversed its May 2020 decision, impacting several of PJM’s energy price formation revisions. (See FERC Reverses Itself on PJM Reserve Market Changes.) The ruling led to a delay of the BRA for the 2023/24 delivery year originally scheduled for Jan. 25, nullifying the IMM’s request for the waivers. PJM earlier this month filed with FERC proposing to move the upcoming BRA to the end of June to comply with the commission’s order. (See PJM Reveals Preliminary Capacity Auction Timeline.)