default energy bid (DEB)

FERC accepted CAISO’s proposal to allow for storage resources to bid above the ISO’s $1,000/MWh soft offer cap in the real-time market to account for their intraday opportunity costs.

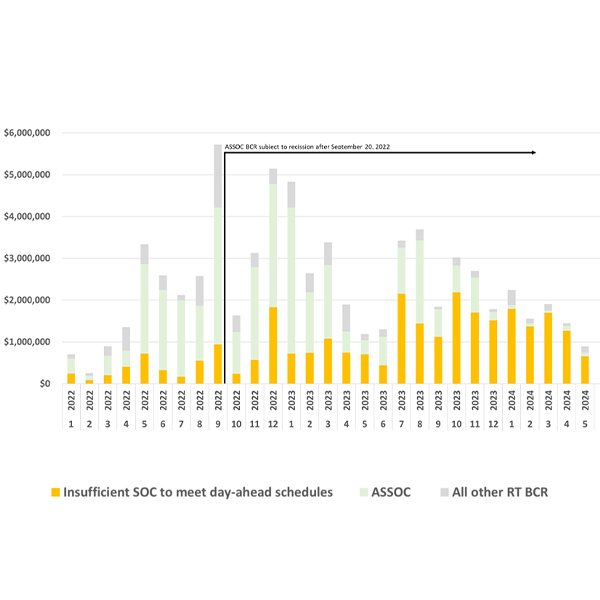

Batteries may be receiving excessive or inefficient bid cost recovery payments in CAISO, an issue that could be exacerbated by the ISO’s recent move to increase its soft offer cap to allow for higher bids by storage resources.

CAISO’s Board of Governors and WEIM Governing Body unanimously voted to approve an expedited proposal to increase the ISO’s soft offer cap from $1,000/MWh to $2,000.

CAISO is proposing to raise the soft offer cap in its market from $1,000/MWh to $2,000 to accommodate the bidding needs of battery storage and hydro resources in time for operations this summer.

FERC on Thursday approved energy storage and reliability improvement rules that help ensure CAISO will be able to meet needs.

FERC approved two CAISO proposals to address concerns that the EIM’s rules constrain hydroelectric operations and undercut the value of resources.

Powerex is navigating a turbulent relationship with EIM rules the company says undercut the value of its hydro power resources.

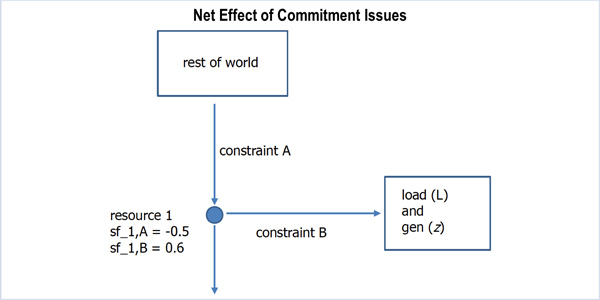

CAISO’s Department of Market Monitoring amplified its opposition to a fundamental aspect of the ISO’s plan for commitment cost mitigation.

CAISO's Monitor submitted comments on the ISO’s straw proposal for its Commitment Cost and Default Energy Bid Enhancements (CCDEBE) initiative.

Want more? Advanced Search