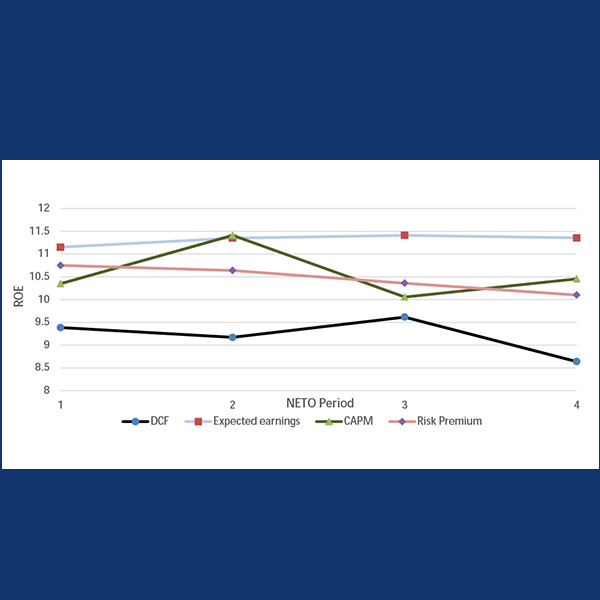

discounted cash flow (DCF)

FERC continues to fiddle with the return on equity MISO transmission owners can earn, this time setting the base amount at 9.98% while once again eradicating the risk premium model from the calculation.

FERC lifted MISO transmission owners’ base return on equity from 9.88% to 10.02% and allowed them to add a third calculation model into the mix.

FERC’s new method for calculating transmission ROE drew requests for rehearing from TOs perplexed it would use a MISO-centric order to set national policy.

FERC adopted a new methodology for calculating return on equity rates for transmission owners and applied it to two MISO proceedings.

FERC’s request for comments on transmission incentives produced splits between transmission owners and load interests, as well as calls for new policies.

FERC is re-evaluating how its 2018 decision on transmission owners’ return on equity might affect Entergy Arkansas’ unit power sales tariff from 2013.

FERC disclosed data underlying its new formula for setting ROE rates for New England transmission owners and explained how it influenced the methodology.

The OMS and the OPSI urged FERC to examine whether current return on equity incentives on top of a new base ROE will result in excessive customer costs.

FERC moved to apply its proposed new methodology for calculating transmission owners’ return on equity rates to dockets in MISO and the South.

FERC signaled a major change in how it sets transmission owners' return on equity rates; no longer relying solely on the discounted cash flow model.

Want more? Advanced Search