Inflation Reduction Act (IRA)

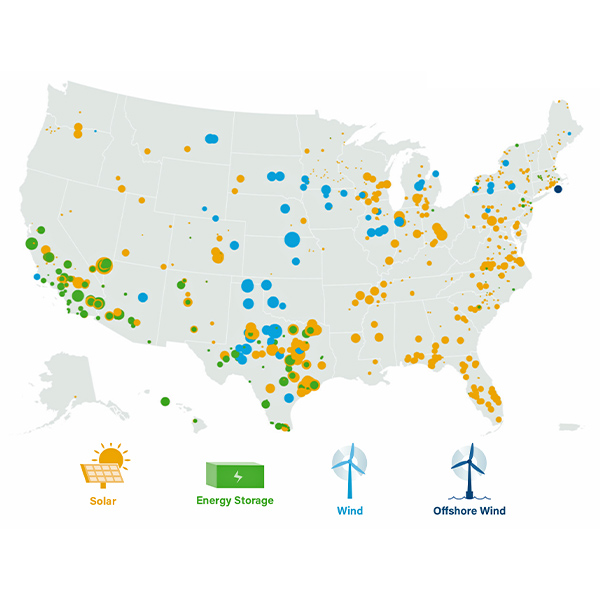

The Inflation Reduction Act and other policies have made the U.S. into one of the most attractive places to invest in clean energy, but completing the energy transition will require additional advances, according to panelists at the Aurora Energy Transition Forum.

A panel on hydrogen at the National Clean Energy Week Policymakers Symposium provided a state-of-the-industry update.

With the presidential election five weeks away, the fate of permitting reform and the Inflation Reduction Act were top of mind for attendees and speakers at the National Clean Energy Week Policymakers Symposium.

DOE has selected 25 battery supply chain projects to receive $3 billion in grants from the Infrastructure Investment and Jobs Act, according to an announcement.

Hybrid power plants, especially projects combining solar and storage, represent a growing amount of new generation online and in interconnection queues across the U.S., signaling a shift in how renewable power can be integrated into electric power markets, according to a new report from the Lawrence Berkeley National Laboratory.

The U.S. Department of Agriculture announced more than $7.3 billion in financing for 16 rural cooperatives through its New ERA program.

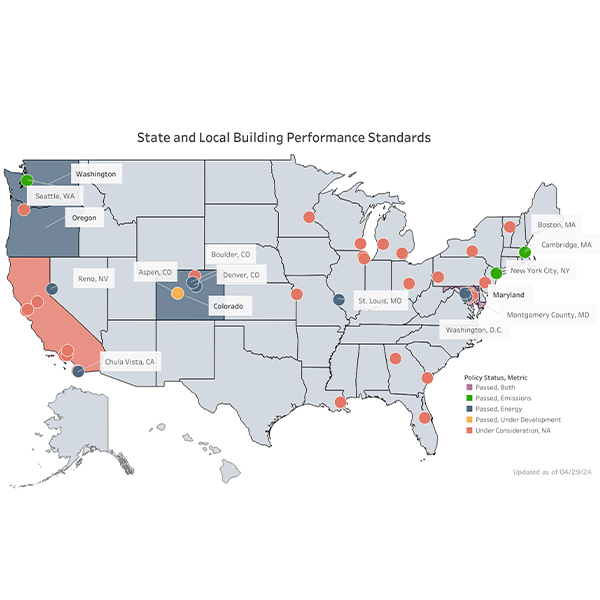

The Department of Energy aims to help cities and states reduce emissions with more than $240 million in grants to promote the adoption of building performance standards

To gain a deeper understanding of how the IRA is being implemented, NetZero Insider invited several industry leaders to talk about their views on the law.

Signed into law Aug. 16, 2022, the IRA is the largest federal investment in climate and clean energy action in history, and leading up to the IRA’s second anniversary, the Department of Energy and other agencies have heralded the law’s impact and benefits.

The American Clean Power Association reports that U.S. clean energy investments announced over the past two years have reached a half-trillion dollars.

Want more? Advanced Search