market manipulation

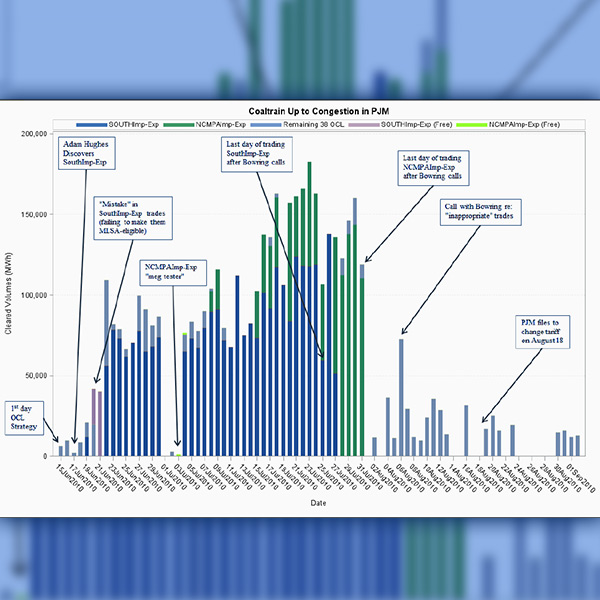

Coaltrain Energy agreed to pay $4 million in disgorged profits to resolve a FERC investigation into accusations that the company engaged in market manipulation.

FERC determined that GreenHat Energy and its owners violated the Federal Power Act by “engaging in a manipulative scheme” in PJM’s FTR market.

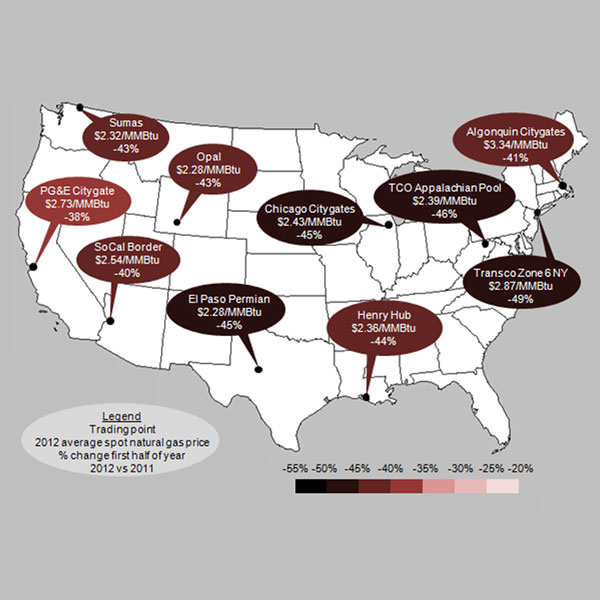

FERC ordered a hearing on allegations that Total manipulated the price of natural gas at several locations in the Southwestern U.S. between 2009 and 2012.

FERC threatened GreenHat Energy and its owners with $229 million in civil penalties over the company’s 890 million MWh default of its FTR portfolio in PJM.

Top officials discussed CAISO’s handling of California’s mid-August blackouts and actions to avoid future shortages in a webinar.

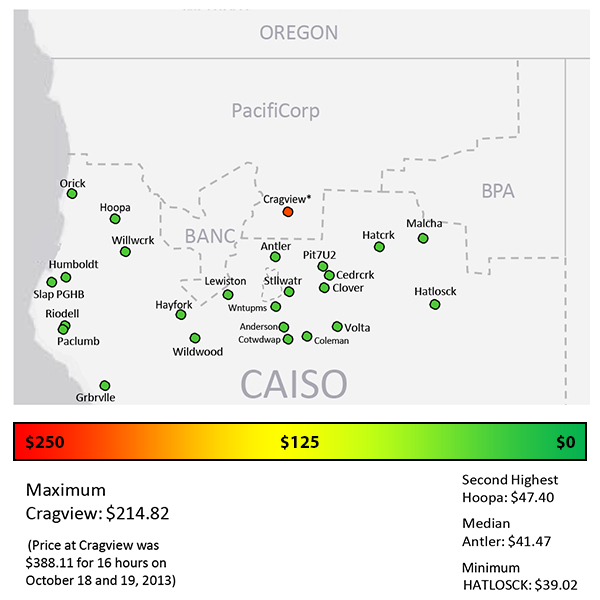

CAISO’s Market Monitor found no evidence of market manipulation or strategic outages during the rolling blackouts of mid-August.

The CAISO Board of Governors bid farewell to its retired CEO, greeted a new leader and approved a plan to implement FERC Order 831.

MISO and its Monitor are making several changes to market mitigation procedures — most of which will increase the IMM’s authority to mitigate and penalize.

FERC ordered Vitol and a senior trader to show cause why they should not be fined for manipulating CAISO’s market to limit losses on the company’s CRRs,

PJM and its Monitor must turn over a trove of documents stemming from allegations of manipulation against now-defunct Coaltrain Energy.

Want more? Advanced Search