By Christen Smith

PJM and its Independent Market Monitor must turn over a trove of documents stemming from allegations of market manipulation against now-defunct Coaltrain Energy over its profits on up-to-congestion (UTC) trades collected in 2010.

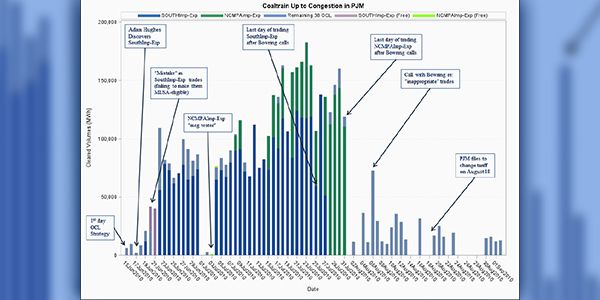

The U.S. District Court for Southern Ohio subpoenaed both agencies on June 4 for records supporting complaints to FERC that the trading group profited by $4.2 million using an “over-collected loss strategy” that diverted more than $8 million in marginal loss surplus allocation (MSLA) payments between June and September 2010.

FERC and Coaltrain’s former staff — including leaders Shawn Sheehan and Peter Jones and traders Jeff Miller, Jack Wells, and Robert Jones — have been locked in a lengthy and expensive court battle over the commission’s demand for $42 million in fines and disgorged profits as penalty for the bad behavior.

Coaltrain is one of at least three firms accused by FERC of market manipulation for profiting on line-loss rebates from what the commission called risk-free UTC trades in PJM. (See Traders Deny FERC Charges; Seek Independent Review.) The company maintains it didn’t manipulate the market, its trading strategy wasn’t deceptive and it didn’t engage in wash trades or try to affect market prices.

FERC also alleged Coaltrain’s use of employee-monitoring software gave investigators evidence of the company’s trading strategy. FERC said Coaltrain employees at first claimed they had forgotten about the software — Spector 360 — when the Office of Enforcement initially asked and then repeatedly delayed giving up the data. Sheehan and Jones allegedly didn’t have the program installed on their computers, effectively concealing their actions. (See FERC: Spy Software Provide Evidence of UTC Scam.)

Now, the court wants the Monitor and PJM to hand over all communications regarding Coaltrain from Jan. 1, 2010, through Sept. 30, 2010 — including phone calls, emails, studies, simulations, calculations and even the 2009 State of the Market Report.

The Monitor said in a June 4 email to PJM stakeholders the court order forces it to reveal confidential member information. Those opposed to the release must alert the IMM no later than June 28, the Monitor said.