market manipulation

CAISO’s Market Monitor found no evidence of market manipulation or strategic outages during the rolling blackouts of mid-August.

The CAISO Board of Governors bid farewell to its retired CEO, greeted a new leader and approved a plan to implement FERC Order 831.

MISO and its Monitor are making several changes to market mitigation procedures — most of which will increase the IMM’s authority to mitigate and penalize.

FERC ordered Vitol and a senior trader to show cause why they should not be fined for manipulating CAISO’s market to limit losses on the company’s CRRs,

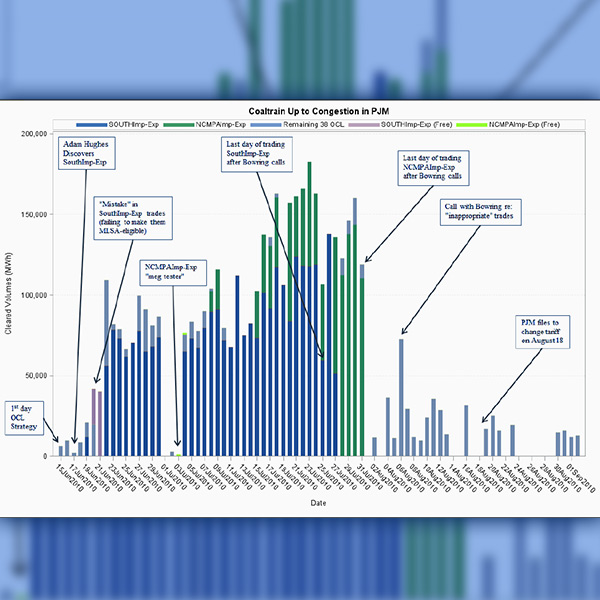

PJM and its Monitor must turn over a trove of documents stemming from allegations of manipulation against now-defunct Coaltrain Energy.

PJM’s lax credit policy allowed Greenhat Energy, whose traders had a history of market manipulation, to run up as much as $140 million in FTR losses.

FERC’s Office of Enforcement urged the commission to withdraw its show cause order alleging that the operators of the Salem Harbor plant misled ISO-NE.

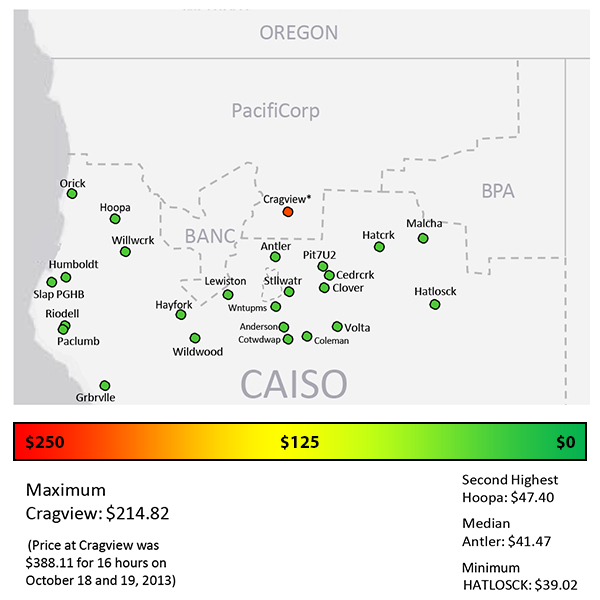

ETRACOM agreed to pay $1.9 million to settle allegations that it manipulated CAISO markets in a scheme that netted the company $315,000 in profits.

FERC said that a preliminary investigation indicates that PSEG committed multiple violations of PJM market-bidding rules and made “false and misleading statements” to RTO staff.

Stakeholders denied four proposals to revise PJM’s rules on evaluating designated market paths for energy sales coming into the RTO.

Want more? Advanced Search